January 28, 2025

Solar tracker company Nextracker (NASDAQ:NXT) reported Q4 CY2024 results exceeding the market’s revenue expectations , but sales fell by 4.4% year on year to $679.4 million. The company expects the full year’s revenue to be around $2.85 billion, close to analysts’ estimates. Its non-GAAP profit of $1.03 per share was 74.1% above analysts’ consensus estimates.

Is now the time to buy Nextracker? Find out in our full research report .

“We’re very pleased with the company’s execution, delivering record revenue and profit year-to-date driven by strong demand,” said Dan Shugar, founder and CEO of Nextracker.

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dabhi solar farm project, Nextracker (NASDAQ:NXT) is a provider of solar tracker systems that help solar panels follow the sun.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

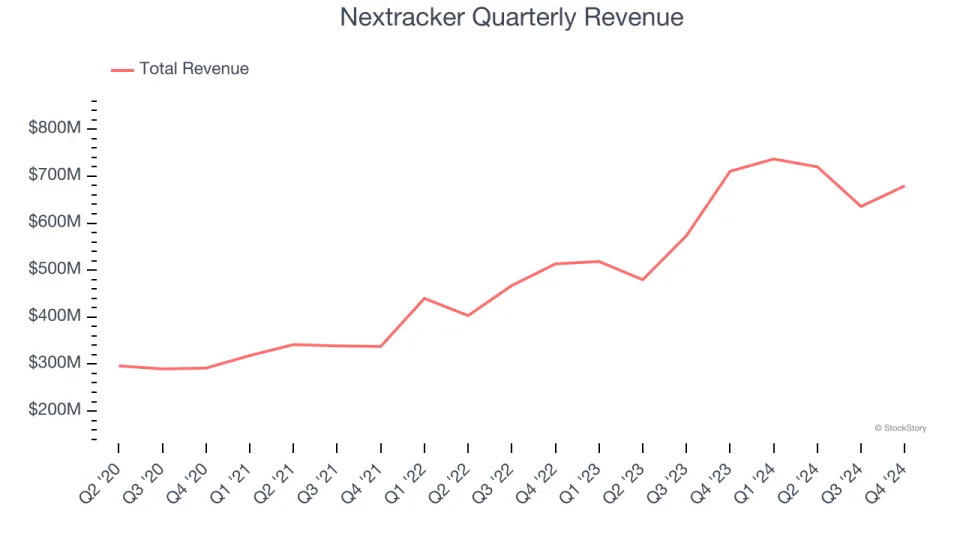

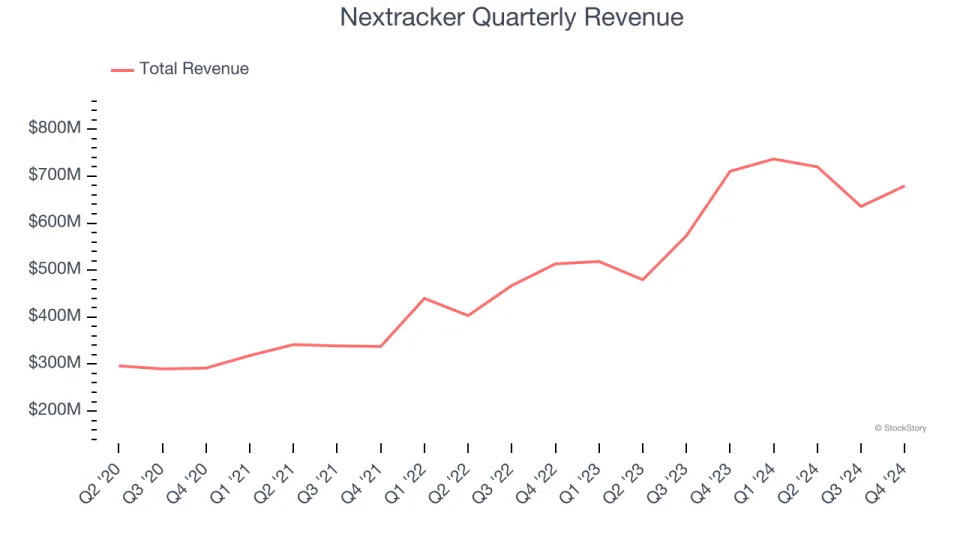

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Nextracker’s sales grew at an incredible 23.4% compounded annual growth rate over the last four years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Nextracker’s annualized revenue growth of 23.3% over the last two years aligns with its four-year trend, suggesting its demand was predictably strong.

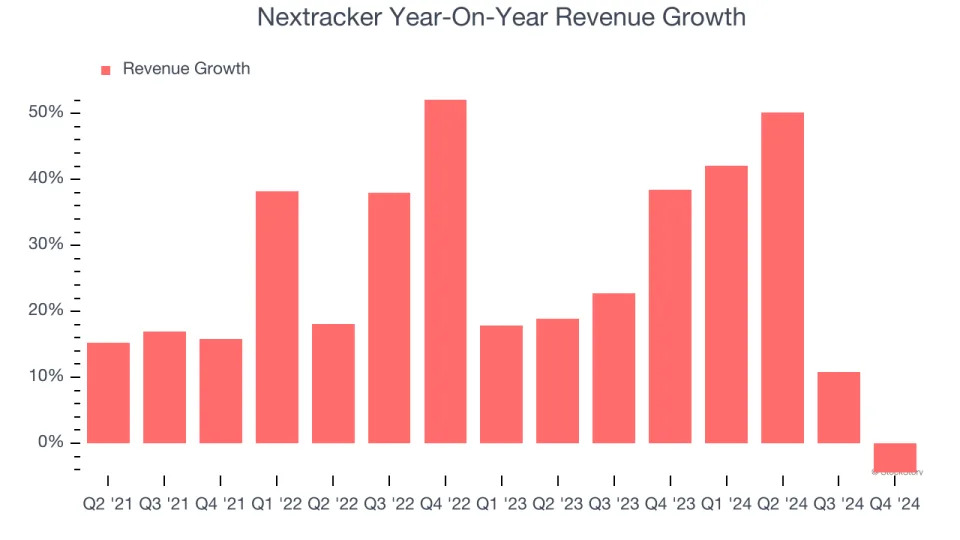

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Nextracker’s backlog reached $4.5 billion in the latest quarter and averaged 54.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Nextracker’s products and services but raises concerns about capacity constraints.

This quarter, Nextracker’s revenue fell by 4.4% year on year to $679.4 million but beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

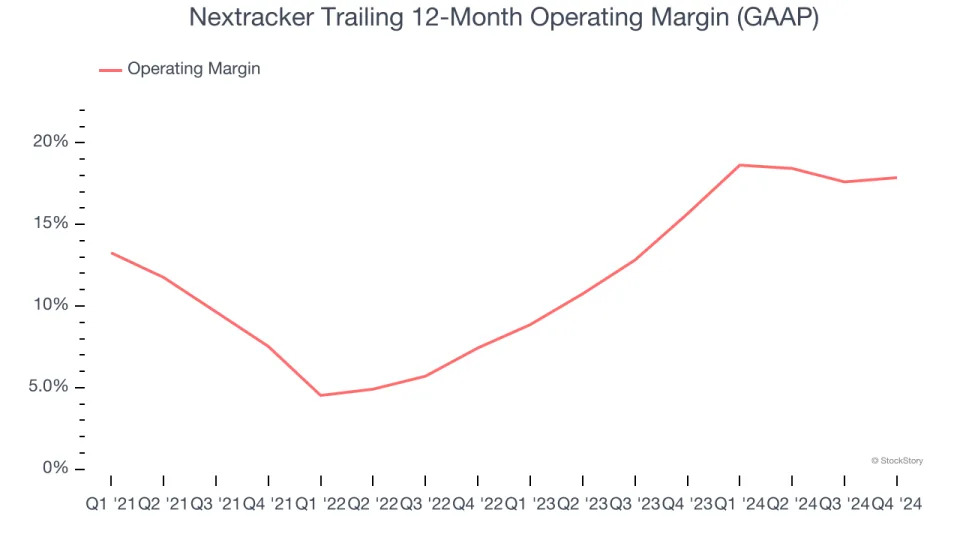

Nextracker has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Nextracker’s operating margin rose by 3.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Nextracker generated an operating profit margin of 22.1%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

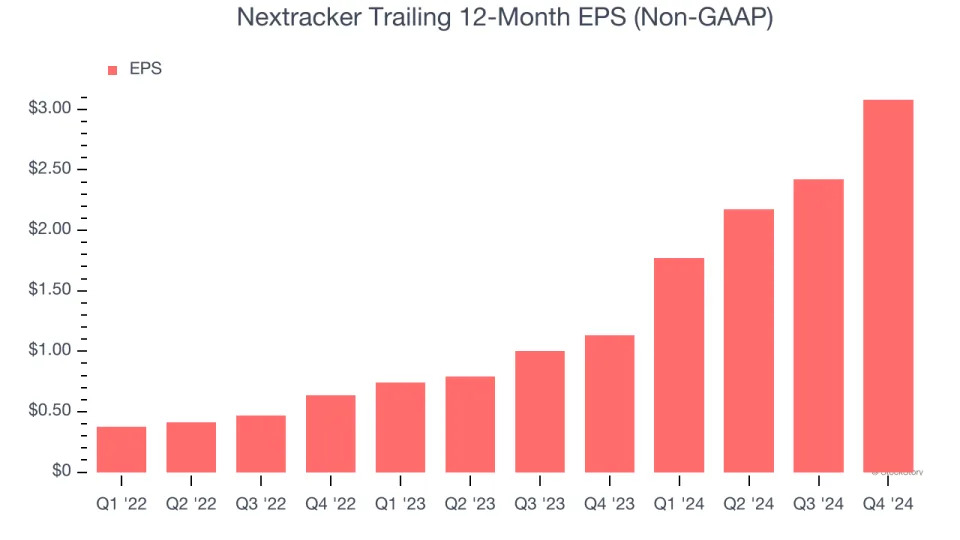

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Nextracker’s EPS grew at an astounding 120% compounded annual growth rate over the last two years, higher than its 23.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Nextracker’s earnings to better understand the drivers of its performance. Nextracker’s operating margin has expanded by 10.7 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Nextracker reported EPS at $1.03, up from $0.38 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Nextracker’s full-year EPS of $3.08 to grow 5.6%.

We were impressed by how significantly Nextracker blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited it raised its full-year EPS and EBITDA guidance. On the other hand, its backlog missed, potentially indicating weaker demand down the line. Still, we think this was a solid "beat-and-raise" quarter with some key areas of upside. The stock traded up 13.6% to $45.02 immediately after reporting.

Indeed, Nextracker had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .