January 24, 2025

Intuitive Surgical ISRG reported fourth-quarter 2024 adjusted earnings per share (EPS) of $2.21, which beat the Zacks Consensus Estimate of $1.65 by 24.9%. The bottom line improved 38.1% year over year.

GAAP EPS in the quarter was $1.88, up 11.2% from the year-ago quarter’s level.

This Zacks Rank #3 (Hold) company reported revenues of $2.41 billion, up 24.9% year over year reportedly and 26% at constant currency (cc). A higher number of installed systems and growth in the da Vinci procedure volume contributed to the improvement. The top line was in line with the Zacks Consensus Estimate.

Instruments & Accessories

Revenues from this segment totaled $1.41 billion, indicating a year-over-year improvement of 23.7%. This can be attributed to the da Vinci procedure’s 18% volume growth. The sales growth also reflects approximately 70% growth in Ion procedures and 81% for SP platform. ISRG completed 32,000 procedures globally in 2024 using its latest da Vinci 5 system. The top-line improvement was also aided by higher revenues per procedure (3.3% up YoY) led by a higher mix of SP procedures, partially offset by a lower mix of bariatric procedures and a higher mix of cholecystectomy procedures.

Intuitive Surgical, Inc. price-consensus-eps-surprise-chart | Intuitive Surgical, Inc. Quote

Systems

This segment’s revenues totaled $655 million, up 36.5% year over year. The robust growth was driven by a higher average selling price and a lower mix of leased systems. Intuitive Surgical shipped 493 da Vinci Surgical Systems compared with 415 in the prior-year quarter. The company placed 284 systems in the United States and 209 in international markets. During the fourth quarter, ISRG placed 174 of its latest da Vinci 5 systems, taking the total placements to 362 since its launch in March 2024.

Services

Revenues from this segment amounted to $347.4 million, up 14.1% from the year-ago quarter’s level.

Adjusted gross profit was $1.68 billion, up 28% year over year. As a percentage of revenues, the gross margin was 69.5%, up approximately 150 bps from the prior-year quarter’s figure.

Selling, general and administrative expenses totaled $612.6 million, up 8% year over year.

Research and development expenses totaled $294.7 million, up 13.3% on a year-over-year basis.

Adjusted operating income totaled $927.7 million, up 49.4% year over year. As a percentage of revenues, the operating margin was 38.4%, up approximately 620 bps from the prior-year quarter’s figure.

Intuitive Surgical exited the fourth quarter with cash, cash equivalents and investments of $8.83 billion compared with $9.31 billion in the previous quarter.

Total assets increased to $18.74 billion from $17.74 billion a year ago.

ISRG ended the fourth quarter on a strong note, with earnings and revenues beating their respective estimates. Despite this robust quarterly performance, the stock was down 2.2% during after-hours trading on Jan. 23, as investors likely factored in the quarterly strength last week following the announcement of preliminary results.

Revenues were primarily driven by continued improvement in the company’s da Vinci procedure volume, coupled with strong Ion procedure growth. Intuitive Surgical has also been increasing the pricing of procedures to fight inflationary pressure that also aided sales growth. Moreover, a lower proportion of systems sold under operating-lease arrangement aided the top line further.

The company’s da Vinci system placement was also higher year over year, which should continue to boost procedure volume growth. Meanwhile, the launch of da Vinci 5 systems is bringing in additional system placement. ISRG is set to open new manufacturing facilities for da Vinci 5 and Ion systems in 2025, along with endoscope facilities in Germany and Bulgaria.

However, the continued slowdown in bariatric procedures is likely to continue in 2025 amid the rise of GLP-1 medications, hurting top-line growth. ISRG also expects a slow, gradual decline in Instruments & Accessories revenues per procedure over the next few years due to growth in benign procedures, which require less instrumentation than complex cancer surgeries.

Improving gross and operating margins during the fourth quarter buoy optimism. However, operating expenses are likely to be on the higher side in 2025 due to increased depreciation costs on account of new facilities.

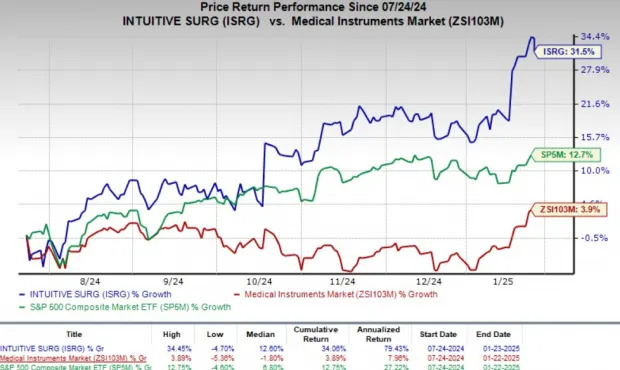

Shares of Intuitive Surgical have risen 31.5% in the past six months compared with the industry’s 3.9% growth. The S&P 500 Index has gained 12.7% during the same time frame.

Some better-ranked stocks in the broader medical space are Penumbra PEN, Masimo MASI and Biosig Technologies BSGM.

Penumbra, carrying a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 37.5% for 2025. You can see the complete list of today’s Zacks #1 Rank stocks here.

PEN’s earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 10.54%. The company is scheduled to release fourth-quarter results on Feb. 18.

PEN’s shares have gained 42.8% compared with the industry’s 3.9% growth in the past six months.

Masimo, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 11.8% for 2025.

MASI’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 17.10%. Its shares have risen 58.5% compared with the industry’s 3.9% growth year to date. The company is scheduled to relase fourth-quarter results on Feb. 25.

Biosig, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 17.1% for 2025. It delivered a trailing four-quarter average earnings surprise of 40.00%. The company is expected to relase fourth-quarter results soon.

BSGM’s shares have risen 31.9% in the past six months compared with the industry’s 3.9% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Biosig Technologies, Inc. (BSGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research