January 17, 2025

Berkshire Hathaway Inc . (BRK.B) shares have gained 4.7% in the past six months, underperforming the industry’s 13.6% growth, the sector’s increase of 8.7% and the S&P 500 composite’s rise of 7.8%.

Berkshire Hathaway is a conglomerate with more than 90 subsidiaries engaged in diverse business activities. About 40% of Berkshire’s operating earnings came from its insurance underwriting and insurance investment subsidiaries in 2023. Other operations, including utilities and energy, and manufacturing, service and retail, combined accounted for the remaining 60%.

However, Berkshire shares are trading well above the 50-day moving average, signaling a short-term bullish trend and making it an attractive option for investors from a technical perspective.

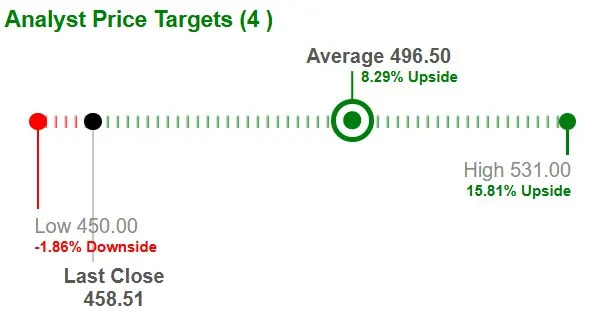

Based on short-term price targets offered by four analysts, the Zacks average price target is $496.50 per share. The average suggests a potential 8.3% upside from Thursday’s closing price.

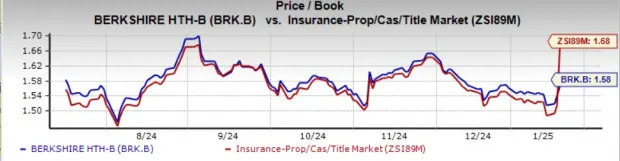

BRK.B shares are trading in line with the Zacks Property and Casualty Insurance industry. Its price-to-book value of 1.58X is lower than the industry average of 1.68X.

This insurance behemoth has a market capitalization of $997.3 billion. The average volume of shares traded in the last three months was 4 million.

The stock remains attractively valued compared with other insurers like

The Progressive Corporation

PGR and

The Allstate Corporation

ALL.

The consensus estimate for 2025 has moved 3 cents south in the past seven days, reflecting analyst pessimism.

Yet, the Zacks Consensus Estimate earnings for 2025 is pegged at $19.94, indicating a 0.8% year-over-year increase on 2.9% higher revenues of $375.4 billion. The expected long-term earnings growth rate is pegged at 7%.

Berkshire’s insurance operations contribute around one-fourth of its top line. Increased exposure, prudent underwriting standards and better pricing poise the insurance business for long-term growth. However, underwriting profitability and in turn the combined ratio gets affected due to catastrophes.

Continued insurance business growth fuels an increase in float, drives earnings and generates maximum return on equity.

The Utilities and Energy, and Manufacturing, Service and Retail businesses are economically sensitive non-insurance businesses. Thus, their performances are linked with the health of the economy. Given improving economic health, these businesses are poised to grow.

The Utilities and Energy business has grown with increased revenue contributions from Burlington Northern SantaFe Corp. However, unfavorable changes in the business mix and lower fuel surcharge revenues are areas of concern. Lower fuel costs are expected to limit any downside. Nonetheless, demand for utilities is expected to be strong in the future and will drive earnings growth.

Collectively, these have driven revenues and facilitated margin expansion over the past many years.

With a huge cash hoard, we believe Berkshire Hathaway will successfully continue its acquisition spree, acquiring entities that have consistent earnings power and boast impressive returns on equity. While big acquisitions open up more business opportunities for the company, bolt-on acquisitions ramp up the earnings of the existing business.

Warren Buffett has always eyed acquisitions or made investments in properties that are undervalued or have growth potential. Investments in Coca-Cola, American Express, Apple, Chevron and Occidental Petroleum show the investment acumen of Warren Buffett.

This insurer distributes wealth to shareholders through share buybacks. Berkshire Hathaway bought back shares worth $2.9 billion in the first nine months of 2024.

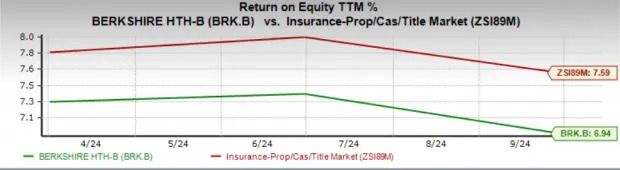

Return on equity (“ROE”) in the trailing 12 months was 6.9%, underperforming the industry average of 7.6%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders. It's noteworthy that though BRK.B’s ROE lags the industry average, the company has successfully improved the same.

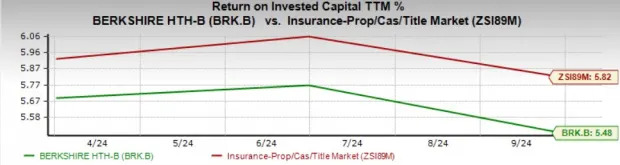

Its return on invested capital (ROIC) has increased every year since 2020. This reflects BRK.B’s efficiency in utilizing funds to generate income. However, ROIC in the trailing 12 months was 5.5%, lower than the industry average of 5.8%.

Holding shares of Berkshire Hathaway renders dynamism to shareholders’ portfolios. Also, it has Warren Buffett at its helm, who has been creating tremendous value for shareholders over nearly six decades with his unique skills. However, unfavorable return on capital and downward estimate revisions keep us cautious.

Thus, investors who already hold Berkshire shares should continue to retain this Zacks Rank #3 (Hold) stock in their portfolio, while others can wait for some more time as this behemoth is unlikely to disappoint any time.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research