January 27, 2025

US chipmaker Nvidia has suffered the largest stock market slump in history after the emergence of an advanced Chinese artificial intelligence (AI) model raised doubts about its technology.

Nvidia, the world’s most valuable company, plunged as much as 18pc during trading on Wall Street on Monday, wiping more than $600bn (£480bn) off its valuation.

The fall was equivalent to just over a third of the total market capitalisation of the FTSE 100 and more than the value of Exxon Mobil, the biggest oil company in the US.

Nvidia ended the day down 16.9pc, wiping $589bn off its market value.

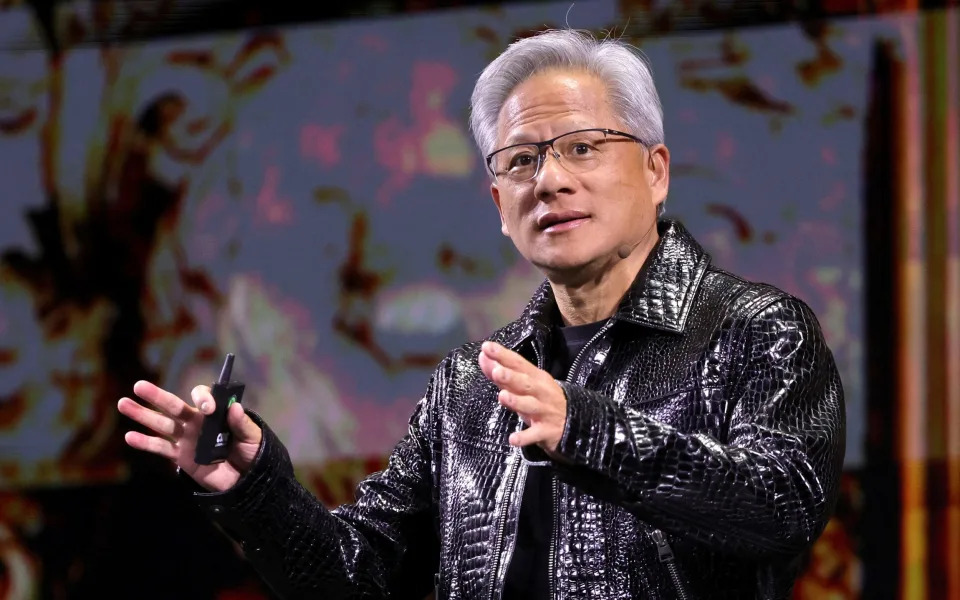

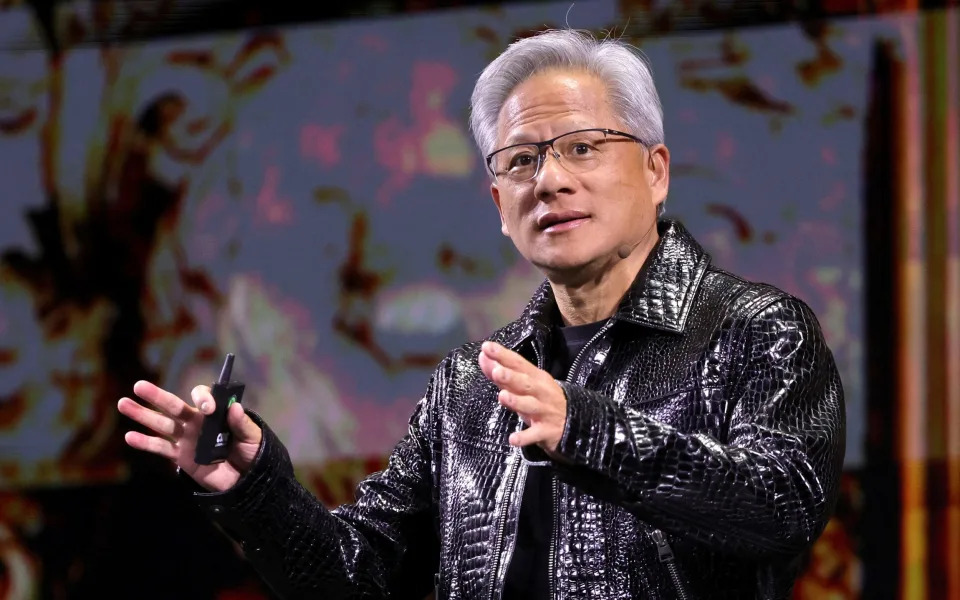

Nvidia’s founder, Jensen Huang, who owns 3.4pc of the company, saw his net worth drop by around $20bn, though he retains an estimated fortune of $100bn.

The historic sell-off, which still left the chipmaker valued at $2.9 trillion (£2.3 trillion), came after a surge of global interest in Chinese startup DeepSeek.

The company last week debuted a highly advanced AI model that rivalled those developed by Silicon Valley tech giants and was allegedly developed for a fraction of the cost.

It comes despite US restrictions on the sale of the most advanced microchips needed for the development of AI, including cutting edge Nvidia chips. This has raised questions about how far ahead the US is in the global AI race and over Nvidia’s edge in the market. Until this week, the company was seen as the global leader in AI chip development.

Jim Reid, a strategist at Deutsche Bank, said: “DeepSeek’s development has been in an era where China has been restricted from accessing the highest-end AI technology and chips, with limited access to Nvidia’s products.

“So for now this raises the potential for stratospheric valuations in US tech firms to be questioned.”

Nvidia led a broader sell-off for tech stocks , with almost $1 trillion wiped off global markets. The debut of DeepSeek raised investor concerns about the hundreds of billions US companies have committed to developing AI.

Microsoft plans to invest $80bn in AI this year, while Mark Zuckerberg’s Meta announced at least $60bn in investments on Friday. The Facebook owner said it would grow its AI teams significantly, while talking up a datacenter in Louisiana that will be so large it could cover most of Manhattan.

Separately, Japan’s SoftBank, ChatGPT-developer OpenAI and US software company Oracle last week announced plans to invest $500bn into AI in America over the next four years under the Stargate Project.

By contrast, DeepSeek claimed to have spent only $5.6m (£4.5m) developing its model.

Jordan Rochester at investment bank Nomura said: “Markets are now wondering if this is an AI bubble popping moment.”

On Monday night, Nvidia said that DeepSeek’s advances showed the usefulness of its chips for the Chinese market and suggested that more of its products would be needed to meet demand as a result.

An Nvidia spokesman said: “DeepSeek’s work illustrates how new models can be created ... leveraging widely-available models and compute that is fully export control compliant.”

Satya Nadella, the Microsoft chief executive, took to social media hours before markets opened on Monday to dismiss concerns about cheaply produced AI, saying less expensive AI was good for everyone.

Mr Nadella said on X: “As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can’t get enough of.”

The historic sell-off came after a huge rally for both Nvidia and the Nasdaq in recent years, fuelled by hopes of a looming AI boom. Despite Monday’s slump, Nvidia shares are still up more than 1,900pc over the last five years.

Much of that growth has been fuelled by expectations of future business, leading to volatile swings when the company either under performs or does better than expected in quarterly earnings.

Nvidia accounts for eight of the ten biggest single-day losses for an individual company, according to Bloomberg data. The previous record loss was $279bn recorded in September.