January 16, 2025

As the UK market grapples with global economic uncertainties, particularly influenced by faltering trade data from China, the FTSE 100 has seen a downturn, reflecting broader concerns about international demand and commodity prices. In such volatile conditions, dividend stocks can offer investors a measure of stability and income potential through regular payouts, making them an attractive consideration for those navigating today's unpredictable financial landscape.

|

Name |

Dividend Yield |

Dividend Rating |

|

Pets at Home Group (LSE:PETS) |

6.05% |

★★★★★★ |

|

Keller Group (LSE:KLR) |

3.46% |

★★★★★☆ |

|

4imprint Group (LSE:FOUR) |

3.24% |

★★★★★☆ |

|

OSB Group (LSE:OSB) |

8.42% |

★★★★★☆ |

|

Dunelm Group (LSE:DNLM) |

8.11% |

★★★★★☆ |

|

Man Group (LSE:EMG) |

6.15% |

★★★★★☆ |

|

Big Yellow Group (LSE:BYG) |

5.19% |

★★★★★☆ |

|

Grafton Group (LSE:GFTU) |

4.04% |

★★★★★☆ |

|

DCC (LSE:DCC) |

3.77% |

★★★★★☆ |

|

James Latham (AIM:LTHM) |

6.75% |

★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc delivers technology and services to corporate and public sector organizations across the UK, Germany, France, North America, and internationally, with a market cap of £2.18 billion.

Operations: Computacenter plc's revenue segment includes Computer Services, generating £6.44 billion.

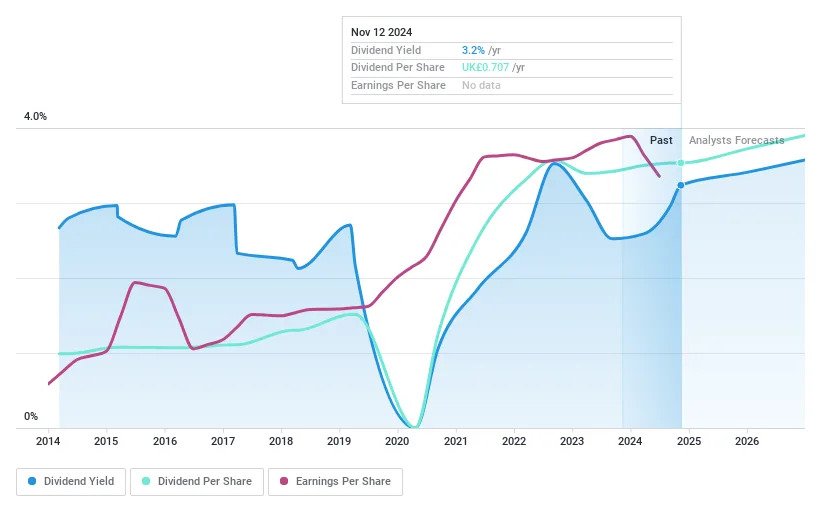

Dividend Yield: 3.4%

Computacenter's dividend payments have been volatile over the past decade, with a low yield of 3.4% compared to top UK dividend payers. However, dividends are well-covered by earnings and cash flows, with payout ratios of 46.8% and 28.2%, respectively. The stock trades below its estimated fair value and analysts expect price appreciation. Recent board changes include Simon McNamara's appointment as an independent non-executive director, potentially enhancing strategic oversight amidst leadership transitions.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £420.17 million.

Operations: Foresight Group Holdings Limited generates revenue through its segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Dividend Yield: 6.2%

Foresight Group Holdings' dividend yield of 6.22% ranks in the top 25% of UK payers, with stable growth over three years despite being relatively new to dividends. Payout ratios are sustainable, covered by earnings at 86.6% and cash flows at 68.6%. Recent earnings showed significant improvement, with net income rising to £12.65 million for H1 2025 from £8.49 million a year prior, alongside an increased equity buyback plan by £5 million to £15 million total authorization.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services, with a market cap of £144.16 billion.

Operations: HSBC Holdings plc generates revenue through its key segments, including Commercial Banking ($19.78 billion), Global Banking and Markets ($16.80 billion), and Wealth and Personal Banking ($24.83 billion).

Dividend Yield: 6.1%

HSBC Holdings offers a dividend yield of 6.09%, placing it in the top 25% of UK payers, yet its dividends have been volatile over the past nine years. Despite this, current and forecasted payout ratios are sustainable at around 50%. The bank faces challenges with high bad loans at 2.2% and low allowance coverage at 45%. Recent executive changes aim to streamline operations and enhance growth, reflecting ongoing strategic restructuring efforts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CCC LSE:FSG and LSE:HSBA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]