January 25, 2025

Would it surprise you to hear that 60% of Amazon 's (NASDAQ: AMZN) total operating income came from Amazon Web Services (AWS) alone over the past 12 months? It's true! While some still consider Amazon an online retailer, AWS is the company's best moneymaker. This is even more important given the rise of artificial intelligence (AI).

Rather than use thousands of words, below are three charts that show why Amazon is one of the best AI stocks to own today.

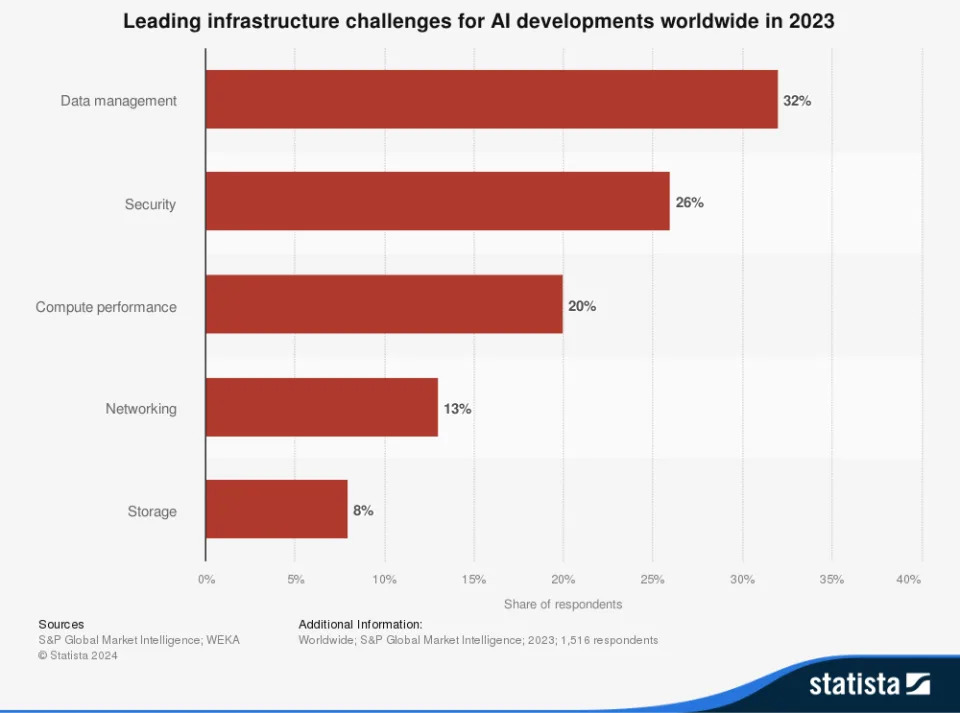

AI is a boon for efficiency and has the potential to wildly increase productivity over time. However, the technology brings its own set of challenges. As shown below, managing and processing the vast amount of required data is the largest one:

This is where Amazon comes in. The company is the world's leading provider of cloud data services and intends to stay there. Amazon plans to invest around $100 billion in over 200 data centers worldwide in the next decade. This will ensure that AWS has the capacity to continue as the global leader.

AWS functions much like a utility, where customers pay for the data they use. This is a tremendous business model in a world where data needs are constantly growing. The segment grew 19% in Q3 2024 to $27.5 billion. Over the trailing 12 months, it also surpassed $100 billion in sales and $36 billion in operating income. With AI demand and expanded capacity, AWS will continue to power profits for a long time to come.

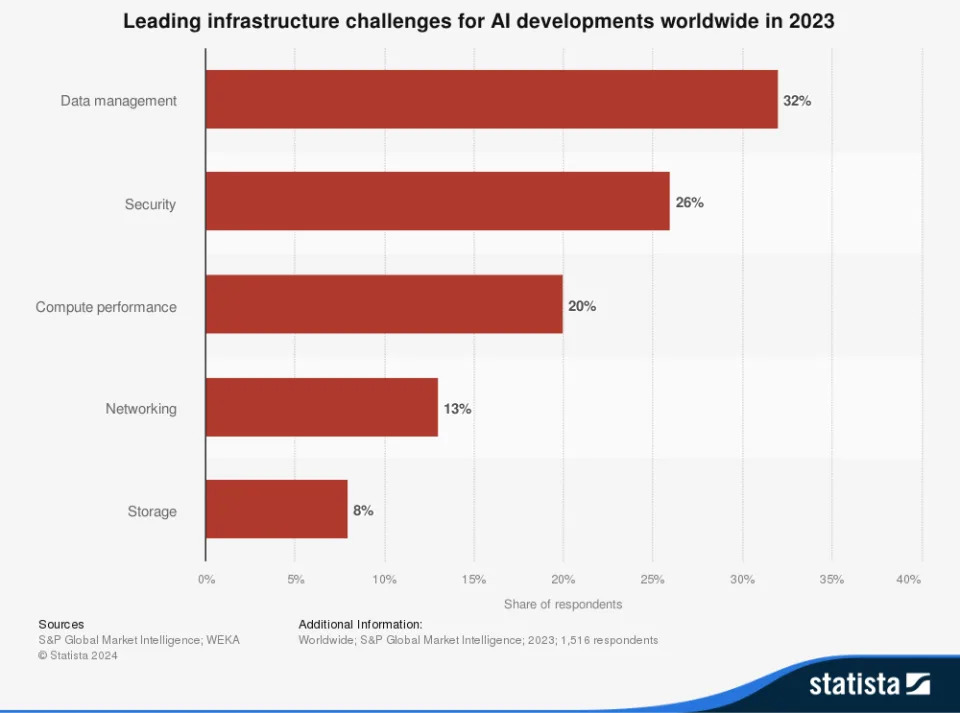

Amazon was a major beneficiary when the stimulus flowed in 2020 and 2021. People were spending, interest rates were near zero, and Amazon's operating cash flow soared to record highs. Operating cash flow is essentially the amount of money a company's primary business generates, making it a terrific metric to judge success.

In Amazon's case, it is the cash created from product sales, advertising sales, third-party seller services, and AWS. While the stimulus years were excellent, Amazon's recent operating cash flow has ,exploded much, much higher:

The $113 billion generated over the past 12 months is by far an all-time high, dwarfing the 2020-2021 boom. Much of this is the result of surging sales in AWS. Due to AI-driven demand, cash flow should continue to reach new heights, allowing Amazon to invest heavily in growth and sustain its lead in the cloud.

The S&P 500 index hit a new all-time high over 50 times in 2024, and many companies' valuations are very high. However, Amazon's stock price is still reasonable. Based on the abovementioned cash flow and earnings, it trades below five-year historical averages, as shown below.

Amazon's price-to-earnings ratio drops to just 37 based on next year's estimates, which may still sound high but is quite low historically for the company. Despite the market's rapid rise, Amazon is still a great value for long-term investors.

There are dozens of quality AI stocks to consider, and I recommend owning at least a few. Given the intense demand for data, Amazon's prolific cash-flow generation, and a reasonable valuation, Amazon stock is an excellent choice for long-term investment.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Learn more »