January 21, 2025

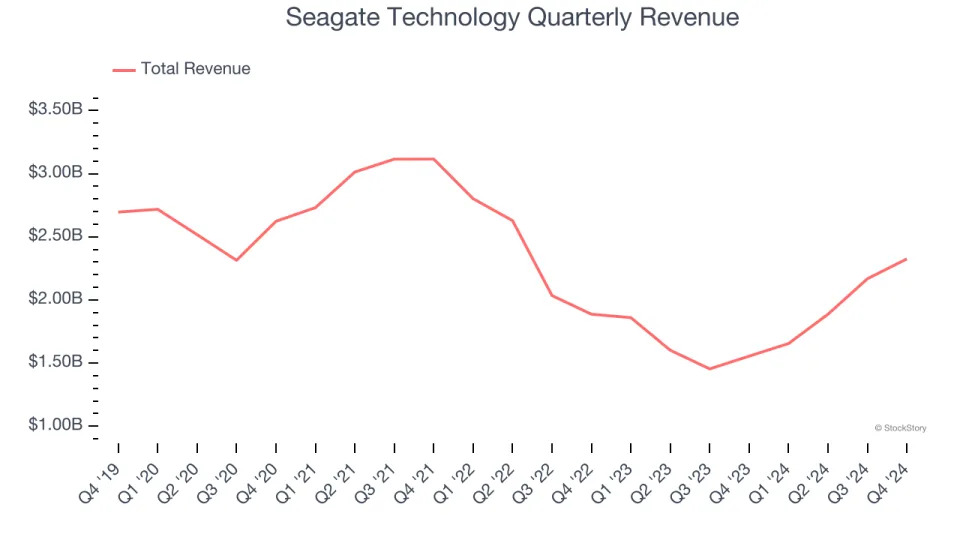

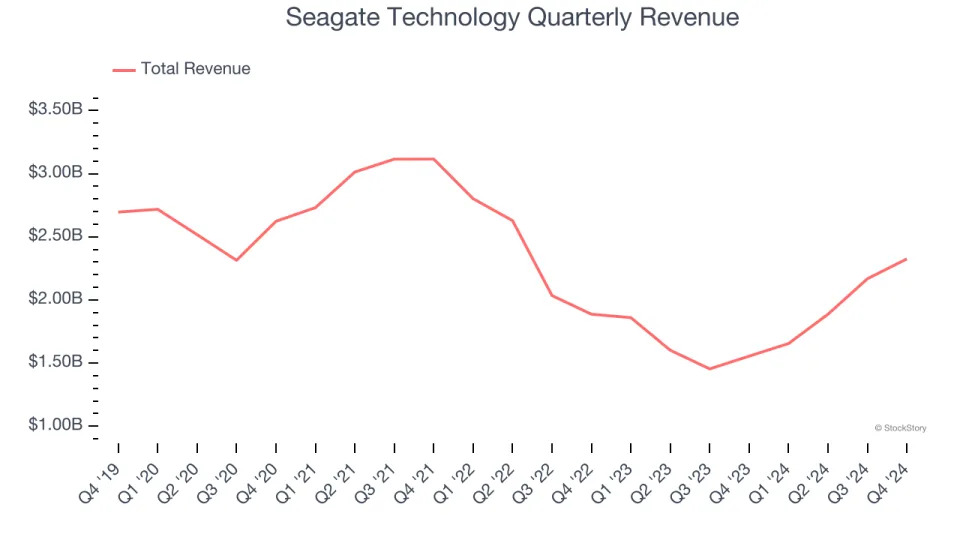

Data storage manufacturer Seagate (NASDAQ:STX) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 49.5% year on year to $2.33 billion. On the other hand, next quarter’s revenue guidance of $2.1 billion was less impressive, coming in 4.9% below analysts’ estimates. Its non-GAAP profit of $2.03 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Seagate Technology? Find out in our full research report .

"Seagate ended calendar 2024 on a strong note as we grew revenue, gross margin and non-GAAP EPS successively in each quarter of the year. Our results demonstrate structural improvements in the business and our focus on value capture in an improving demand environment, highlighted by decade-high gross margin performance exiting the December quarter," said Dave Mosley, Seagate’s Chief Executive Officer.

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

The rapid growth in data generation and the need to support increases in processing power for everything from consumer devices to data center servers are driving the demand for memory chips. From the content delivery networks and edge computing to the cloud, data storage is a key component underpinning the global technology architecture. On top of that, secular growth drivers like machine learning and the boom in media-rich digital content are further accelerating the need for storage. Like all semiconductor segments, memory makers are highly cyclical, driven by supply and demand imbalances and exposure to consumer product cycles.

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Seagate Technology’s demand was weak over the last five years as its sales fell at a 4.2% annual rate. This fell short of our benchmarks and is a sign of lacking business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Seagate Technology’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.3% annually over the last two years.

This quarter, Seagate Technology’s year-on-year revenue growth of 49.5% was magnificent, and its $2.33 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 26.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.6% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

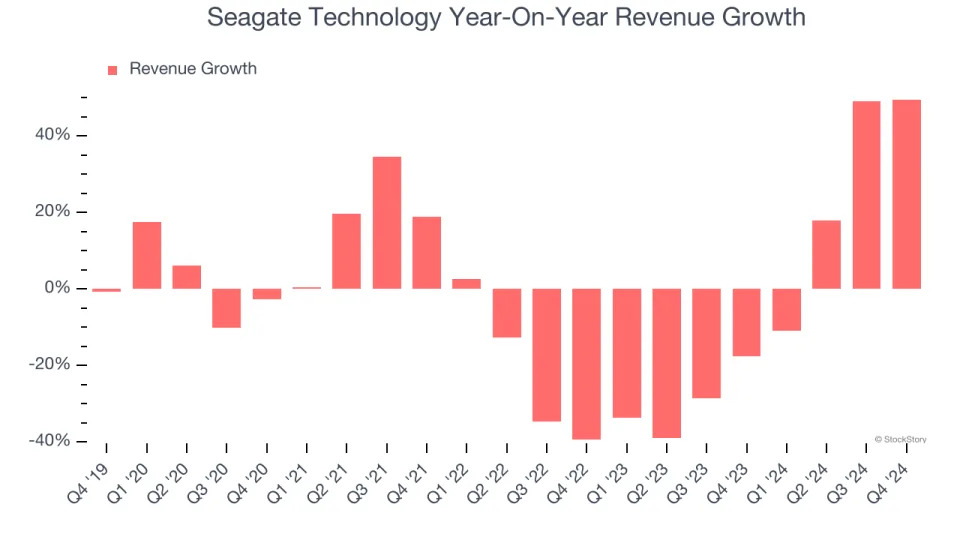

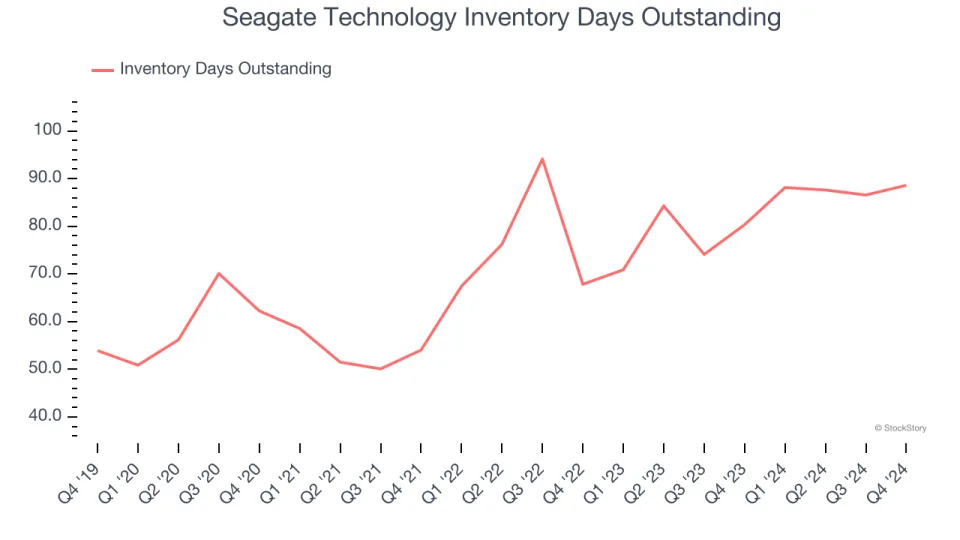

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Seagate Technology’s DIO came in at 89, which is 18 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

We were impressed by how significantly Seagate Technology blew past analysts’ EPS expectations this quarter. On the other hand, its revenue and EPS guidance for next quarter missed significantly and its inventory levels slightly increased. Overall, this quarter was mixed. The stock remained flat at $101.13 immediately following the results.

So do we think Seagate Technology is an attractive buy at the current price? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .