January 15, 2025

As global markets grapple with inflation concerns and political uncertainties, small-cap stocks have notably underperformed, with the Russell 2000 Index dipping into correction territory. In such a volatile environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting economic landscapes.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Shanghai Baosight SoftwareLtd |

21.82% |

25.22% |

★★★★★★ |

|

Seojin SystemLtd |

35.41% |

39.86% |

★★★★★★ |

|

eWeLLLtd |

26.41% |

28.82% |

★★★★★★ |

|

Yggdrazil Group |

30.20% |

87.10% |

★★★★★★ |

|

Mental Health TechnologiesLtd |

25.83% |

113.12% |

★★★★★★ |

|

Ascelia Pharma |

76.15% |

47.16% |

★★★★★★ |

|

Medley |

20.97% |

27.22% |

★★★★★★ |

|

Fine M-TecLTD |

36.52% |

131.08% |

★★★★★★ |

|

JNTC |

29.48% |

104.37% |

★★★★★★ |

|

Delton Technology (Guangzhou) |

20.25% |

29.52% |

★★★★★★ |

Let's review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

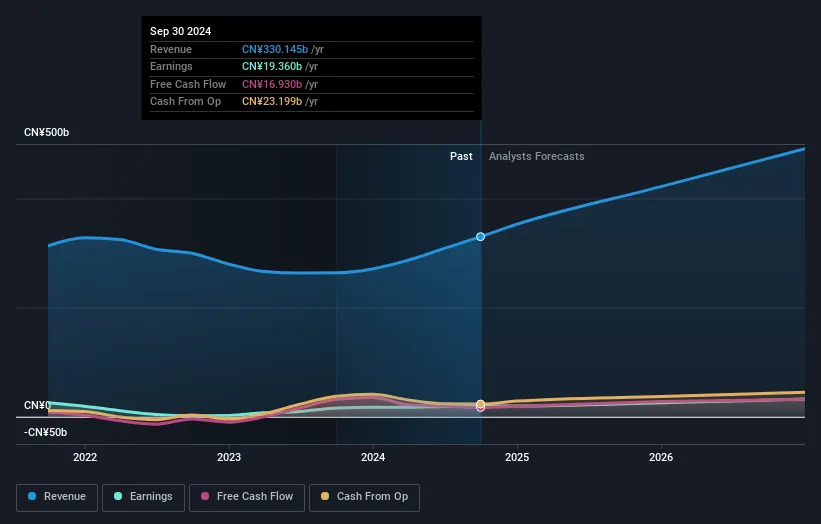

Overview: Xiaomi Corporation is an investment holding company that offers a range of hardware and software services both in Mainland China and internationally, with a market capitalization of HK$841.66 billion.

Operations: Xiaomi generates revenue primarily through its Smartphones segment, which accounts for CN¥184.68 billion, and IoT and Lifestyle Products contributing CN¥93.58 billion. The Internet Services segment adds CN¥32.66 billion to its revenue stream.

Xiaomi's strategic maneuvers, including a substantial share repurchase of 72.11 million shares for HKD 1.35 billion and a relocation of its Hong Kong business address, underscore its proactive corporate governance. Financially, Xiaomi has demonstrated robust growth with a 30.7% increase in quarterly sales to CNY 92.51 billion and an annualized earnings growth rate of 21.4%, outpacing the Hong Kong market's average. These figures reflect not only Xiaomi's resilience but also its ability to adapt and thrive amidst market fluctuations, positioning it as a dynamic entity within the tech landscape despite less aggressive revenue forecasts compared to some peers.

Simply Wall St Growth Rating: ★★★★★☆

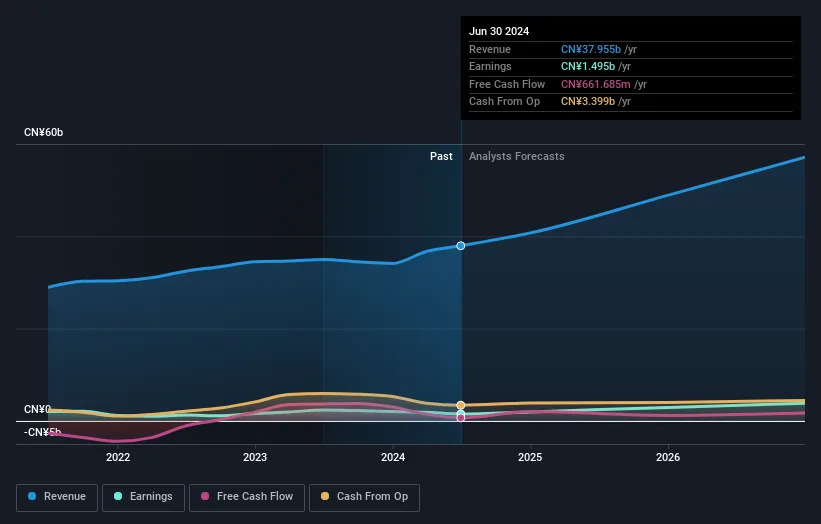

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market capitalization of approximately HK$4.72 billion.

Operations: Inspur Digital Enterprise Technology Limited generates revenue primarily through its Internet of Things (IoT) solutions, management software, and cloud services in China. The IoT solution segment is the largest contributor, followed by management software and cloud services.

Inspur Digital Enterprise Technology, with its robust annual revenue growth at 23.3%, outstrips the Hong Kong market average of 7.6%, indicating a strong market position and potential for sustained expansion. This performance is underpinned by an impressive earnings surge of 84.5% over the past year, significantly eclipsing the software industry's growth rate of 10.4%. The company's commitment to innovation is evident in its R&D investments, which are critical to maintaining technological leadership and driving future growth in a competitive landscape where companies like TSMC dominate with high-profile clients such as Apple. With earnings projected to climb by 38.76% annually, Inspur is poised to capitalize on emerging tech trends despite facing challenges like lower forecasted return on equity at 19.7% in three years compared to industry benchmarks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market capitalization of CN¥56.17 billion.

Operations: Lingyi iTech focuses on providing smart manufacturing services and solutions. The company's operations encompass various revenue streams, contributing to its market presence in the technology manufacturing sector.

Lingyi iTech (Guangdong) demonstrates a compelling trajectory in the tech sector, marked by a notable revenue increase to CNY 31.48 billion, up from CNY 24.65 billion year-over-year, reflecting a growth rate of 27.7%. Despite facing challenges with a dip in net income from CNY 1.87 billion to CNY 1.41 billion and earnings per share decreasing slightly, the company's aggressive R&D spending and strategic moves such as considering new audit firms and launching foreign exchange derivatives transactions signal a proactive stance towards future scalability and market adaptability. These efforts are crucial as they navigate through profitability pressures while still investing heavily in innovation to stay competitive in the fast-evolving tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1810 SEHK:596 and SZSE:002600.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]