January 24, 2025

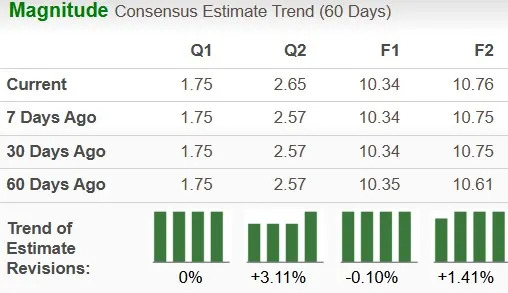

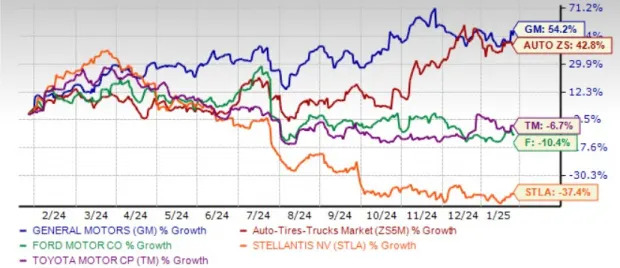

General Motors GM is slated to release fourth-quarter 2024 results on Jan. 28, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $1.75 per share and $43.7 billion, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar .

The EPS estimate for the to-be-reported quarter has remained constant over the past 60 days. The bottom-line projection indicates year-over-year growth of 41%. The Zacks Consensus Estimate for quarterly revenues suggests a modest year-over-year increase of 1.75%.

For 2025, the Zacks Consensus Estimate for GM’s revenues is pegged at $178.6 billion, implying a contraction of 2% year over year. The consensus mark for 2025 EPS is pegged at $10.76, implying growth of around 4% on a year-over-year basis.

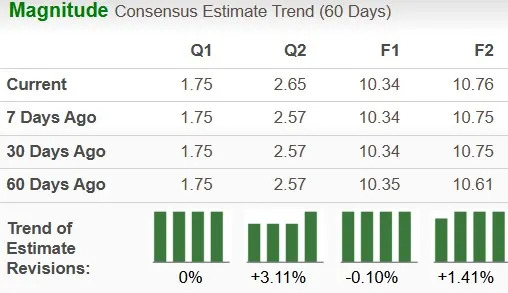

In the trailing four quarters, this U.S. legacy automaker surpassed EPS estimates on all occasions, with the average earnings surprise being 17.54%.

General Motors Company price-eps-surprise | General Motors Company Quote

Our proven model predicts an earnings beat for General Motors this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

GM has an Earnings ESP of +2.85% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here .

General Motors’ fourth-quarter sales in the United States grew 20.8% year over year to 755,160 vehicles. All four key brands — Chevrolet, GMC, Buick and Cadillac — posted solid gains during the quarter. Cadillac and GMC brands sold 49,084 and 178,289 vehicles, up 35% and 33%, respectively. Chevrolet and Buick’s deliveries rose to 481,064 and 46,186 units, up 16.7% and 9.5%, respectively. Deliveries of BrightDrop Zevo 400/600 vehicles were up a whopping 227.4% to 537 units. GM’s electric vehicle (EV) sales rallied 50% year over year to 43,982 units for the quarter. The company sold 18,089 units of the Chevrolet Equinox EV, 7,883 units of Chevrolet Blazer EV and 8,084 units of Cadillac Lyriq. More than 5,000 GMC Hummer EV pickups and SUVs were delivered during the quarter.

Our estimate for wholesale vehicle sales volumes in the GMNA (General Motors North America) segment is 787,000 units, suggesting a year-over-year uptick of 0.6%. GM's average transaction price for the fourth quarter approached $53,000, significantly higher than the industry average, while per-vehicle incentive spending declined. We project revenues from the GMNA segment to be $35.8 billion, implying an increase of 1.8%. Operating income from the unit is estimated at $2.87 billion, implying growth of 43%. General Motors’ $2 billion net cost reduction program is expected to have been completed by 2024 end.

General Motors’ fourth-quarter deliveries in China rose 40.6% sequentially to nearly 600,000 vehicles.This represents the company’s strongest sequential growth since the second quarter of 2022. China remains a crucial market for GM, ranking second only to its U.S. operations.Having said that, GM faced struggles in the China market last year amid rising competition from domestic brands and regulatory shifts. To address these challenges, the company is restructuring its operations in China and is expecting a $5 billion hit to its fourth-quarter adjusted pretax earnings. The automaker is writing down the value of its SGM joint venture by $2.6-$2.9 billion and incurring another $2.7 billion in restructuring charges, including plant closures and portfolio adjustments.

We also expect wholesale volumes from the GMI unit (excluding China JV) to be down roughly 10% in the quarter to be reported to 145,000 units. Our projections call for a contraction of 10.6% and 73% in revenues and operating income, respectively, year over year.

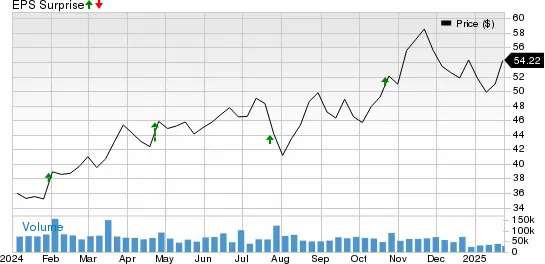

Over the past year, shares of GM have surged 54%, outperforming the auto sector. It has also performed better than its major peers, including Ford F, Stellantis STLA and Toyota TM.

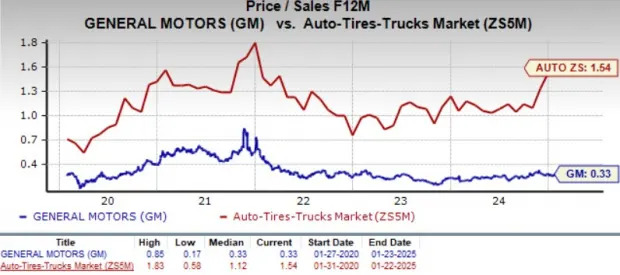

From a valuation perspective, General Motors is trading relatively cheap. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.33, way below the sector’s 1.54. The company has a Value Score of A.

While GM’s $5 billion fourth-quarter charge related to its China operations might be a near-term concern, investors shouldn’t be much concerned. With a robust U.S. market presence, disciplined cost management, a strong financial position and promising advancements in EVs, GM remains well-positioned for long-term success.

It is the top-selling automaker in the United States, having sold 2.7 million vehicles in 2024, a 4.3% increase year over year, with all four key brands posting solid gains. With regard to EV sales, GM secured the second spot in U.S. BEV sales in 2024, just behind Tesla. General Motors’ EV sales totaled 114,000 in 2024, representing a 50% increase from 2023. The company’s diverse lineup, including the Chevy Equinox EV, Cadillac Lyriq and GMC Hummer EV, positioned it as the second-largest EV seller in the country. General Motors’ deals with Vianode, Lithium Americas, LG Chemical, POSCO Chemical and Livent have boosted its EV supply chain, aligning with its long-term electrification goals.

GM’s robust liquidity position is another positive. As of Sept. 30, 2024, the company had $40.2 billion in total automotive liquidity, including $23.7 billion in cash and cash equivalents. Its robust share buyback program reflects management’s confidence in the company’s future. On its last earnings call, the company disclosed plans to retire 25 million shares in fourth-quarter 2024.

Overall, GM stock presents an appealing combination of value, growth potential and resilience. With robust performance in the first three quarters of 2024, sustained vehicle demand, and cost containment efforts, General Motors guided upbeat 2024 results. Its strong track record of earnings surprises and the likelihood of another beat in the to-be-reported quarter bolster confidence. We remain bullish on GM and believe investors should consider buying the stock ahead of its fourth-quarter results, as it is well-positioned for further upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research