January 17, 2025

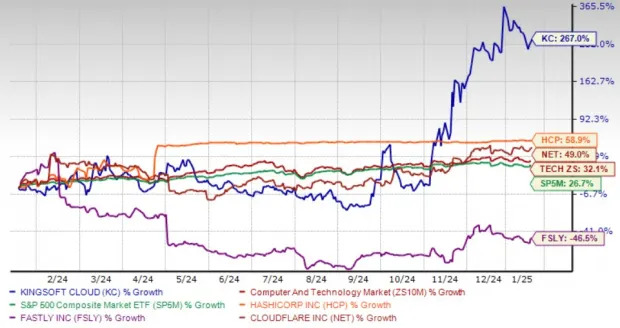

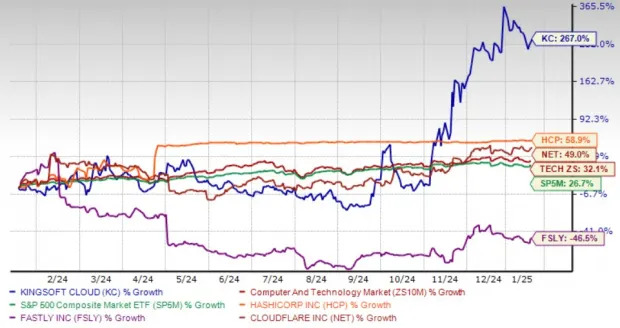

Kingsoft Cloud Holdings KC shares have skyrocketed 267% in the past year, outperforming the Zacks Computer and Technology sector and the S&P 500 index’s appreciation of 32.1% and 26.7%, respectively.

KC has also outperformed its Zacks Internet - Software industry peers, including Fastly FSLY, HashiCorp HCP and Cloudflare NET, each of which competes with Kingsoft Cloud in the content delivery network (CDN) space.

Shares of HashiCorp and Cloudflare have rallied 58.9% and 49%, whereas Fastly shares have plunged 46.5% in the past year. Kingsoft Cloud’s one-year performance reflects investors’ confidence in its position in the cloud services space.

The growing market for CDN bodes well for Kingsoft Cloud’s prospects. According to a report by MarketsAndMarkets, the CDN market is expected to witness a CAGR of 10.9% through 2024-2028 and reach $36.5 billion in 2028.

Kingsoft Cloud operates its CDN business through the Kingsoft Cloud Delivery Network (KCDN) and Kingsoft Cloud Edge Computing Network (KECDN). Both KCDN and KCEDN are developed as a distributed network infrastructure comprising numerous server clusters built with edge nodes covering various regions, with KCDN consisting of larger clusters than KECDN.

Both these network architectures distribute user content to edge nodes, reduce Internet network congestion and improve the Internet speed for users. Through the combination of KCDN and KECDN, Kingsoft Cloud has achieved a service stability rate of 99.99% for millions of endpoint nodes.

At present, the company is focusing on the scale-down of CDN services within the less-profitable public cloud services space and is focusing on strict project screening among its enterprise customers, which is enabling it to cut down cost of revenues. Kingsoft Cloud’s gross profit margin increased from 5.3% in 2022 to 12.1% in 2023 through these measures.

Based on these factors, KC’s earnings outlook for 2025 appears promising. The Zacks Consensus Estimate for KC’s 2025 earnings reflects a year-over-year improvement of 35.2%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Kingsoft Cloud is leveraging AI to improve its revenues. The company’s AI revenues have experienced triple-digit year-over-year growth for five consecutive quarters.

Kingsoft Cloud is expanding its capabilities to become a one-stop AI platform for applications, such as large model training, inference and application development through partnerships with leaders like Shine Wing. KC has also secured financial support of RMB 11.3 billion over three years from its partner Xiaomi and its parent company Kingsoft for GPU and AI investments.

Furthermore, Kingsoft Cloud is the sole cloud provider for Xiaomi and Kingsoft. This has enabled KC to benefit from Xiaomi’s rapid business expansion in autonomous driving, AIoT and EV space. Xiaomi and Kingsoft’s revenue contribution increased 36% year over year, driven by the uptick of Xiaomi’s AI-enabled devices and services.

Kingsoft Cloud’s strategy to improve its profit margin by strict project screening in the CDN space and its expansion in the AI capabilities makes the stock worth buying. KC carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HashiCorp, Inc. (HCP) : Free Stock Analysis Report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Kingsoft Cloud Holdings Limited Sponsored ADR (KC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research