January 13, 2025

Skechers U.S.A., Inc.

SKX has demonstrated strong upward momentum, trading above its 50 and 200-day simple moving averages (SMAs). SMA is a key indicator of price stability and long-term bullish trends.

The company ended Friday’s trading session at $70.09, above its 50 and 200-day SMAs of $65.62 and $65.60, respectively, highlighting a continued uptrend. This technical strength, combined with consistent momentum, indicates positive market sentiment and investor confidence in Skechers’ financial stability and growth potential.

SKX Trades Above 50 & 200-Day Moving Averages

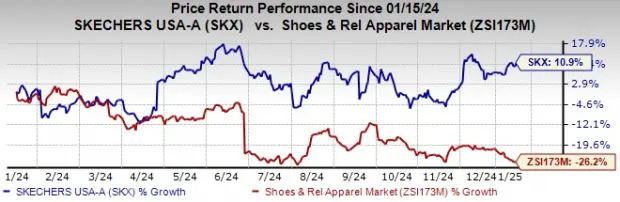

Shares of this leading designer and producer of innovative, niche footwear and accessories are currently trading 6.7% below its 52-week high of $75.09, attained on June 12, 2024, making investors contemplate their next moves. In the past year, SKX stock has gained 10.9%, comfortably outperforming the Zacks Shoes and Retail Apparel industry’s 26.2% decline.

SKX Stock Past-Year Performance

Skechers is broadening its portfolio with a multi-brand approach, prioritizing comfort-focused footwear to cater to a diverse customer base. Strategic investments in infrastructure, including advancements in e-commerce and retail operations, are driving the company's omnichannel growth and direct-to-consumer (“DTC”) expansion.

The DTC segment indicates Skechers’ emphasis on improving customer engagement, refining the retail experience and expanding its online presence. In the third quarter of 2024, the DTC segment achieved a 9.6% year-over-year sales increase, reaching $931.7 million, fueled by strong consumer demand. International DTC sales rose 14.4%, while domestic DTC sales grew 3.7% during the same period.

Skechers anticipates continued growth in its wholesale segment throughout fiscal 2024, supported by steady product demand and targeted investments in logistics and retailer partnerships. In the third quarter, wholesale sales soared 20.6% year over year to $1.42 billion, driven by 26% and 18% increase in domestic and international sales, respectively.

Domestic performance showcased the popularity of Skechers’ comfort-driven technologies, resulting in double-digit growth across men’s, women’s and children’s footwear categories alongside significant volume increases. On the international front, the EMEA region led wholesale expansion due to strong demand for innovative products and improved shipping efficiency.

International markets and retail expansion remain at the core of Skechers’ growth strategy. In the third quarter, international revenues surged 16.4% year over year, contributing 61% of total revenues. The EMEA region posted a standout 30.2% growth, followed by a 13.6% rise in the Americas and a 7.4% increase in the APAC region, with notable performances from key markets such as Japan, Korea, and India.

The company recently opened a flagship store on Prague’s High Street, offering a wide range of footwear, apparel and accessories. The 596-square-meter store features sustainable materials and showcases Skechers’ signature comfort innovations. As part of its expansion in Europe, this is one of eight Skechers stores in the Czech Republic, enhancing accessibility for locals and tourists alike.

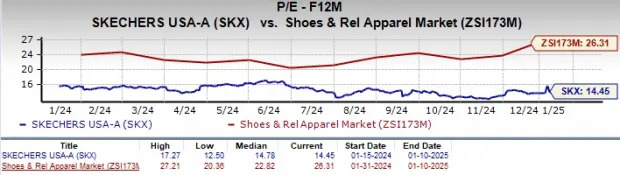

From a valuation perspective, the company stands out as a compelling value play within the industry, trading at a forward 12-month price-to-earnings ratio of 14.45, below the industry and the Consumer Discretionary sector’s average of 26.31 and 18.26, respectively. This undervaluation highlights its potential for investors seeking attractive entry points. SKX's Value Score of A further emphasizes its investment appeal.

Investors may find Skechers an appealing option due to its strong technical performance with an ambitious $10 billion sales target by 2026. The company's growth is fueled by its diverse brand approach, successful DTC strategy and solid wholesale performance, with significant gains both domestically and internationally. Skechers’ expansion in global markets, including a strong presence in EMEA and increased retail outlets worldwide, further enhances its growth potential. Moreover, with a competitive valuation and robust earnings projections, SKX stands as an attractive value play in the footwear industry. The company currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks are

The Gap, Inc.

GAP,

Abercrombie & Fitch Co.

ANF and

Steven Madden, Ltd.

SHOO.

Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It presently flaunts a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gap’s fiscal 2025 earnings and sales indicates growth of 41.3% and 0.8%, respectively, from the fiscal 2024 reported figures. GAP delivered a trailing four-quarter average earnings surprise of 101.2%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It sports a Zacks Rank of 1 at present.

The Zacks Consensus Estimate for Abercrombie’s fiscal 2025 earnings and sales indicates growth of 69.3% and 15%, respectively, from the fiscal 2024 reported levels. ANF delivered a trailing four-quarter average earnings surprise of 14.8%.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 8.6% and 13.6%, respectively, from the year-ago actuals. SHOO delivered a trailing four-quarter average earnings surprise of 9.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

The Gap, Inc. (GAP) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research