January 16, 2025

ASML Holding ASML has struggled to keep pace with the tech sector’s meteoric rise over the past year. While the ASML stock has moved up a modest 2.1%, it has significantly lagged the Zacks Computer and Technology sector’s impressive 29.8% jump and the S&P 500’s 24.4% climb.

The broader semiconductor space has seen standout performances, with industry leaders like NVIDIA NVDA, Broadcom AVGO and Marvell Technology MRVL surging 142.5%, 106.6% and 77.5%, respectively. In this context, ASML’s tepid growth raises the question: Is it time to part ways with this underperforming chip equipment giant?

ASML Holding’s third-quarter 2024 results showcased respectable growth, with net sales climbing 11.9% year over year to €7.5 billion and net income rising 9.7% to €2.1 billion. Earnings per share grew 9.8% to €5.28, reflecting solid operational efficiency. However, the company’s muted guidance for the fourth quarter has cast a shadow over its near-term prospects.

ASML projects sales between €8.8 billion and €9.2 billion, with a gross margin of 49-50%, indicating margin challenges as cost pressures mount. Management’s warning of weaker order intake in 2025, attributed to sluggish recoveries in mobile and PC markets, has added to investor concerns.

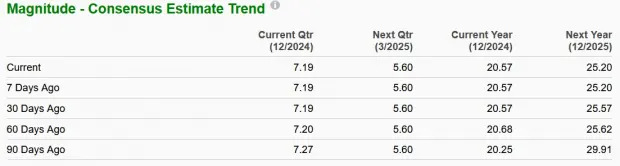

Analysts have responded by revising earnings estimates downward, signaling diminished optimism about ASML’s immediate growth trajectory.

ASML’s cutting-edge High Numerical Aperture Extreme Ultraviolet (High NA EUV) systems are pivotal to advancing chip manufacturing for artificial intelligence (AI) and high-performance computing. While this technology cements ASML’s position as an industry leader, the associated costs are proving burdensome. The company’s third-quarter shipment of two High NA EUV systems underscores its commitment to innovation, but these systems’ steep production expenses have strained profitability.

Management has acknowledged a 3.5% margin dilution in the fourth quarter due to ramp-up costs for High NA EUV production. This trend is expected to persist, as scaling this technology for commercial adoption will likely pressure margins in the foreseeable future. While the long-term potential remains undeniable, the near-term financial strain cannot be ignored.

Geopolitical tensions pose a substantial threat to ASML Holding’s revenue streams. With China accounting for 47% of ASML’s lithography shipments in the third quarter of 2024, escalating U.S. export restrictions could significantly impact sales from this critical market. Any disruption in China demand would erode investor confidence.

Meanwhile, macroeconomic challenges such as inflation, a sluggish recovery in mobile and PC markets, and delays in the memory segment’s rebound compound ASML’s woes. These factors highlight the cyclical nature of the semiconductor industry, which is still contending with post-pandemic demand volatility.

Despite its underwhelming stock performance, ASML remains pricey. Its forward 12-month price-to-earnings (P/E) ratio of 28.46X exceeds the sector’s average of 26.32X. While this premium reflects ASML’s technological edge and market leadership, it also limits the stock’s immediate upside potential.

Also, the stock has a Zacks Value Style Score of D, which indicates a stretched valuation. For investors seeking value or growth, ASML’s elevated valuation and uncertain near-term outlook present a compelling case to exit the stock.

ASML Holding’s long-term leadership in semiconductor technology is undeniable, but the stock’s near-term challenges are too significant to ignore. Weaker guidance, profitability pressures, geopolitical risks and macroeconomic headwinds weigh heavily on the company’s immediate prospects. Coupled with a premium valuation that limits upside potential, the ASML stock appears overextended.

Investors should consider selling ASML Holding shares for now and reallocating capital to better-performing or undervalued opportunities in the tech and semiconductor spaces. While ASML’s strategic innovations may pay off in the long run, the current headwinds make it a less attractive choice in today’s market environment. The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research