January 31, 2025

Vertex Pharmaceuticals Incorporated VRTX announced that the FDA has approved its oral, non-opioid, highly selective NaV1.8 pain signal inhibitor, suzetrigine, for the treatment of adults with moderate-to-severe acute pain. The pain drug will be marketed by the name of Journavx.

Following the nod, Journavx has become the first and only non-opioid oral pain signal inhibitor and the first new class of pain medicine to be approved by the FDA in more than 20 years.

Per the company, Journavx has the potential to transform the treatment paradigm of acute pain. Pain is an area with limited treatment options, mostly highly addictive opioid-based medications.

Vertex believes Journavx, a non-opioid drug, is an effective and well-tolerated medicine for use in all types of moderate-to-severe acute pain.

Shares of VRTX were up more than 8% in after-hours trading on Jan. 30 following the news announcement. The stock was also up in pre-market trading on Jan. 31.

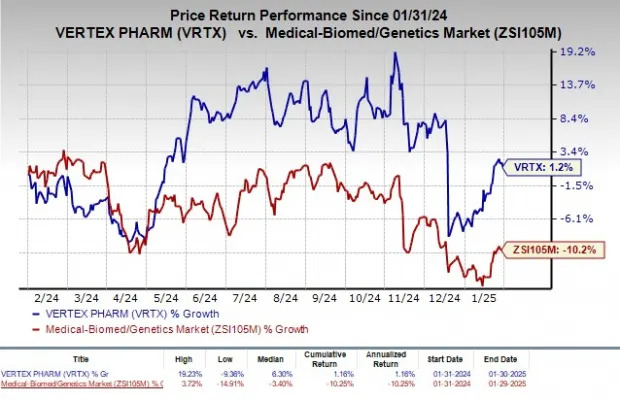

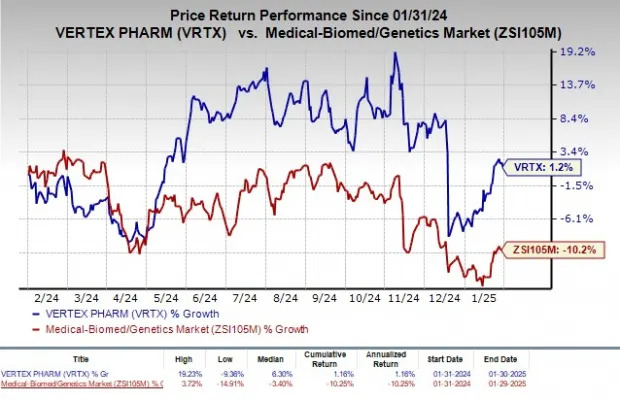

The stock has risen 1.2% in the past year against the industry’s decline of 10.2%.

The FDA accepted the new drug application (“NDA”) for Journavx in July 2024.

Besides acute pain, suzetrigine is also being developed for the treatment of diabetic peripheral neuropathy and painful lumbosacral radiculopathy (“LSR”).

The company’s stock nosedived in December 2024, when it announced data from a phase II study on suzetrigine, for treating painful LSR, a form of peripheral neuropathic pain.

Data from the study showed that treatment with suzetrigine led to a statistically significant and clinically meaningful within-group reduction in pain from baseline with a mean change in numeric pain rating scale of -2.02 at week 12, thereby meeting the primary endpoint. The placebo arm demonstrated a reduction of -1.98 points, indicating not much difference between the two groups.

Overall, investors were not impressed with the data as it showed largely undifferentiated pain reduction on treatment with suzetrigine compared to the placebo arm.

Despite the unimpressive data in the phase II study, management decided to proceed with the phase III study in this indication, which was considered a risky decision.

Vertex initiated a pivotal phase III program of suzetrigine in diabetic peripheral neuropathy, a form of peripheral neuropathic pain caused by damage to nerves, in the third quarter of 2024.

It remains to be seen how Journavx performs in the acute pain indication, especially after disappointing data from the LSR study.

Vertex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Castle Biosciences, Inc. CSTL, Harmony Biosciences Holdings, Inc. HRMY and BioMarin Pharmaceutical Inc. BMRN, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here .

In the past 60 days, estimates for Castle Biosciences’ loss per share have narrowed from $1.88 to $1.70 for 2025. In the past year, shares of CSTL have increased 21.2%.

CSTL’s earnings beat estimates in each of the trailing four quarters, the average surprise being 172.72%.

In the past 60 days, estimates for Harmony Biosciences’ earnings per share have increased from $2.64 to $3.22 for 2025. In the past year, shares of HRMY have rallied 25.3%.

HRMY’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 147.24%.

In the past 60 days, estimates for BioMarin’s earnings per share have moved up from $3.94 to $4.02 for 2025. In the past year, shares of BMRN have plunged 27.6%.

BMRN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 28.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

Harmony Biosciences Holdings, Inc. (HRMY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research