January 24, 2025

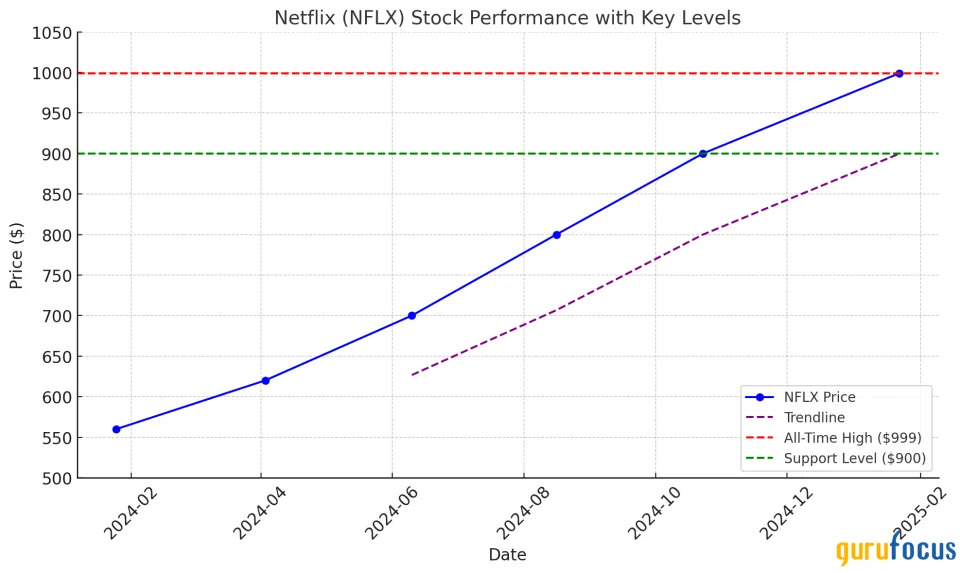

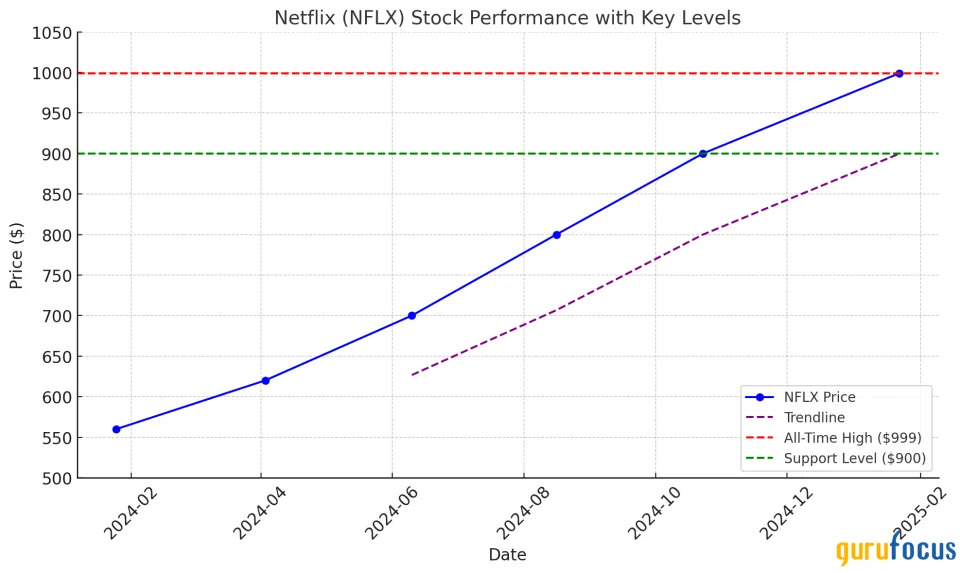

This week's investor attention was Netflix ( NFLX , Financial ), which saw shares jump 14 per cent on Jan. 22 after an impressive earnings report . The streaming giant also beat the top and bottom lines and crossed the 300 million global subscriber milestone. NFLX passed briefly above an all-time high of $999 before drifting down to $953.99.

Technical signals also support momentum, such as bullish ones. Schaeffer's Investment Research points out that NFLX is close to its 52-week high, and its implied volatility (IV) is in the 6th percentile of the stock's annual range. In the past five years, such conditions have yielded a 4.7 percent one-month average return on 75 percent of such setups that emerged historically. Moving me to NF would mean a comparable move of $1,000 or so, comfortably pushing NFLX to over $1,000.

Additional levels of support are contained in the stock's technical chart. Since August, NFLX has maintained a trend of higher highs, with the equity breaking past the upper boundary of this channel, which will give it a lot of momentum. More stability to the rally is afforded by the 80-day moving average, which acted as a launch point earlier this month, as well as the + 10 percent for the year to date.

The performance of NFLX could also be bolstered by analyst sentiment. Using its consensus 12-month price target of $1,047, NFLX has an upside of 6.3 percent to its current position.

Investors focused on growth-oriented investors have an eye on Netflix, as Wall Street watches these developments.

This article first appeared on

GuruFocus

.