Oil (Brent Crude, WTI) News and Analysis

- OPEC+ extends production cuts into 2025 with voluntary cuts to taper off from October this year

- The oil market seeks to halt recent declines on tighter supplies

- IG client sentiment is skewed to the upside but the contrarian indicator lacks conviction

- Are you new to commodities trading? The team at has produced a comprehensive guide to help you understand the key fundamentals of the oil market and accelerate your learning:

OPEC+ Extends Production Cuts into 2025 – Voluntary Cuts to be Wound Down from October

The Organisation for Petroleum Exporting Countries and its allies, otherwise known as OPEC +, decided to extend their existing production cuts when officials met on Sunday. The move comes amid a backdrop of rising stockpiles, surging US oil production and tepid demand growth from the world’s largest oil importer, China.

Elevated interest rates and a generally restrictive economic environment have weighed on the outlook for global growth, which has seen speculators drive down the price of both Brent crude and WTI oil. The vote to sustain the deep supply cuts – which amounts to around 5.7% of global oil demand – was aided by narrowing margins from OPEC producers that are likely to come under pressure if prices move notably below $80.

The 5.86 million barrels per day (mbpd) of cuts are comprised of a larger 3.66 mbpd and a voluntary 2.2 mbpd which was advanced by the Saudis. The 3.66 mbpd cuts are to run until the end of 2025 while the voluntary cuts are to remain until the end of September. Thereafter, the voluntary cuts will be tapered off into 2025.

The Oil Market Seeks to Halt Recent Declines on Tighter Supply

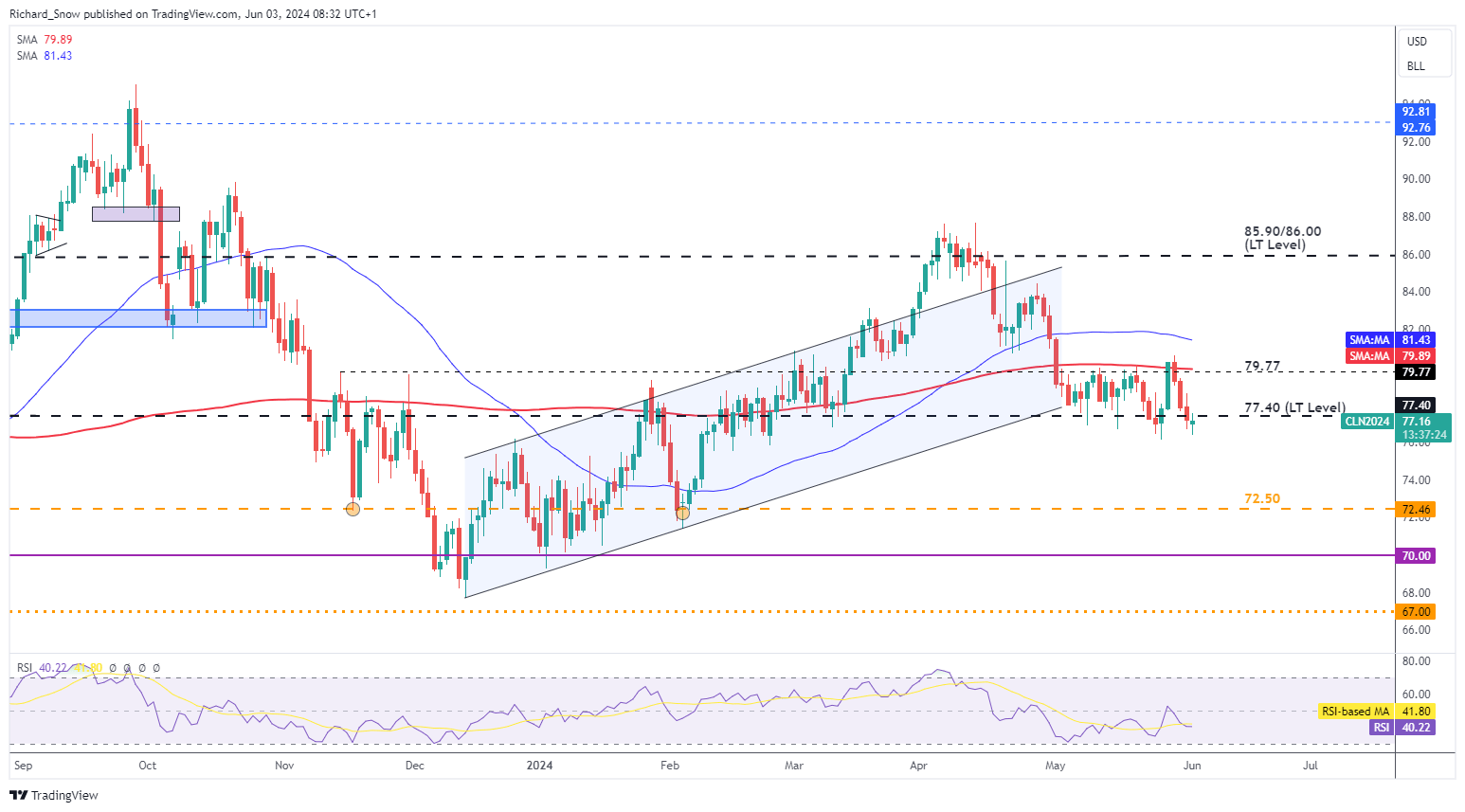

Oil prices have fallen off in recent days, seeing higher prices capped at $85 before heading towards the psychologically important $80. The recent decline also took out the $82 marker with relative ease but today’s price action appears to have found support ahead of the $80 mark.

Upside potential appears to be capped at the $84/$85 level with the 200-day simple moving average (SMA) repelling higher prices. The medium-term trend remains in favour of further downside but the risk of a near-term pullback will need to be observed at the start of the week, with the descending trendline offering the first test of a potential counter-trend move.

Brent Crude Oil Daily Chart