January 26, 2025

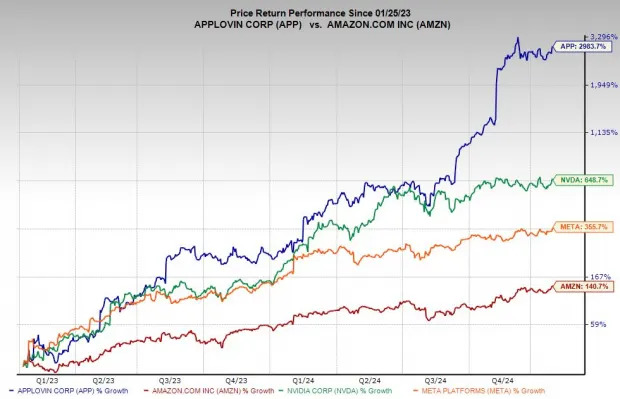

AppLovin Corporation APP stock has been a Wall Street superstar over the last two years, soaring 3,000% to blow away Nvidia and most other artificial intelligence stocks.

AppLovin is thriving as digital app developers and companies flock to its AI-boosted offerings in the hyper-competitive digital app economy. The app-monetization firm's 2025 earnings outlook has jumped even higher recently.

APP stock has traded sideways for the past two months and looks due to break out to all-time highs sooner than later.

AppLovin’s software suite helps app developers improve marketing, revenue generation, and beyond to boost profitable expansion. APP’s products and solutions enable companies and app developers to acquire and keep their ideal users, measure their marketing and reach, and much more.

AppLovin’s broad sales pitch to clients is that its technology attracts more users, keeps them engaged, and increases value across customer lifecycles.

AppLovin boasts that it connects its clients to “audiences in-app, on mobile devices, across CTV, and beyond so your business can do more, accelerate faster, and achieve meaningful growth.”

AppLovin’s array of products are critical tools that its clients utilize to compete and thrive in the digital app world that’s more competitive than ever. Everyone is competing for eyeballs in the attention economy and AppLovin’s AI-boosted offerings are proving vital.

AppLovin first rolled out its enhanced, machine learning and AI engine AXON technology in the second quarter of 2023. APP’s machine learning and AI engine is generating impressive results for its clients across mobile gaming and beyond.

AppLovin nearly doubled its sales (+93%) in 2021, growing its top line from $1.45 billion in 2020 to $2.79 billion in FY21. That massive YoY growth was always going to be difficult to replicate.

AppLovin followed that up with 1% expansion in 2022 as the digital ad market tanked, dragging down Meta and many others.

The digital ad market has come back to life since then. More importantly, AppLovin’s improved portfolio has driven tangible results that its clients are paying for and helping boost its bottom line.

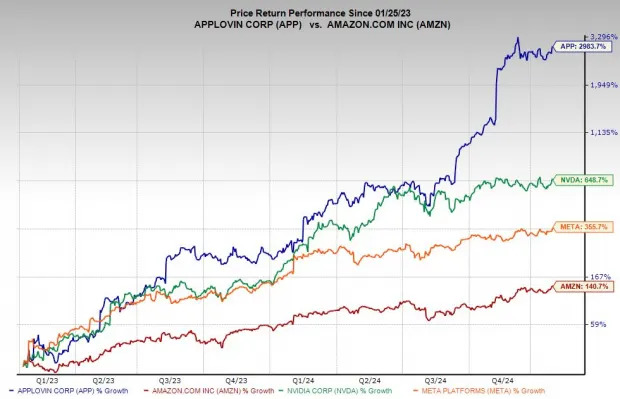

APP grew its revenue by 17% in 2023 and swung from a loss of -$0.52 a share to +$0.98.

AppLovin grew its Software Platform revenue by 66% in Q3 of 2024, as clients spend heavily on offerings that have proven to consistently help them achieve their return on ad spending goals. APP’s booming sales growth, mixed with its ability to lower costs, saw it grow its EPS by over 300%.

APP is projected to grow its revenue by 40% in 2024 from $3.28 billion to $4.60 billion and then expand by 24% in FY25 to reach $5.68 billion—adding over $1 billion to the top-line in both years.

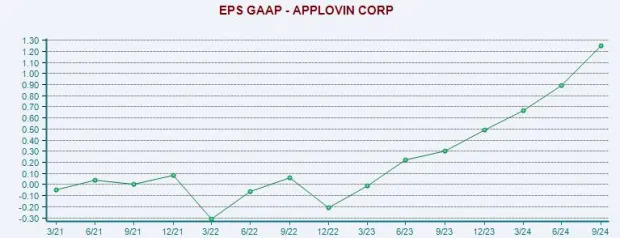

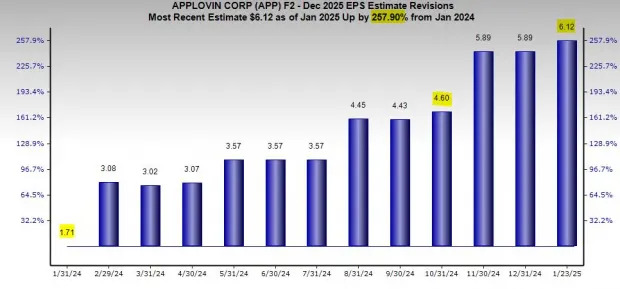

The digital app monetization firm is projected to grow its earnings by 314% from $0.98 to $4.06 a share in FY24. AppLovin’s impressive earnings growth is projected to carry over into 2025 to the tune of 51% expansion to earn $6.12 a share.

APP’s EPS estimates have skyrocketed, with its FY25 estimate up 260% in the past 12 months. This includes a big surge since its Q3 earnings release in early November.

APP’s surging earnings revisions land it a Zacks Rank #1 (Strong Buy). AppLovin’s Most Accurate estimates are also coming in above consensus across the board and it has topped our EPS estimate by an average of 26% in the last four quarters.

AppLovin stock skyrocketed 3,00% in the past two years, leaving Nvidia’s NVDA 650% run in the dust and crushing digital advertising titan Meta’s META 360%.

APP soared 730% in the past 12 months, while Nvidia jumped 130% and Meta climbed 65%.

AppLovin’s run helped it break above its late 2021 highs (April 2021 IPO) in September. APP stock has traded sideways since the middle of November following its post-Q3 release gap higher.

APP might be due for a healthy pullback to recalibrate its valuation, which has grown a little stretched. That said, AppLovin has found support at its recently converging 21-day and 50-day moving averages.

AppLovin’s choppiness has helped cool down the stock. APP might experience profit-taking and fade down to its 200-day moving average (near its pre-Q3 release levels) if it provides underwhelming guidance on February 12.

Long-term investors don’t need to be too picky and try to time stocks exactly. Traders, meanwhile, might want to wait for a possible flush lower before rushing into this standout growth tech stock over the last several years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research