January 16, 2025

Marvell Technology has been on fire lately. In the past six months alone, the company’s stock price has rocketed 74.7%, reaching $118.65 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Marvell Technology, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

We’re happy investors have made money, but we're cautious about Marvell Technology. Here are three reasons why there are better opportunities than MRVL and a stock we'd rather own.

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

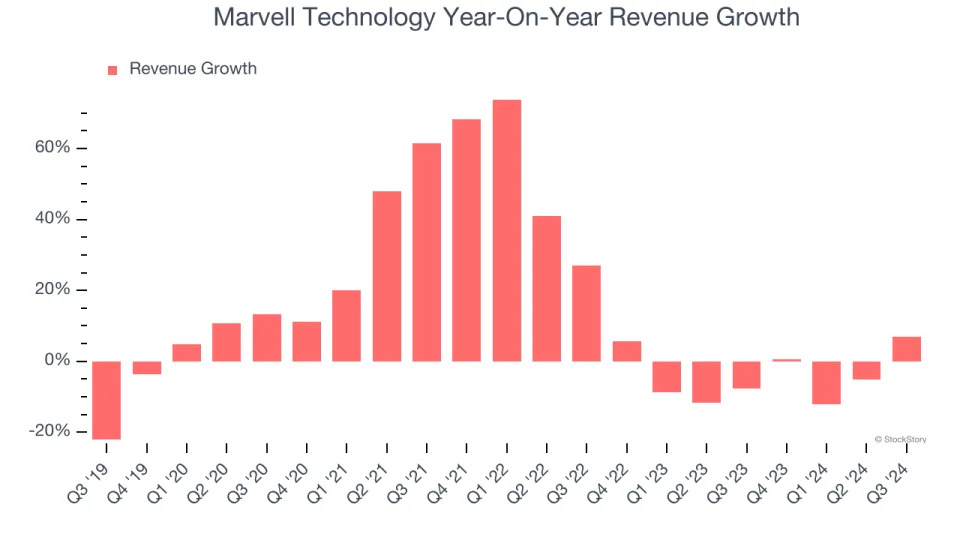

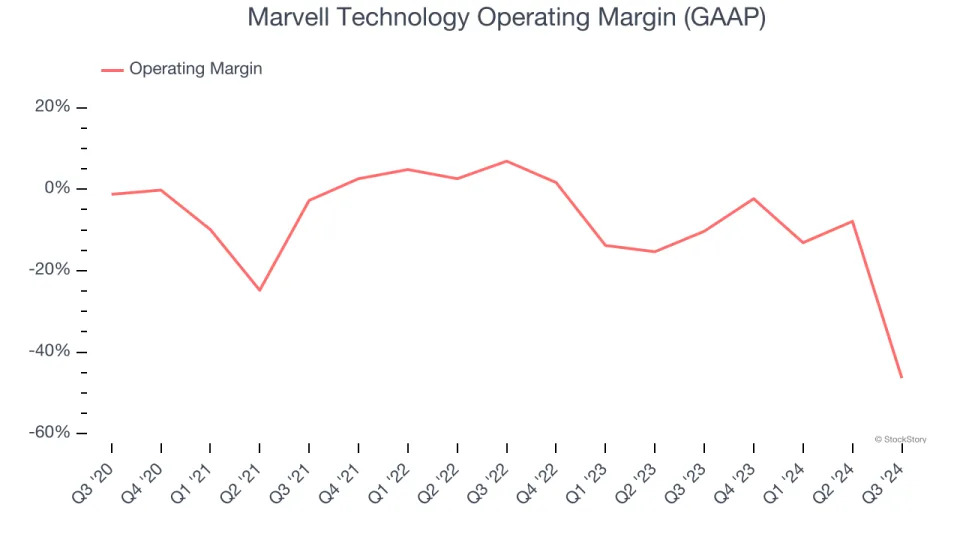

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Marvell Technology’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.1% over the last two years.

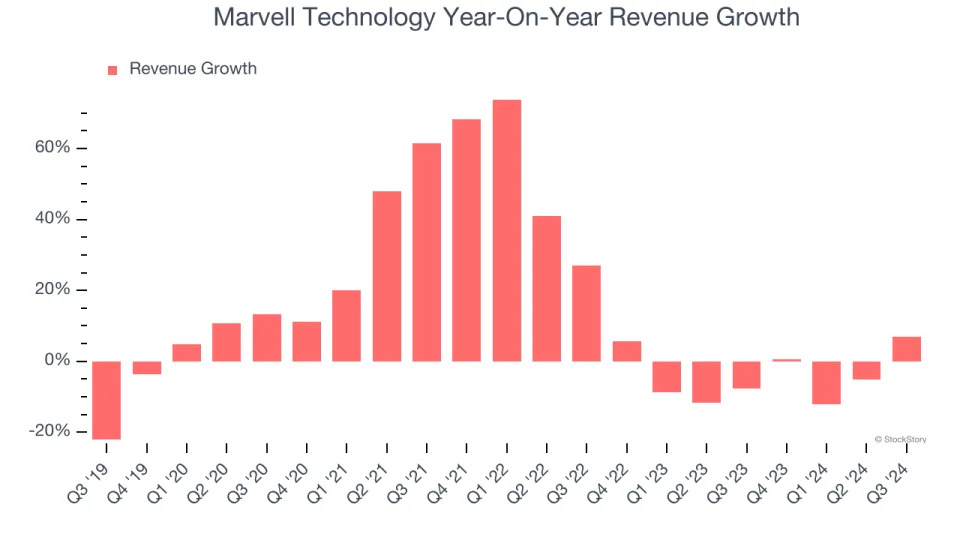

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Marvell Technology’s high expenses have contributed to an average operating margin of negative 13.8% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

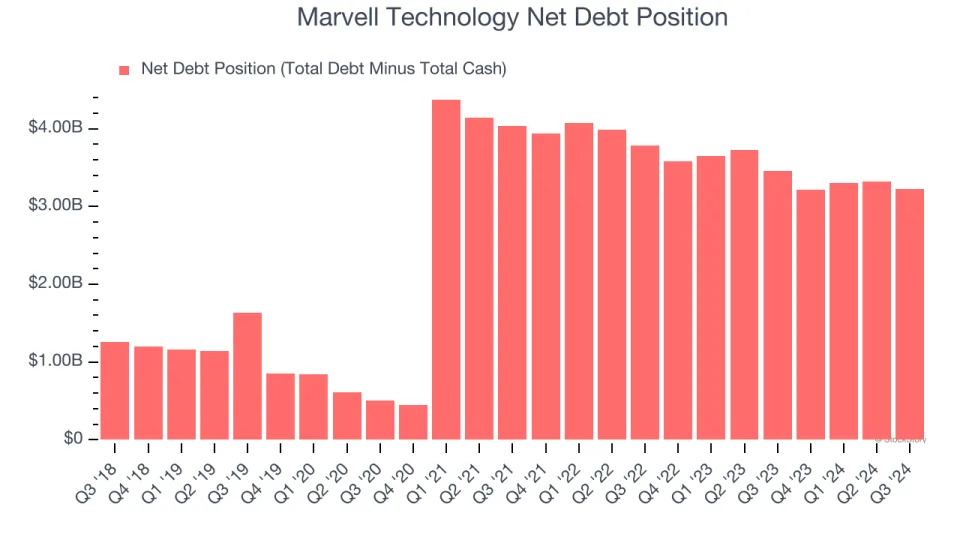

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Marvell Technology posted negative $689.5 million of EBITDA over the last 12 months, and its $4.09 billion of debt exceeds the $868.1 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Marvell Technology if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Marvell Technology can improve its profitability and remain cautious until then.

Marvell Technology isn’t a terrible business, but it doesn’t pass our bar. After the recent surge, the stock trades at 50.8× forward price-to-earnings (or $118.65 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing .

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free .