January 28, 2025

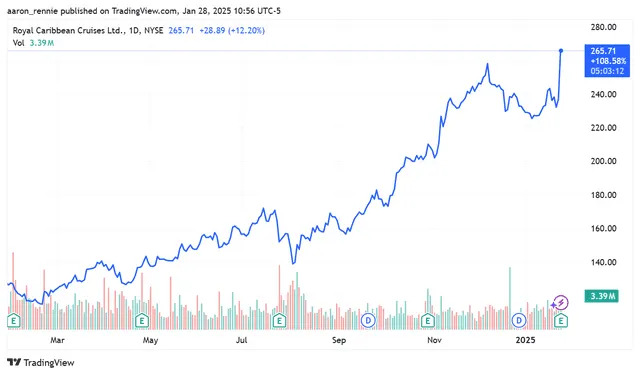

Royal Caribbean Group ( RCL ) led S&P 500 gainers Tuesday morning, with shares rising more than 12% to hit an all-time high, after the cruise ship operator posted better-than-expected profit and gave strong guidance, boosted by price hikes and purchases by passengers on its ships.

The carrier reported fourth-quarter earnings per share (EPS) of $2.02, while analysts surveyed by Visible Alpha were looking for $1.50. Revenue increased 13% year-over-year to $3.76 billion, basically in line with forecasts.

Royal Caribbean said it benefited from "higher pricing across all key products and better onboard revenue." It added that close-in demand "remained strong on both a rate and volume basis." In addition, the company noted that bookings have accelerated since the last earnings call, "resulting in the best five booking weeks in the company's history."

CFO Naftali Holtz explained that Royal Caribbean's focus on "moderate capacity growth, moderate yield growth, and strong cost discipline—is expected to deliver 23% adjusted earnings growth in 2025."

The company also announced that it would begin taking bookings this year on its new river cruises, which are set to start on 10 new ships in 2027.

Royal Caribbean Group shares recently traded up nearly 13% at $267.

Read the original article on Investopedia