January 27, 2025

Tech giants Meta Platforms META and Microsoft MSFT will highlight this week’s earnings lineup which also includes results from EV leader Tesla TSLA.

Scheduled to release their quarterly results on Wednesday, January 29, here’s a look at which software giant may be the better investment as earnings approach.

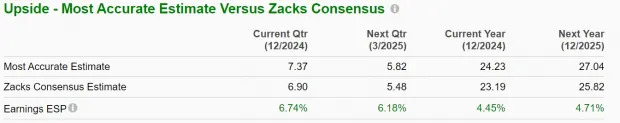

Considered an internet software company due to its involvement in creating and managing internet-based platforms and services, Meta’s Q4 sales are expected to be up 17% to $46.97 billion. On the bottom line, Q4 EPS is thought to have spiked 29% to $6.90 versus $5.33 a share in the comparative quarter.

Notably, Meta’s Zacks Internet-Software Industry is currently in the top 19% out of 250 Zacks industries. It’s also noteworthy that Meta has surpassed the Zacks EPS Consensus for eight consecutive quarters with an average earnings surprise of 11.34% in its last four quarterly reports.

More intriguing, The Zacks ESP (Expected Surprise Prediction) indicates the streak may continue with the Most Accurate Estimate having Q4 EPS pegged at $7.37 and nearly 7% above the Zacks Consensus.

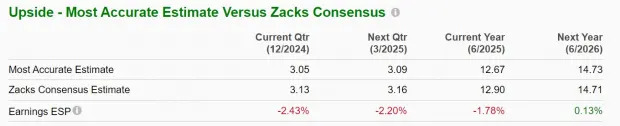

Pivoting to Microsoft, the leader in PC software will be reporting results for its fiscal second quarter (FY25). Microsoft’s Q2 sales are expected to increase 11% to $68.7 billion. Although Q2 EPS is expected to rise 7% to $3.13, the Zacks ESP does indicate Microsoft could miss earnings expectations with the Most Accurate Estimate at $3.05 and 2% below the Zacks Consensus.

Microsoft has exceeded earnings expectations for nine consecutive quarters with an average EPS surprise of 4.91% over the last four quarters. That said, Microsoft’s Zacks Computer-Software Industry is in the bottom 34% of all Zacks industries at the moment.

Over the last year, Meta’s stock has risen +64% to largely outperform Microsoft’s +6%, while topping the benchmark S&P 500 and the Nasdaq’s gains of +24% respectively.

At their current levels, Meta trades at 25X forward earnings which is a pleasant discount to Microsoft’s 34.4X, and is closer to the benchmark. Meta trades at 10.2X sales and beneath Microsoft’s 12.9X, although both are at noticeable premiums to the S&P 500’s 5.6X.

Ahead of their quarterly reports, Meta Platforms stock lands a Zacks Rank #3 (Hold) with Microsoft shares landing a Zacks Rank #4 (Sell).

As alluded to in the Zacks ESP, earnings estimate revisions have remained favorable for Meta and suggest investors could still be rewarded. In contrast, earnings estimates have declined for Microsoft which is an indicator of more downside risk ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research