January 23, 2025

SL Green Realty Corp. SLG recently announced that IBM has expanded its lease by around 92,663 square feet at One Madison Avenue. This brings the tech giant’s total occupied space in the building to around 362,092 square feet. IBM will occupy the entire seventh floor of the building for 15 years, which is now 72% leased.

The above move marks IBM’s continued confidence in SLG’s high-quality office assets. It exemplifies that an increasing number of tenants are choosing premium workspaces to retain top talents.

One Madison Avenue is equipped with a bouquet of amenities that offer its occupiers a wholesome experience, bringing work and wellness in harmony. Some of the features include HVAC filters, an event space and rooftop garden, a dedicated lounge, a fitness center and a number of eateries.

As per Steven Durels, EVP and director of Leasing and Real Property at SL Green, “We are delighted to expand our valued partnership with IBM and support their continued growth and expansion in New York City.”

SL Green has a mono-market strategy focus and an enviable footprint in the large and high-barrier-to-enter New York real estate market. The high demand for premium office spaces is propelling SLG’s leasing momentum. For 2024, the company has signed 188 leases for around 3.6 million square feet, while it continues to hold an active pipeline of more than 875,000 square feet.

Last month, SL Green announced that The Travelers Insurance Company executed a lease renewal for 122,788 square feet at 485 Lexington Avenue. In the same month, a new lease spanning 220,221 square feet was signed by the global professional services firm, Alvarez & Marsal Holdings, LLC at 100 Park Avenue.

SLG reported fourth-quarter 2024 funds from operations (FFO) per share of $1.45. The company had reported an FFO of 72 cents per share in the previous year. The results reflected strong leasing activity in its Manhattan portfolio. However, higher interest expenses and lower same-store NOI acted as dampeners.

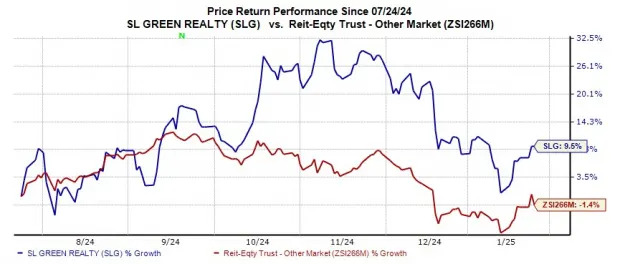

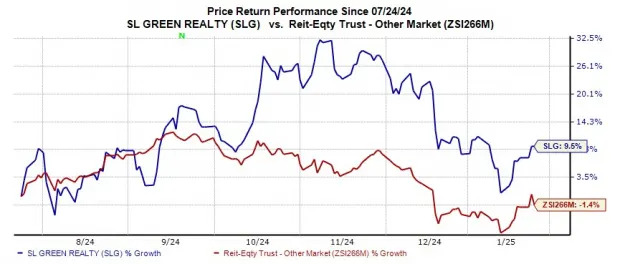

Shares of this Zacks Rank #2 (Buy) company have risen 9.5% over the past six months, against the industry’s fall of 1.4%.

Some other top-ranked stocks from the broader REIT sector are Welltower WELL and OUTFRONT Media OUT, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

The Zacks Consensus Estimate for Welltower’s 2024 FFO per share is pegged at $4.30, suggesting year-over-year growth of 18.1%.

The Zacks Consensus Estimate for OUTFRONT’s 2024 FFO per share stands at $1.77, indicating an increase of 5.4% from the year-ago reported figure.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research