January 24, 2025

ServiceNow

NOW is scheduled to release its fourth-quarter 2024 results on Jan. 29.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar

.

The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $2.95 billion, indicating 21.21% growth from the figure reported in the year-ago quarter.

The consensus mark for earnings is pegged at $3.58 per share, indicating growth of 15.11% from the figure reported in the year-ago quarter. The earnings figure has remained unchanged over the past 30 days.

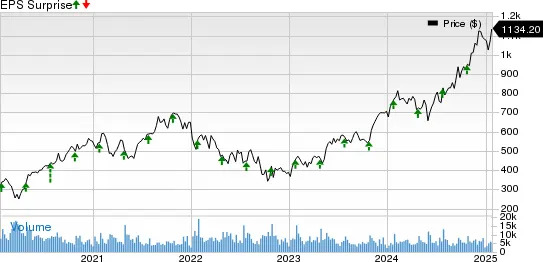

ServiceNow, Inc. price-eps-surprise | ServiceNow, Inc. Quote

ServiceNow’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 9.46%.

Let’s see how things are shaping up prior to this announcement.

ServiceNow expects fourth-quarter 2024 subscription revenues between $2.875 billion and $2.88 billion, suggesting an improvement in the range of 21.5-22% year over year on a GAAP basis. At constant currency, subscription revenues are expected to grow in the 20.5% range.

The Zacks Consensus Estimate for fourth-quarter 2024 subscription revenues is pegged at $2.88 billion, indicating 21.7% year-over-year growth.

The strong portfolio is helping NOW win clients regularly. Exiting the third quarter of 2024, ServiceNow had 2,020 total customers with more than $1 million in annual contract value (ACV).

NOW had 15 deals greater than $5 million in net new ACV and six deals of more than $10 million in the third quarter of 2024. It closed 96 deals greater than $1 million in net new ACV. The number of customers contributing more than $20 million or more grew nearly 40% year over year.

Generative AI (Gen AI) deals continued to gain traction in the third quarter of 2024. ServiceNow had 44 new Now Assist customers spending more than $1 million in ACV, including six with more than $5 million and two with more than $10 million. NOW has also been successful in monetizing its Gen AI offerings, realizing price increases of roughly 30%.

The momentum is expected to have continued in the fourth quarter of 2024.

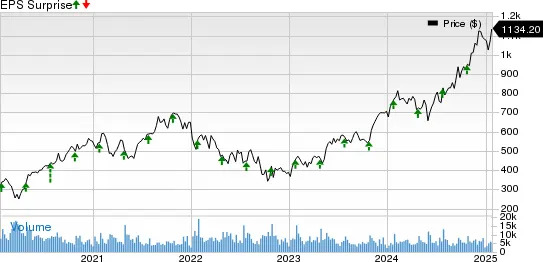

NOW shares have returned 47.9% in the trailing 12-month period, outperforming the Zacks Computer & Technology sector’s appreciation of 28.6% and the Zacks Computers – IT Services industry’s return of 12.1%.

Technically, ServiceNow shares are displaying a bullish trend as they trade above the 50-day and 200-day moving averages.

However, ServiceNow stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment.

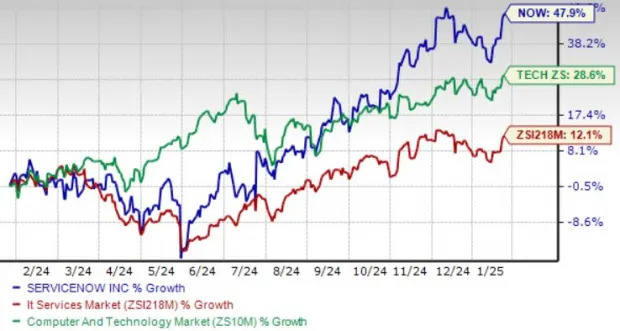

In terms of the forward 12-month P/S ratio, NOW is trading at 17.49X, higher than the sector’s 7.17X and the industry’s 11.61X.

ServiceNow is extensively leveraging AI and machine learning technologies to boost the potency of its solutions. NOW’s expanding Gen AI capabilities are noteworthy, as its total addressable market is expected to hit $275 billion in 2026.

Continued innovation has been a major driver. ServiceNow’s latest update, Xanadu, offers AI-powered, purpose-built industry solutions for domains, including telecom, media and technology, financial services and the public sector.

The Xanadu update adds the latest AI capabilities to boost customer agility, enhance productivity and improve employee experiences. It expands the Gen AI portfolio to enterprise functions, including Security and Sourcing & Procurement Operations.

NOW plans to integrate Agentic AI into the ServiceNow platform and unlock 24/7 productivity at a massive scale. This service, available this November for Customer Service Management AI Agents and IT Service Management AI Agents, is expected to reduce the time to resolve an issue and make live agents more productive.

ServiceNow is adding GenAI and governance innovations to the Now platform to foster responsible AI. NOW is adding more than 150 GenAI innovations to its portfolio, including new, expanded Now Assist capabilities with an AI Governance feature for secure and compliant AI practices.

Amazon

AMZN,

Microsoft

MSFT and

NVIDIA

NVDA are major partners of ServiceNow. Apart from these, ServiceNow has inked several other partnership deals with Five9, Visa, Snowflake, Zoom, Siemens, Rimini Street, IBM, Genesys, Fujitsu, Equinix, Boomi and Infosys, which are expected to boost its growing market share.

ServiceNow and Amazon Web Services recently announced an expanded strategic collaboration with new capabilities to accelerate AI-driven business transformation. The companies are connecting Amazon Bedrock models to ServiceNow, which will help enterprises boost the development and deployment of GenAI solutions.

NOW inked an expanded partnership with Microsoft to modernize front-office business processes with a Microsoft Copilot and ServiceNow AI agent collaboration. The much anticipated Now Assist integration with Microsoft Copilot for Microsoft 365 is generally available with the Xanadu update.

NVIDIA and NOW are collaborating to develop out-of-the-box use cases for AI agents on the Now platform using NVIDIA NIM Agent Blueprints.

ServiceNow’s robust GenAI portfolio and strong partner base are expected to drive its subscription revenues in the long haul. The Growth Style Score of B is hard to ignore for investors despite a stretched valuation.

ServiceNow currently has a Zacks Rank #2 (Buy), suggesting that prior to the fourth quarter of 2024, it is the right time to accumulate the stocks. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research