January 28, 2025

As of January 2025, the U.S. stock market is experiencing turbulence, with major indices like the Nasdaq Composite and S&P 500 facing declines due to concerns over China's advancements in artificial intelligence. Amidst this volatility, dividend stocks can provide a measure of stability and income for investors seeking reliable returns in uncertain times.

|

Name |

Dividend Yield |

Dividend Rating |

|

Columbia Banking System (NasdaqGS:COLB) |

5.12% |

★★★★★★ |

|

Interpublic Group of Companies (NYSE:IPG) |

4.51% |

★★★★★★ |

|

Peoples Bancorp (NasdaqGS:PEBO) |

4.84% |

★★★★★★ |

|

Polaris (NYSE:PII) |

4.67% |

★★★★★★ |

|

Dillard's (NYSE:DDS) |

5.45% |

★★★★★★ |

|

Farmers National Banc (NasdaqCM:FMNB) |

4.92% |

★★★★★★ |

|

Citizens & Northern (NasdaqCM:CZNC) |

5.11% |

★★★★★★ |

|

CompX International (NYSEAM:CIX) |

5.10% |

★★★★★★ |

|

First Interstate BancSystem (NasdaqGS:FIBK) |

5.65% |

★★★★★★ |

|

Ennis (NYSE:EBF) |

4.78% |

★★★★★★ |

Let's take a closer look at a couple of our picks from the screened companies.

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering various banking products and services across the United States, with a market cap of approximately $3.41 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily through its Community Banking segment, which accounts for $951.20 million.

Dividend Yield: 5.6%

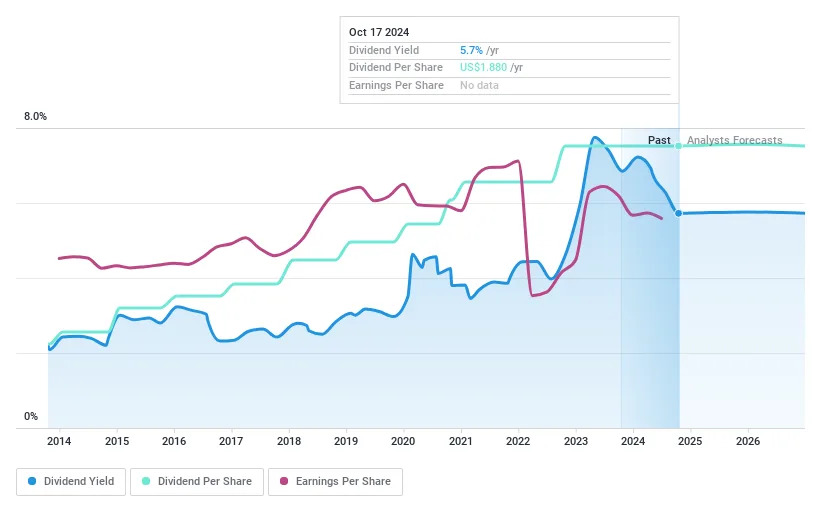

First Interstate BancSystem offers an attractive dividend yield of 5.65%, placing it in the top 25% of US dividend payers. The company has maintained stable and growing dividends over the past decade, supported by a current payout ratio of 82.3%, which is forecasted to improve to 71% in three years. Despite trading at a discount to its estimated fair value, significant insider selling in recent months warrants caution for potential investors seeking dividend reliability.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S&T Bancorp, Inc. is the bank holding company for S&T Bank, offering retail and commercial banking products and services, with a market cap of approximately $1.43 billion.

Operations: S&T Bancorp generates revenue primarily through its Community Banking segment, which accounted for $386.29 million.

Dividend Yield: 3.5%

S&T Bancorp provides a reliable dividend, growing steadily over the past decade with minimal volatility. Currently, its dividends are well-covered by earnings with a low payout ratio of 9.3%, expected to remain sustainable at 43.8% in three years. Despite trading at a good value compared to peers, its yield of 3.45% is below the top tier in the US market. Recent shelf registration filings may indicate strategic financial maneuvers impacting future dividends.

Simply Wall St Dividend Rating: ★★★★★★

Overview: Polaris Inc. designs, engineers, manufactures, and markets powersports vehicles globally, with a market cap of approximately $3 billion.

Operations: Polaris Inc.'s revenue is segmented into Marine at $486.70 million, On-Road at $1.04 billion, and Off-Road at $6.19 billion.

Dividend Yield: 4.7%

Polaris offers a high dividend yield of 4.67%, placing it in the top 25% of US dividend payers. Its dividends are well-covered by earnings and cash flows, with payout ratios of 73.2% and 57.6%, respectively, suggesting sustainability despite lower profit margins this year. The company has consistently increased its dividends over the past decade without volatility. However, interest payments are not well covered by earnings, which could pose a risk to financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:FIBK NasdaqGS:STBA and NYSE:PII .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]