January 26, 2025

Nio (NYSE: NIO) has always been an intriguing stock for investors looking to get exposure to the blossoming electric vehicle (EV) industry. The company has been a leading player in China's premium EV market, has championed battery-swap technology, and has posted months of sustained and strong delivery figures. But with the stock down by roughly 85% over the past three years to well below $5, is it a buy as we start 2025?

The dollar value any stock trades at is far less important than that figure's context -- its valuation metrics. While $5 a share might sound cheap, whether it's a bargain or not depends on how much revenue and earnings the company is churning out, and just what investors are paying for each dollar's worth of those sales and earnings.

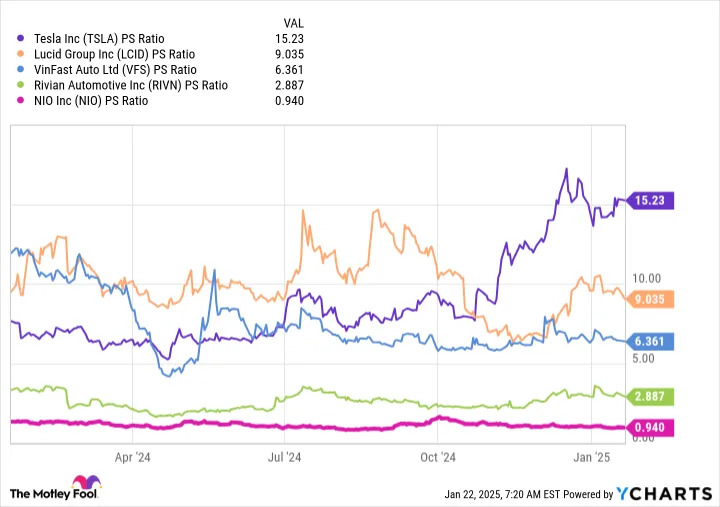

In Nio's case, as the company has yet to reach profitability, the best metric an investor can use to gauge its valuation -- and weigh it against its peers -- is the price-to-sales ratio.

As Nio trades at a much cheaper price-to-sales ratio than its competitors, this under-$5 stock looks more like a bargain than you might have originally thought. If Nio's price-to-sales ratio rose to more closely match its peers, that would amount to a generous gain in its stock price.

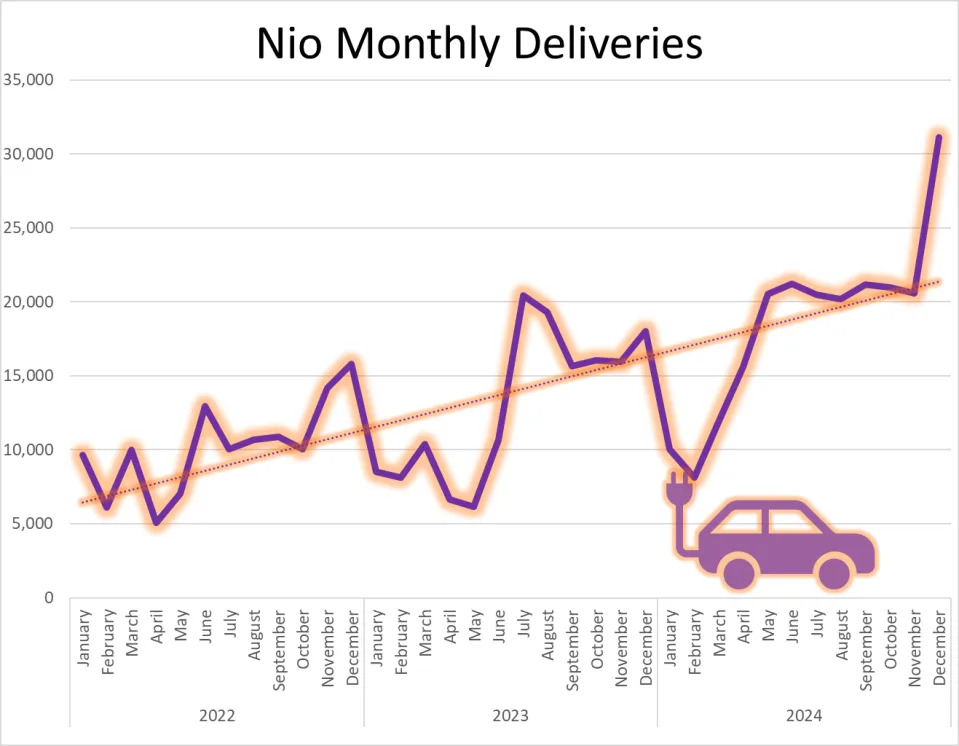

For Nio to close the valuation gap with some of its EV rivals, the company will need to show investors there's growth to be had. The good news is that Nio should be setting itself up for substantial growth in 2025 with production and deliveries of two new models -- Firefly and Onvo -- accelerating throughout the year.

The Onvo, Nio's second model, only went into production in September, and the Firefly launched in late December. But as production ramps up for those two models, it will push deliveries and revenues higher. Indeed, evidence of that had already appeared in December.

After posting many months of fairly consistent deliveries in the range of 20,000 to 21,500 units, December offered a sneak peek of what growth in 2025 could look like. Fresh deliveries of its Onvo model drove Nio's deliveries above the 30,000 unit mark to a monthly record.

But Nio, already one of the largest Chinese EV players by sales, has much bigger ambitions for 2025. On the back of its two newer models, the company expects to deliver roughly 440,000 units in 2025 -- nearly double 2024's sales.

Part of its expansion plan revolves around expanding into 25 overseas markets by the end of this year. And what might be most impressive about that plan is that it expects to deliver this growth while improving gross profit margins, controlling costs, and boosting operational efficiency.

Nio has set itself up well for a strong 2025. While the company's bottom-line losses might expand before it pivots toward turning a profit, it's also true that management is aiming to reach the breakeven point as soon as 2026. The Chinese EV maker is also well positioned to deliver top-line growth that could induce the market to narrow its valuation gap with competitors, providing significant upside to shareholders.

If management can not only deliver top-line growth but also improve its gross margins, 2025 could be an excellent year for Nio's investors.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Learn more »