January 29, 2025

Founded by a quant fund manager, DeepSeek is a Chinese AI startup that seemingly came out of nowhere to wreak havoc on Wall Street on Monday. Allegedly, Deepseek has discovered the “holy grail” of AI and created a ChatGPT-like large language model (LLM) on a shoestring budget of just ~$6 million. If true (and there are doubts), DeepSeek’s success (shot to number one on the Apple ( AAPL ) app store) is unprecedented. Mega-cap tech stocks like Microsoft ( MSFT ), Meta Platforms ( META ), and Alphabet ( GOOGL ) have spent literally billions of dollars to buildexpensive data centers to power AI filled with expensive Nvidia ( NVDA ) GPUs. Regardless of whether or not DeepSeek’s claims are valid, Wall Street investors pulled the trigger on selling AI-related stocks first and asked questions later. For instance, Nvidia’s $560 billion swoon Monday marked the single largest daily market cap loss for a stock in history.

Whether you believe that what DeepSeek accomplished was on a low-budget or not, the model unveiled was impressive, regardless of the cost.

“Deepseek’s r1 is an impressive model, particularly around what they’re able to deliver for the price.” ~ Sam Altman, CEO of ChatGPT parent OpenAI

“DeepSeek is an excellent AI advancement and a perfect example of Test Time Scaling .” ~ Nvidia Spokesperson

The whirlwind week is an example of how fast the pace of advancement is in AI and AI models. Yesterday, Alibaba (BABA) unveiled a new large language model that claims to beat DeepSeek, ChatGPT, and Meta’s Lama. According to BABA, it outperformed the global leaders in almost every metric.

Below, I will explain three reasons investors should buy the stock (even when you don’t account for BABA’s new AI model):

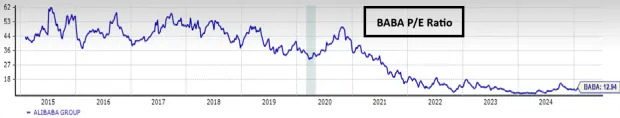

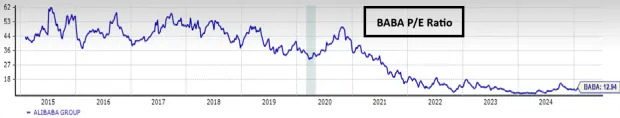

BABA’s current valuation is the cheapest it has ever been. In addition, BABA’s valuation is inexpensive compared to that of its American counterparts. For instance, Amazon ( AMZN ) has a P/E ~50x while BABA’s is just 12.94x.

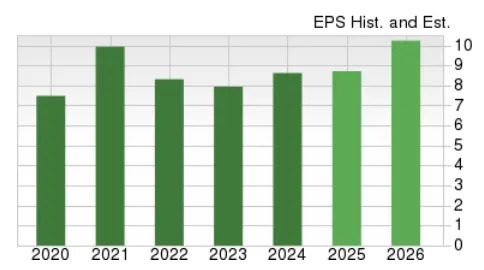

Wall Street is a game of expectations, and BABA’s expectations remain low. Earnings down trended from 2021 to 2023. In 2024, BABA’s earnings rebounded, and by 2026, they are set to explode. A rebounding Chinese economy, new AI innovations, and fiscal stimulus should lead to a stronger Chinese stock market. Furthermore, BABA is no longer reliant only on the Chinese consumer – the company is pushing to expand into global markets such as Spain and South East Asia.

BABA shares are curling up the right-hand side of a massive base structure. Tuesday, as news of Qwen broke, volume turnover swelled, signaling heavy demand for shares.

Bottom Line

If “Qwen’s” results hold up, Alibaba can cement itself as a premier AI juggernaut. Regardless, BABA is historically cheap, faces easy comps, and enjoys a bullish technical pattern.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research