Market Snapshot Ahead of the FOMC Meeting

- S&P 500 receives another excuse to break new ground

- What happened to the euro amid the shock political developments

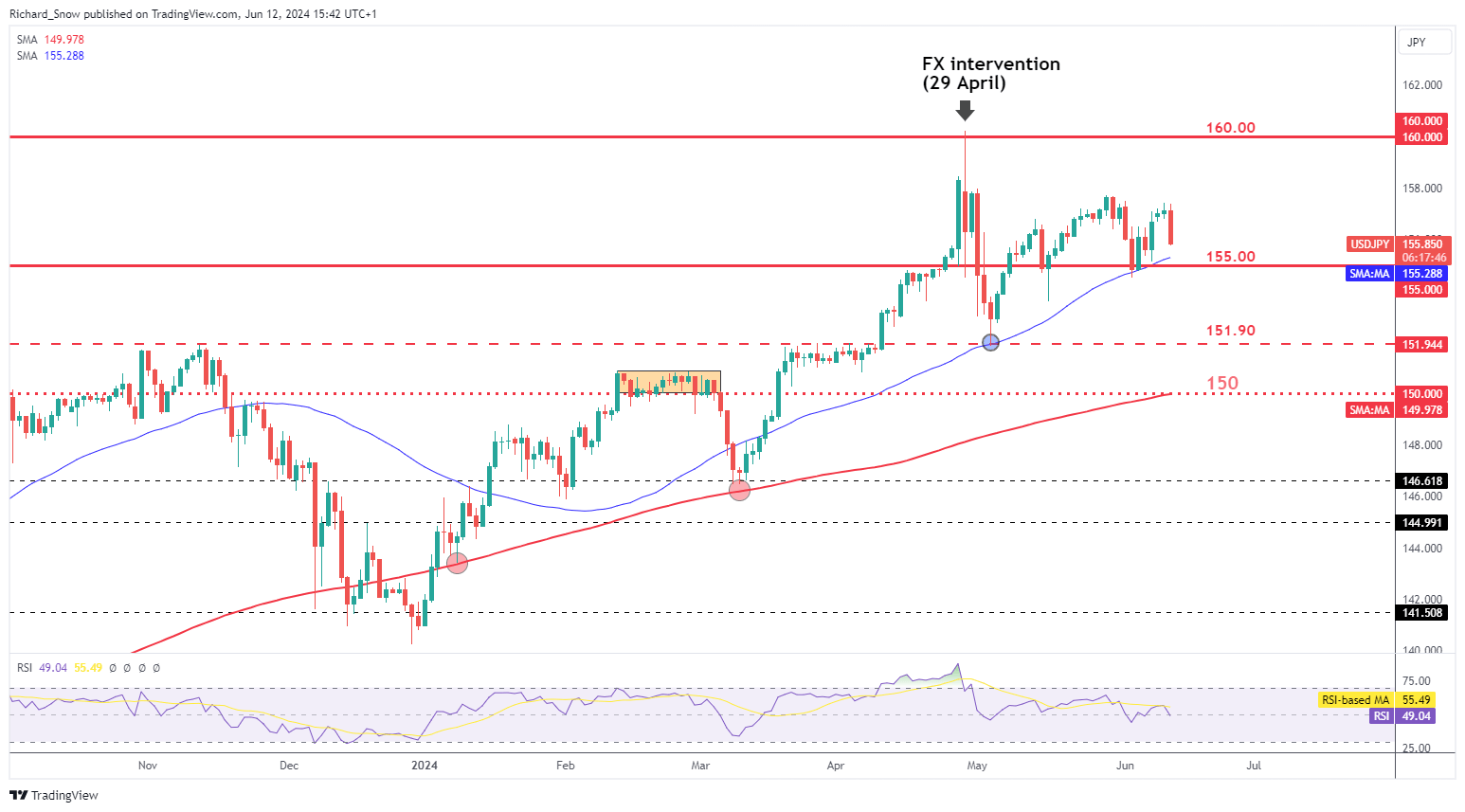

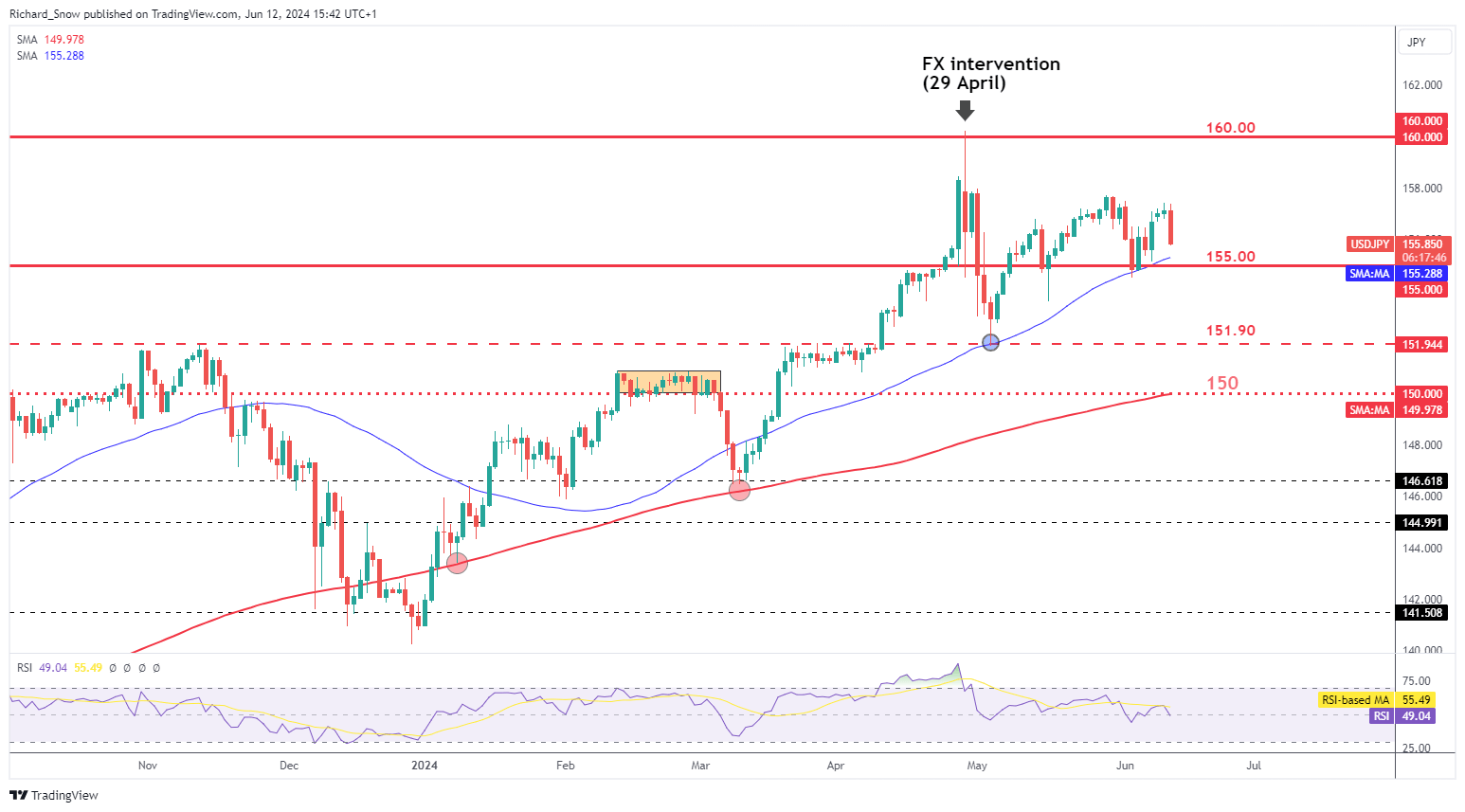

- USD/JPY pulls back ahead of BoJ meeting

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

US CPI for the month of May cooled, sending the dollar sharply lower ahead of the FOMC statement and updated forecasts due for release at 19:00 (UK). For the real-time coverage, read our US CPI report from senior strategist Nicholas Cawley.

On the face of it, it was a good report, seeing headline measures of core and headline inflation come in below expectations on a yearly and monthly basis. Fed officials look to services inflation and super core inflation (services excluding housing and energy) as key gauges of inflation momentum. More recently, officials have been interested to see monthly core cpi breaking the trend of successive 0.4% prints which has now materialized after April's 0.3% and now May's 0.2% .

Source: Refinitiv, Prepared by Richard Snow

Learn how to prepare for high impact economic data or events:

S&P 500 Gets Another Excuse to Break New Ground

In the lead up to the inflation print, it is fair to say US equity markets were tentative, consolidating around the recent high. Now, with inflation heading in the right direction again, markets have put a second rate cut back on the table – providing stocks with new vigor.

The Fed is due to update their dot plot projection of the likely Fed funds rate for 2024. In March, officials projected three quarter-point rate cuts but May’s inflation data could see that revised to just two or in an extreme case, one. Nevertheless, the prospect of lower future rates has stocks trading higher with 5,500 the next level of interest to the upside.

S&P 500 Daily Chart