January 16, 2025

Over the last 7 days, the United States market has remained flat, yet it is up 25% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies with innovative technologies and strong growth potential that can capitalize on these favorable conditions.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Exelixis |

64.24% |

20.95% |

★★★★★★ |

|

Super Micro Computer |

24.13% |

24.28% |

★★★★★★ |

|

Ardelyx |

21.46% |

54.85% |

★★★★★★ |

|

Alkami Technology |

21.99% |

102.65% |

★★★★★★ |

|

AVITA Medical |

33.33% |

51.81% |

★★★★★★ |

|

TG Therapeutics |

29.87% |

43.91% |

★★★★★★ |

|

Bitdeer Technologies Group |

50.44% |

122.48% |

★★★★★★ |

|

Clene |

61.16% |

59.11% |

★★★★★★ |

|

Alnylam Pharmaceuticals |

21.43% |

56.40% |

★★★★★★ |

|

Travere Therapeutics |

30.02% |

61.89% |

★★★★★★ |

Let's explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions globally, with a market cap of approximately $85.73 billion.

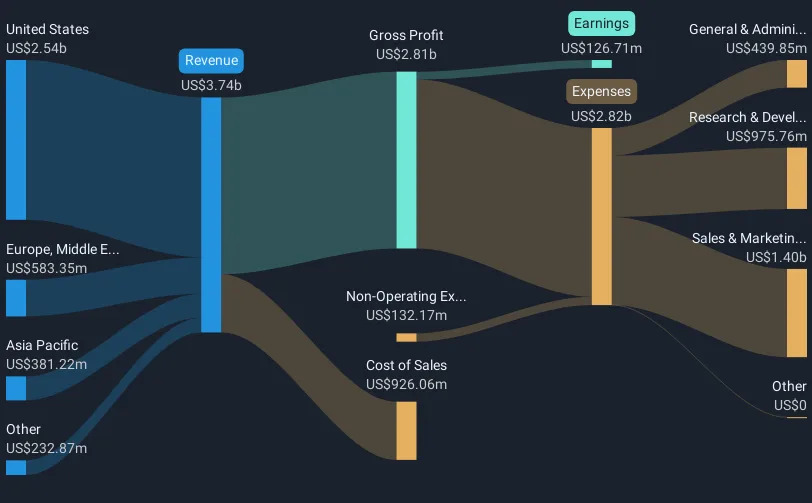

Operations: CrowdStrike Holdings, Inc. generates revenue primarily from its Security Software & Services segment, which accounted for $3.74 billion. The company's focus on cybersecurity solutions positions it in a competitive market within the United States and internationally.

CrowdStrike Holdings continues to innovate in the cybersecurity space, recently launching services aimed at mitigating insider risks—a growing concern costing organizations an average of $16.2 million annually to address. This move complements their strategic partnerships and integrations, such as with Salt Security for enhanced API security and AWS for cloud-based AI innovations, underpinning CrowdStrike's commitment to comprehensive digital protection. Financially, CrowdStrike reported a significant revenue jump to $1.01 billion in Q3 2024 from $786 million the previous year, although it swung to a net loss of $16.82 million from a net income of $26.67 million year-over-year, reflecting its aggressive investment in growth avenues like R&D which remains pivotal amidst evolving cyber threats.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd. is a company that develops software applications globally, with a market capitalization of approximately $10.98 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $906.59 million. Its business operations span across multiple regions including the United States, Europe, and the Middle East.

Amidst a landscape where software firms are increasingly pivoting to SaaS models, monday.com stands out with its robust annual revenue growth of 19.4% and an even more impressive earnings growth forecast at 34.7% per year. The company's commitment to innovation is underscored by its R&D expenses, which are pivotal in maintaining its competitive edge within the tech industry. Recent expansions, like the new Denver office designed to foster creativity and collaboration, align with monday.com’s strategy to enhance its North American operations and support sustained growth. This strategic focus not only caters to a growing demand for streamlined enterprise solutions but also positions monday.com favorably as it continues navigating the dynamic tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guidewire Software, Inc. offers a platform tailored for property and casualty insurers globally, with a market capitalization of approximately $14.36 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to approximately $1.04 billion.

Guidewire Software has demonstrated a notable agility in adapting to the evolving tech landscape, particularly through its strategic Insurtech Vanguards program and partnerships with entities like Shift Technology. These initiatives not only enhance Guidewire's service offerings but also solidify its position in the property and casualty insurance sector by integrating AI-driven solutions for fraud detection and claims processing. Financially, Guidewire turned profitable this year with a reported net income of $9.14 million from a previous net loss, reflecting robust operational improvements. The company's R&D expenditure remains pivotal, supporting continuous innovation and maintaining competitive advantage in a dynamic market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CRWD NasdaqGS:MNDY and NYSE:GWRE .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]