January 22, 2025

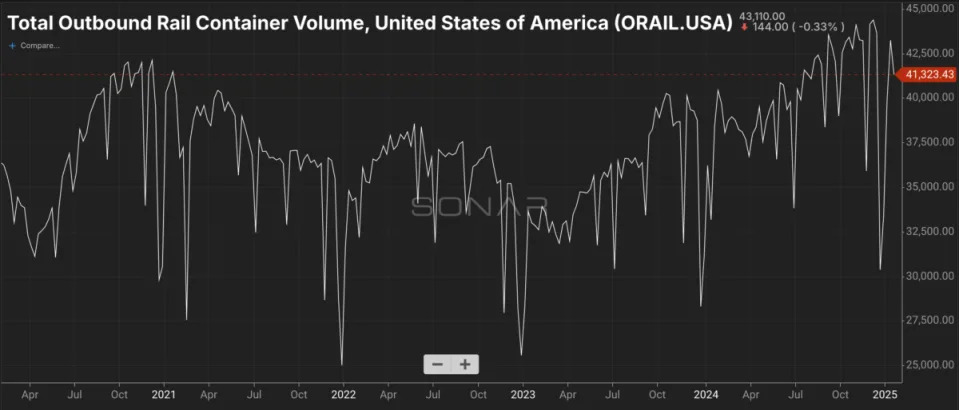

Intermodal’s long peak continues , as volumes are still outpacing January 2024.

The rail intermodal market rocketed forward in the third week of January, recording remarkable year-over-year volume growth of 27% which was helped by easier year-over-year comparisons during a typical period of seasonal softness. That softness hasn’t manifested this year, as intermodal volume growth continues to be driven by high Chinese exports, a robust U.S. consumer and shippers building up inventory in anticipation of tariffs.

Leading the pack, CPKC’s intermodal volumes grew an astonishing 38% year over year in week three, Union Pacific’s intermodal volumes were up 36% y/y, and Canadian National’s intermodal volume increased by 31% y/y. BNSF’s intermodal volume grew 29% y/y in week three, CSX’s intermodal volume grew 28% y/y, and Norfolk Southern’s intermodal volume grew 20% y/y.

(Total Outbound Rail Container Volume measures the number of international and domestic, loaded and empty, rail container movements originating in the United States. Chart: SONAR. To learn more about SONAR, click here .)

Container movements seem to have peaked but are still exceptionally super-seasonal and strong on a year-over-year basis. Ocean container volumes inbound to the United States have recovered nicely in January and stayed stronger for longer but still peaked in August 2024. Intermodal volumes appear to be following the same trend, but delayed by some months.

Railroads are navigating this growth by strategically maintaining their head count levels, despite the rising volumes. The Big Four U.S. railroads — BNSF, CSX, Norfolk Southern (NSC), and Union Pacific (UNP) — are collectively aiming to keep their workforce relatively flat, with total head count down by approximately 2% y/y. This approach is primarily driven by reductions at CSX (down by 0.3%) and BNSF (down by 0.7%), offset by marginal increases at NSC (up by 0.3%) and UP (up by 0.1%).

The rationale behind this strategy lies in enhancing operational efficiency and productivity. By leveraging technological advancements and optimizing processes, railroads aim to handle the growing intermodal volumes without a proportional increase in workforce. For instance, Union Pacific CEO Jim Vena highlighted improvements in productivity at an investor conference in December, allowing the railroad to manage steady volumes with fewer employees. Similarly, CSX has projected a flat head count outlook for 2025, anticipating that its existing workforce can absorb the increased demand through improved efficiency measures.

Despite the optimistic outlook, railroads remain aware of potential risks that could impact their ambitious growth targets. Factors such as capacity constraints on rail networks or volatility in freight pricing could pose challenges. However, the proactive measures being undertaken to optimize head count and improve operational efficiency provide a buffer against these uncertainties, positioning railroads to navigate potential headwinds effectively.

Diversified growth across commodity types may protect the railroads against downturns as well as anything else: across the Class I rails, grain is up 15% so far this year, petroleum products volume has increased by 10% so far this year, and chemicals are up 7% year to date.

The intermodal market’s resilience through the third week of January 2025 — normally a deep trough in rail volumes — is a signal that stands out from the typical noise. While rail intermodal competes with trucking on the longest lengths of haul, it’s a backstop for trucking volumes at shorter lengths of haul and is generally indicative of shippers’ attitudes toward their inventories. The question looking forward is how deep a seasonal trough, if any, intermodal volumes will see this winter before they start rebuilding momentum toward their traditional late-fall peak.

The post Intermodal volume still outperforming appeared first on FreightWaves .