January 24, 2025

Twilio Inc. TWLO shares soared 14.7% during Thursday’s extended trading session as the company issued an optimistic long-term financial forecast and reported preliminary results for the fourth quarter of 2024. The communications software maker’s new share repurchase announcement was another bright spot that boosted investors’ confidence.

The company’s robust guidance, along with an aggressive shareholder return plan, offers compelling reasons for investors to consider holding the stock right now. These moves underscore Twilio's commitment to delivering shareholder value and solidifying its position in the growing Communications Platform-as-a-Service (CPaaS) market.

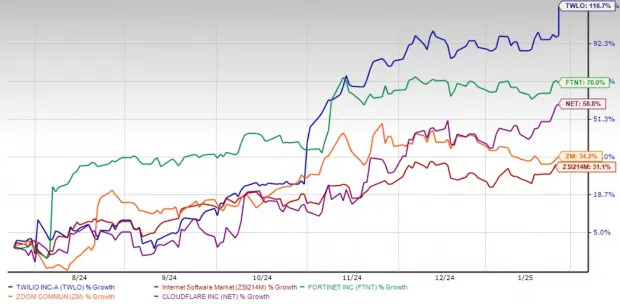

TWLO stock has been riding high, soaring 116.7% over the past six months. Over the same time frame, the stock has outperformed the Zacks Internet – Software industry’s rise of 31.1%. It has also outpaced the gains of industry peers, including Fortinet FTNT, Zoom Communications ZM and Cloudflare NET.

Twilio has set clear targets to drive profitability and free cash flow. For fiscal 2025, the company projects a non-GAAP operating profit in the band of $825-$850 million, with free cash flow in the same range. It also projects organic revenues for the year to grow in the 7-8% range year over year.

Twilio’s robust outlook for 2025 builds on its strong preliminary results for the fourth quarter of 2024, which include achieving GAAP operating profitability ahead of schedule. The preliminary results also imply that non-GAAP operating income will exceed the previously projected range of $185-$195 million.

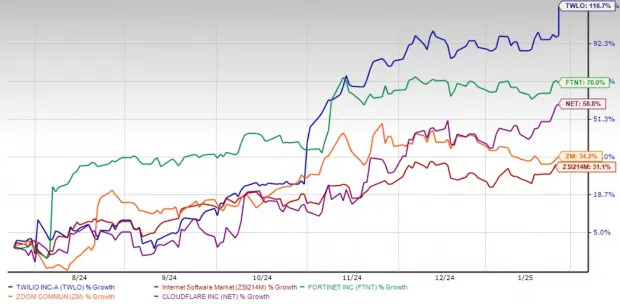

Twilio’s preliminary results for the quarter also show 11% year-over-year growth, which is significantly higher than management’s earlier guidance of a 7%-8% increase and the Zacks Consensus Estimate of a 7.6% rise. The consensus mark for the fourth quarter EPS has remained unchanged at $1, implying year-over-year growth of 16.3%. The company surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 31%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Twilio's focus on disciplined cost management, including a 40% reduction in headcount since 2022 and a shift to a remote-first policy, has resulted in significant operating leverage. These initiatives position the company for sustainable growth and increased margins, targeting 21%-22% non-GAAP operating margins by 2027, which is way higher than the last reported quarter’s non-GAAP operating margin of 16.1%. The company also targets to generate more than $3 billion in cumulative free cash flow through 2025-2027.

Twilio's long-term forecast demonstrates its cross-selling initiatives are paying dividends, with multi-product customers now accounting for 90% of its revenues. The company is also leveraging international expansion and partnerships with Independent Software Vendors (ISVs) to tap underpenetrated markets, which currently constitute only 35% of its revenues.

Twilio’s $2 billion share repurchase plan, set to run through the end of 2027, highlights its confidence in the company's long-term growth trajectory and current valuation. This plan follows $3 billion in share buybacks over the past two years, which reduced shares outstanding by 16%.

By committing to return approximately 50% of annual free cash flow to shareholders, Twilio aligns its capital allocation strategy with investor interests, creating a compelling case for value creation.

Twilio remains the undisputed leader in the CPaaS market, with a 2023 revenue share of $2.7 billion, according to a Gartner report, far surpassing competitors. Its innovation engine, combining communications, contextual data and AI, is a key differentiator. Recent innovations like Unified Profiles, predictive AI tools and enhanced fraud prevention capabilities reinforce its market position.

Additionally, the emerging Customer Experience as a Service (CXaaS) market represents a significant growth opportunity. Twilio's integration of CPaaS, CDP (Customer Data Platforms) and AI positions it to capture a larger share of the $158 billion addressable market projected by 2028.

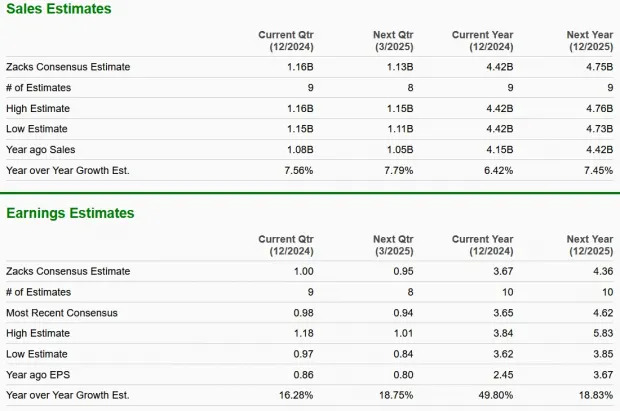

While Twilio’s fundamentals are strong, its valuation raises concerns. The stock’s forward 12-month price-to-sales (P/S) ratio stands at 3.65, significantly higher than the industry average of 3.07. This premium reflects its technological edge and market leadership but also suggests limited upside in the near term. The Zacks Value Style Score of D further underscores the stock’s stretched valuation.

Twilio’s combination of strong financial performance, operational discipline and strategic innovation positions it as a compelling investment opportunity. The $2 billion share repurchase plan provides immediate shareholder value, while its leadership in CPaaS and expansion into CXaaS ensure long-term growth potential.

However, given its premium valuation, caution is warranted. For investors already holding the stock, staying invested is a prudent strategy. TWLO carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

Zoom Communications, Inc. (ZM) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research