January 26, 2025

Telecommunications conglomerate AT&T (NYSE:T) will be reporting earnings tomorrow before market open. Here’s what investors should know.

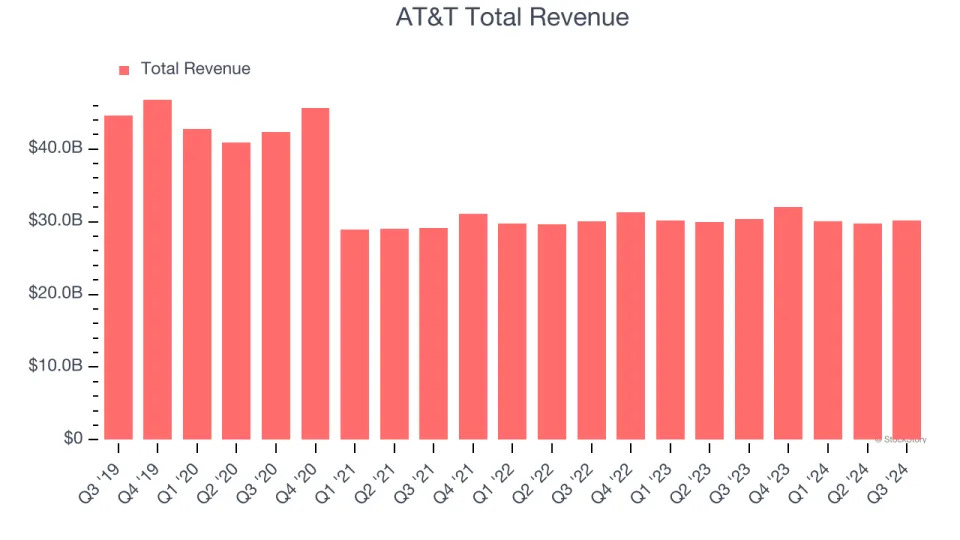

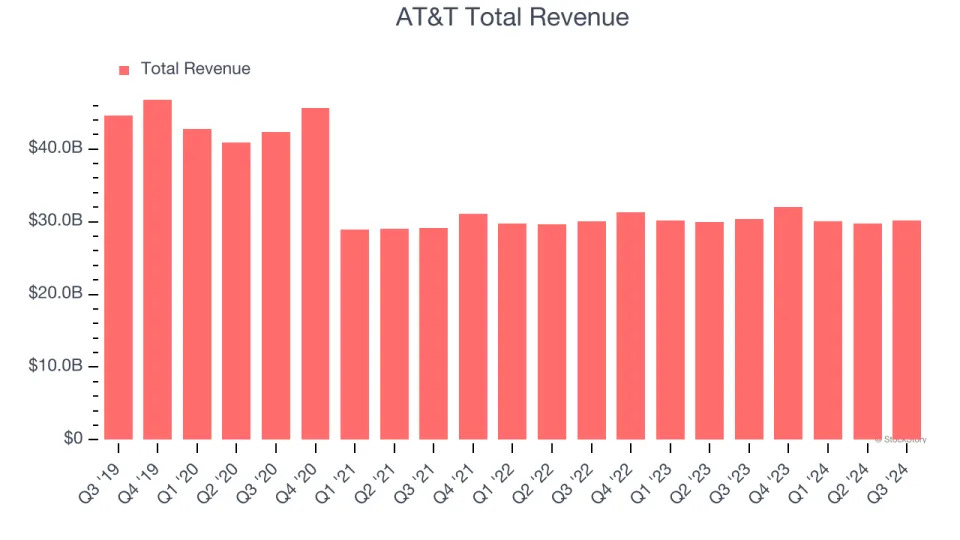

AT&T missed analysts’ revenue expectations by 0.8% last quarter, reporting revenues of $30.21 billion, flat year on year. It was a slower quarter for the company, with a miss of analysts’ EPS estimates.

Is AT&T a buy or sell going into earnings? Read our full analysis here, it’s free .

This quarter, analysts are expecting AT&T’s revenue to be flat year on year at $31.94 billion, slowing from the 2.2% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.51 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. AT&T has missed Wall Street’s revenue estimates six times over the last two years.

Looking at AT&T’s peers in the consumer discretionary segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Verizon delivered year-on-year revenue growth of 1.6%, beating analysts’ expectations by 1%, and Nike reported a revenue decline of 7.7%, topping estimates by 2%. Nike’s stock price was unchanged following the results.

Read our full analysis of Verizon’s results here and Nike’s results here .

There has been positive sentiment among investors in the consumer discretionary segment, with share prices up 4.6% on average over the last month. AT&T’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $26.15 (compared to the current share price of $22.65).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. .