January 16, 2025

The market received fourth-quarter results from many of the major U.S. banks on Wednesday, including reports from investment firms Goldman Sachs GS and BlackRock BLK .

As two of the renowned global leaders in asset management, let’s see if it’s time to buy stock in either of these New York-based finance giants.

Goldman Sachs stole the show in yesterday’s busy earnings lineup which also included Q4 reports from three of the four major big banks, Wells Fargo WFC , Citigroup C , and JPMorgan JPM .

Taking the spotlight, Goldman reported a massive EPS surprise of 48% with Q4 earnings at $4.11 billion or $11.95 per share compared to expectations of $8.07. This came on quarterly sales of $13.86 billion which was 13% above estimates of $12.26 billion.

Goldman attributed its stellar Q4 results to an improved operating backdrop with Q4 earnings doubling from the comparative quarter while sales increased 22% from $11.31 billion a year ago.

BlackRock didn’t blow away its Q4 expectations but was able to flex its robust financial figures as well. Q4 EPS was at $11.93 compared to expectations of $11.27 with sales of $5.67 billion coming in 2% better than expected.

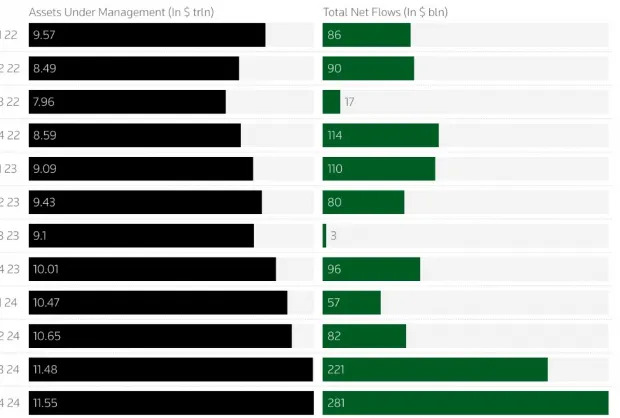

Year over year, BlackRock’s Q4 earnings and sales spiked over 20% respectively as the company highlighted that its assets under management (AUM) hit a record $11.6 trillion thanks to quarterly net inflows of $281 billion.

While BlackRock remains the world’s largest money manager, Goldman ended 2024 as the global leader in announced and completed mergers and acquisitions (M&A).

Overall, Goldman’s total sales spiked 16% in fiscal 2024 to $53.51 billion compared to $46.25 billion in 2023. More impressive, annual earnings soared over 70% to $14.28 billion or $40.54 per share versus EPS of $22.87 in 2023. Notably, this was the second-highest mark on Goldman’s top and bottom lines with its incorporation dating back to 1867.

As for BlackRock, total sales of $20.41 billion increased 14% with annual earnings rising over 15% to $6.37 billion or $43.61 per share. It’s also noteworthy that BlackRock reported record annual net inflows of $641 billion in addition to its peak in AUM.

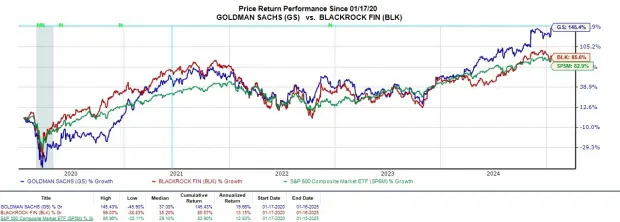

Over the last year, Goldman’s stock has risen +62% to impressively top BlackRock and the benchmark S&P 500’s gains of +26%. In the last five years, GS is up +145% to also top BLK and the broader market’s gains of over +80%.

At their current levels, GS trades at 13.9X forward earnings and at a pleasant discount to BLK which trades roughly on par with the benchmark at 21.2X

Attributed to its "cheaper" P/E valuation and the fact that earnings estimate revisions are likely to rise after a massive Q4 EPS surprise, Goldman Sachs stock sports a Zacks Rank #2 (Buy) with BlackRock landing a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

BlackRock (BLK) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research