February 2, 2025

If investors only factor in General Motors ' (NYSE: GM) price-to-earnings ratio of 6 times and the 11.5% stock price decline the company saw after reporting earnings on Tuesday, they might conclude the company had a rough quarter and year. But such a conclusion would be way off.

GM posted strong metrics in 2024, with multiple guidance upgrades and earnings beats. GM's fourth quarter was solid too. The trouble with the stock price is related to investors thinking that GM's guidance for 2025 is too optimistic because it didn't factor in the potential negative effects of tariff threats made by the Trump administration.

Here's a closer look at GM's Q4 using three graphics that demonstrate the excellent progress the automaker is seeing in key areas of its operations. They also suggest the stock is still a buy. Here's why.

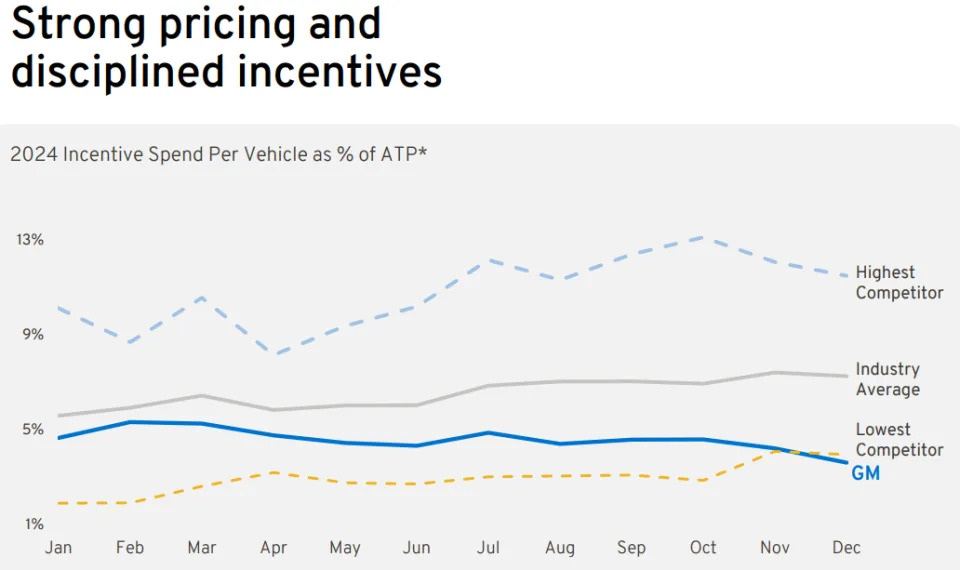

One area General Motors improved on in 2024 was getting profit-eroding incentive spending under control. Offering potential vehicle buyers sales incentives is a common business practice in the automotive industry. When demand is lacking or inventory is too high (among other reasons), automakers are likely to provide dealers with margin-eating incentives and discounts to pass along to customers.

Fortunately for investors, GM has taken steps to get its incentive spending under control.

GM's Q4 incentives as a percentage of Average Transaction Price (ATP) was three percentage points below the industry average, according to the company. GM's ATP was solid as well, averaging roughly $50,000 throughout 2024. This suggests that GM's vehicle lineup was strong and so was the demand for its products.

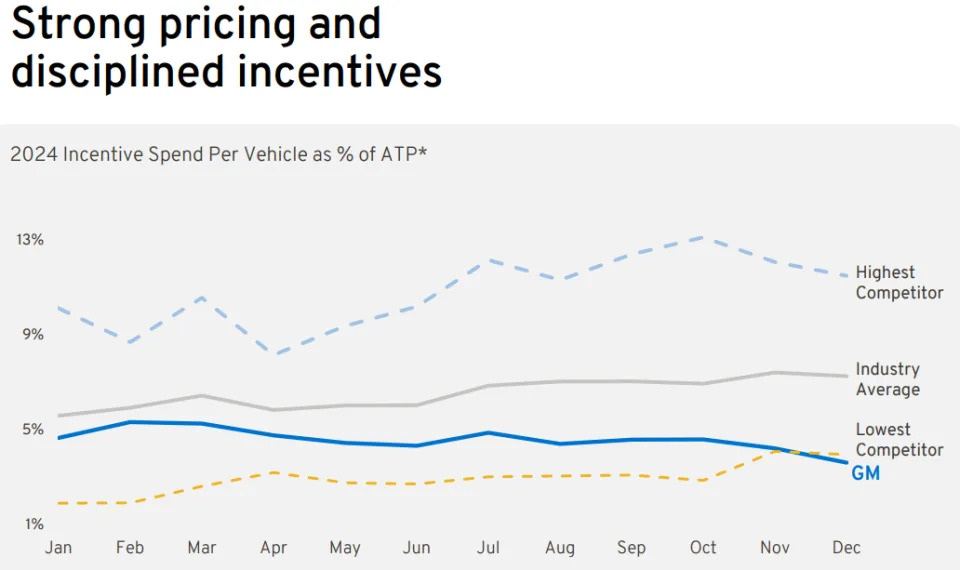

While it's still in its developmental stage, the business model for electric vehicles (EVs) has been a money-loser for many automakers trying to make a go of EV production. Companies are diligently working to bring costs down and improve scale. Nearly all automakers in this space currently lose money on each EV sold. What's imperative for investors is that they see progress toward profitability being made.

Beyond improving its market share (up 6 percentage points over the past four quarters) and sales total (up roughly 167% between Q1 and Q4), GM says it has also grown its EV lineup to cover critical segments and price points. In fact, GM's EV portfolio managed to turn variable profit positive -- a measure that factors in emissions credits and advanced manufacturing tax credits -- during Q4. GM saw a roughly 35% improvement in this metric compared to the prior year's Q4.

GM management expects an earnings before interest and taxes (EBIT) tailwind in 2025 thanks to improved scale, fixed cost absorption, and its continued focus on bringing down battery cell and vehicle costs. These are all welcomed improvements for investors who are hoping EVs will add to overall earnings sooner rather than later.

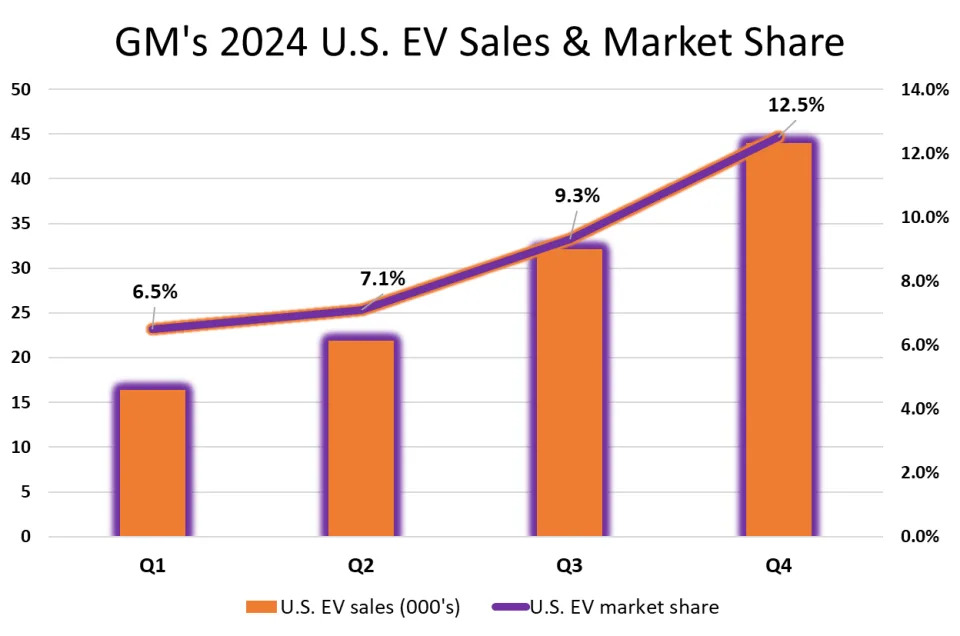

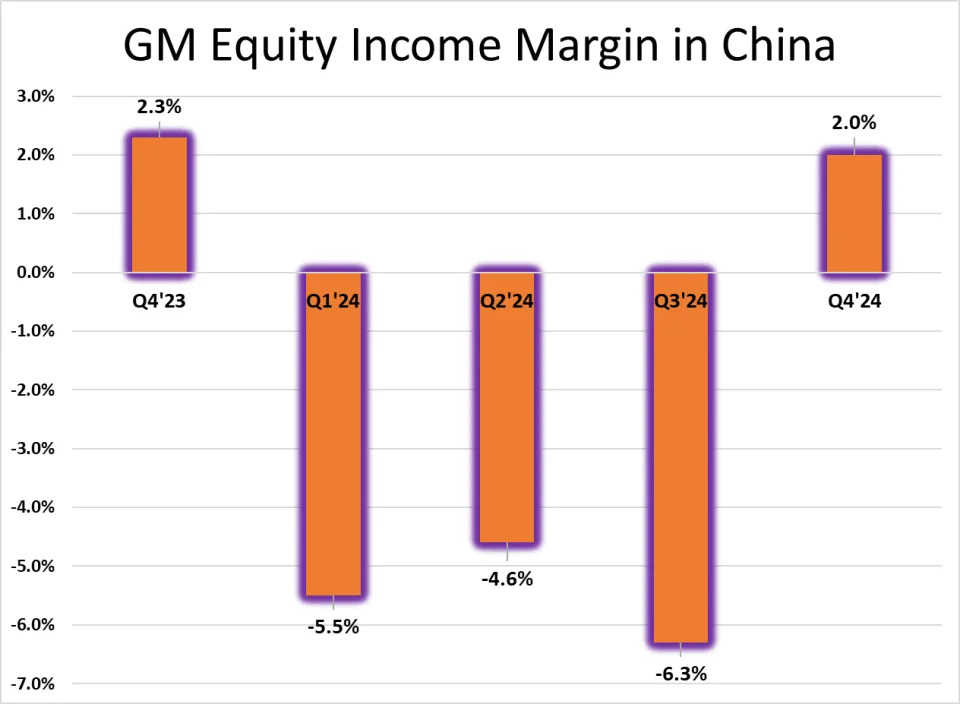

The graph below might look the least interesting, but it's arguably the most impressive improvement in GM's operations. At a time when China's automotive price war has sent foreign automakers scrambling to salvage market share and profitability, GM's restructuring in 2024 has helped it fight the war and has paid off quickly and impressively.

GM returned its China operations to profitability during Q4 (when excluding $5 billion in restructuring charges), thanks to a reduction in inventory, cost reductions, and improved vehicle lineup competitiveness.

In fact, GM nearly doubled its wholesales in China during Q4 compared to the third quarter, and nearly doubled revenue over the same time frame. Investors should now anticipate more year-over-year improvements in GM's China operations during 2025, and for the business to become sustainable without more capital spent.

General Motors managed to generate excellent results in its fourth quarter and its full year 2024. It improved several critical aspects of its business, including its critical China operations, its EV competitiveness, and its incentive spending. The Detroit automaker also managed to return significant value to shareholders by repurchasing $16 billion in shares over the past three years. GM's stock price is up roughly 34% over the past year, while Ford Motor Company and Stellantis have declined roughly 13% and 37%, respectively.

Granted, General Motors' guidance going forward might appear too optimistic because it didn't include potential negative tariff effects. However, investors should focus on the bigger picture regarding GM which shows it is doing well now because its core business is thriving and rewarding investors .

Before you buy stock in General Motors, consider this:

Now, it’s worth noting Stock Advisor ’s total average return is 903% — a market-crushing outperformance compared to 176% for the S&P 500. Don’t miss out on the latest top 10 list.

Learn more »