January 30, 2025

Tobacco company Altria (NYSE:MO) reported Q4 CY2024 results topping the market’s revenue expectations , with sales up 1.6% year on year to $5.11 billion. Its non-GAAP profit of $1.29 per share was 0.8% above analysts’ consensus estimates.

Is now the time to buy Altria? Find out in our full research report .

“2024 was another pivotal year for Altria, headlined by meaningful progress toward our Vision, strong financial results and significant cash returns to shareholders,” said Billy Gifford, Altria’s Chief Executive Officer.

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Altria is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it's harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Altria must lean into newer products.

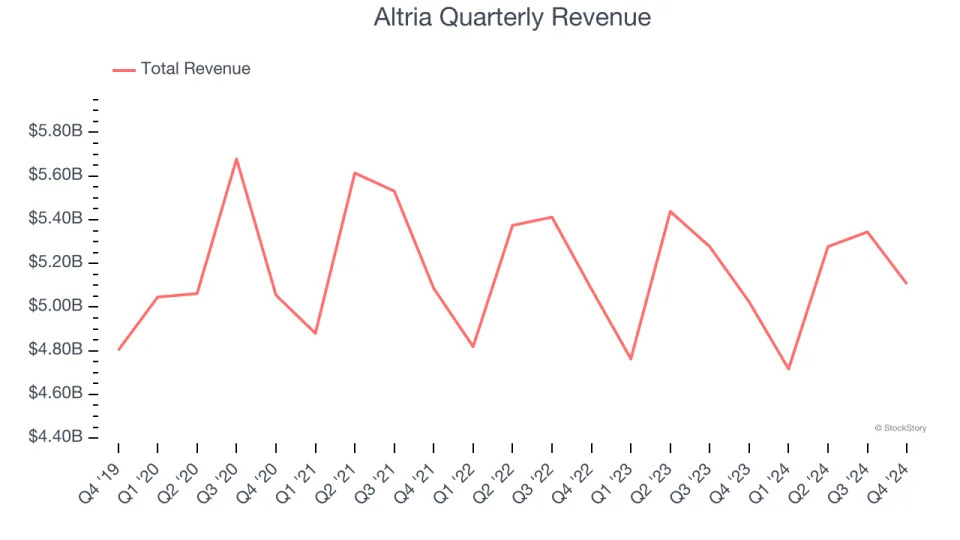

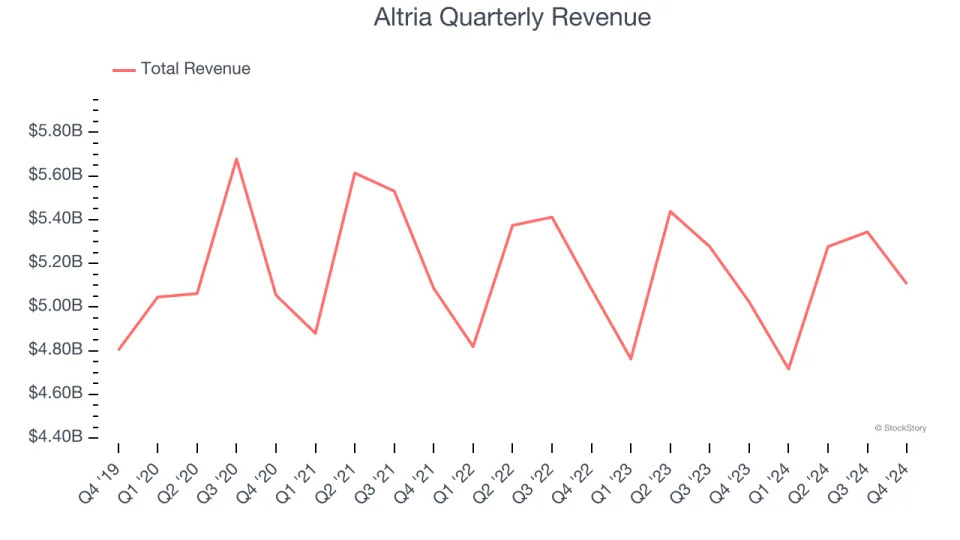

As you can see below, Altria struggled to generate demand over the last three years. Its sales dropped by 1.1% annually, showing demand was weak. This is a poor baseline for our analysis.

This quarter, Altria reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its newer products will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

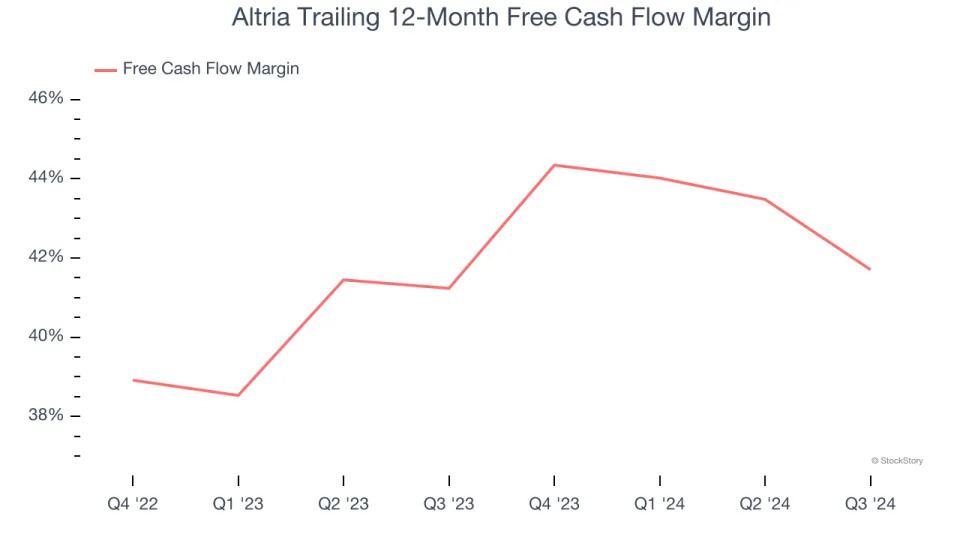

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Altria has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 40.2% over the last two years.

Revenue and EPS in the quarter were roughly in line with expectations. Altria's full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this quarter didn't have many resounding positives. The stock remained flat at $52.50 immediately following the results.

So should you invest in Altria right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .