January 9, 2025

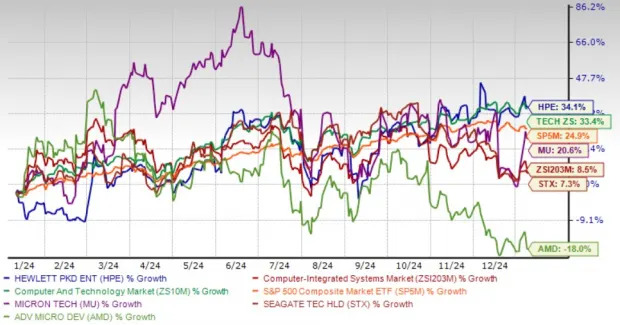

Hewlett Packard Enterprise Company HPE has delivered stellar performance over the past year, with its stock surging 34.1%, outperforming the Zacks Computer - Integrated Systems, Zacks Computer and Technology sector and the S&P500 index’s return of 8.5%, 33.4% and 24.9%, respectively. The stock has also outperformed industry peers, including Micron MU, Seagate Technology STX and Advanced Micro Devices AMD.

While this rally showcases HPE’s resilience, the question remains: Is there more room for growth, or is it time to lock in profits? For now, holding the stock appears to be the most prudent strategy.

HPE’s rally over the past year has been driven by strong performance in its key segments, particularly GreenLake and artificial intelligence (AI) systems. There is significant momentum in the adoption of HPE GreenLake as organizations are capitalizing on the flexibility and scalability of this IT transformation solution.

GreenLake’s customer base expanded by approximately 34.5% year over year, reaching 39,000 in the fourth quarter of fiscal 2024. This growth in customer base has driven the annualized revenue run rate, which has increased 48% year over year, exceeding $1.9 billion at the end of the fiscal fourth quarter.

Hewlett Packard Enterprise continues to see robust demand for its AI system offerings. In the fourth quarter of fiscal 2024, HPE reported that it had $6.7 billion in cumulative orders for AI products and services since the first quarter of fiscal 2023. HPE’s new AI orders in the fiscal fourth quarter of 2024 have brought its backlogs to a value of $3.5 billion.

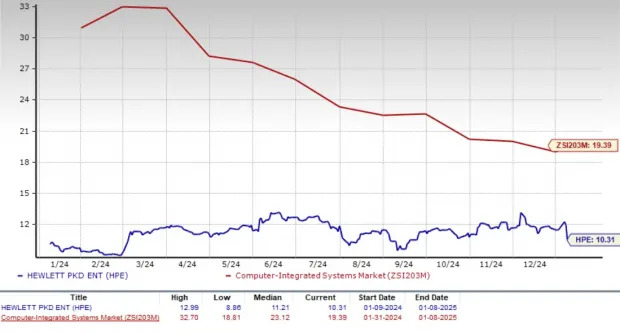

HPE’s valuation adds another layer of appeal. The stock trades at a forward 12-month price-to-earnings (P/E) ratio of 10.31, significantly lower than the Zacks Computer – Integrated Systems industry average of 19.39. Similarly, the forward 12-month price-to-sales (P/S) ratio of 0.89 is substantially lower than the industry average of 3.34. This favorable valuation makes HPE an attractive option for long-term investors.

While Hewlett Packard Enterprise is gaining from the growing adoption of AI, the company is also facing certain headwinds. The company’s near-term prospects might be hurt by softening IT spending. Higher interest rates and protracted inflationary pressures are hurting consumer spending. On the other hand, enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues.

HPE’s intelligent edge division is under pressure from the accumulation of inventory levels among HPE’s customer base. Revenues in the Intelligent Edge division dropped 20% year over year in the fourth quarter of fiscal 2024. In this segment, HPE’s switching and campus solutions are experiencing softer demand.

Moreover, due to the low mix of high-margin Intelligent Edge revenues, HPE’s gross margin is facing pressure. In the fiscal fourth quarter, HPE’s non-GAAP gross margin contracted 390 basis points (bps) on a year-over-year basis and 90 bps on a quarter-over-quarter basis to 30.9%.

HPE’s financial services division is also experiencing a lower single-digit growth. The Financial service segment’s revenues of $893 million increased 2% year over year in the fiscal fourth quarter of 2024. The softness in these two segments was due to weakening IT spending.

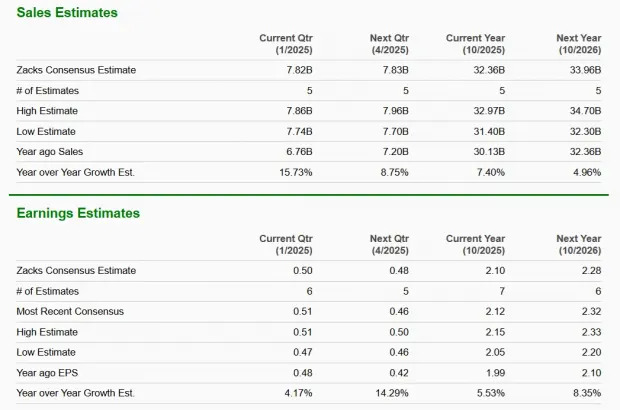

The Zacks Consensus Estimate for fiscal 2025 and 2026 top and bottom lines does not depict a strong financial recovery in the near term for the company. The Zacks Consensus Estimate for fiscal 2025 earnings has been revised downward to $2.10 in the past 30 days. The Zacks Consensus Estimate for fiscal 2026 earnings estimates has been revised downward to $2.28 in the past 30 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

HPE’s GreenLake and AI-driven growth signal promising long-term potential, but near-term challenges, including softer demand and margin pressures, warrant caution. Its attractive valuation and solid market positioning justify holding the stock for now. While HPE navigates these headwinds, patient investors could benefit as the company positions itself for a stronger recovery.

HPE stock carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research