January 7, 2025

Egg company Cal-Maine Foods (NASDAQ:CALM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 82.5% year on year to $954.7 million. Its GAAP profit of $4.47 per share was 21.5% above analysts’ consensus estimates.

Is now the time to buy Cal-Maine? Find out in our full research report .

Sherman Miller, president and chief executive officer of Cal-Maine Foods, stated, “Cal-Maine Foods delivered a very strong financial and operating performance in the second quarter of fiscal 2025. Robust demand for shell eggs resulted in a significant increase in dozens sold for the quarter, which included the seasonal boost leading up to the Thanksgiving holiday and sales from our latest acquisition completed in June. Our results also reflect higher market prices, which have continued to rise this fiscal year as supply levels of shell eggs have been restricted due to recent outbreaks of highly pathogenic avian influenza (“HPAI”).

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Cal-Maine carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it can still flex high growth rates because it’s working from a smaller revenue base.

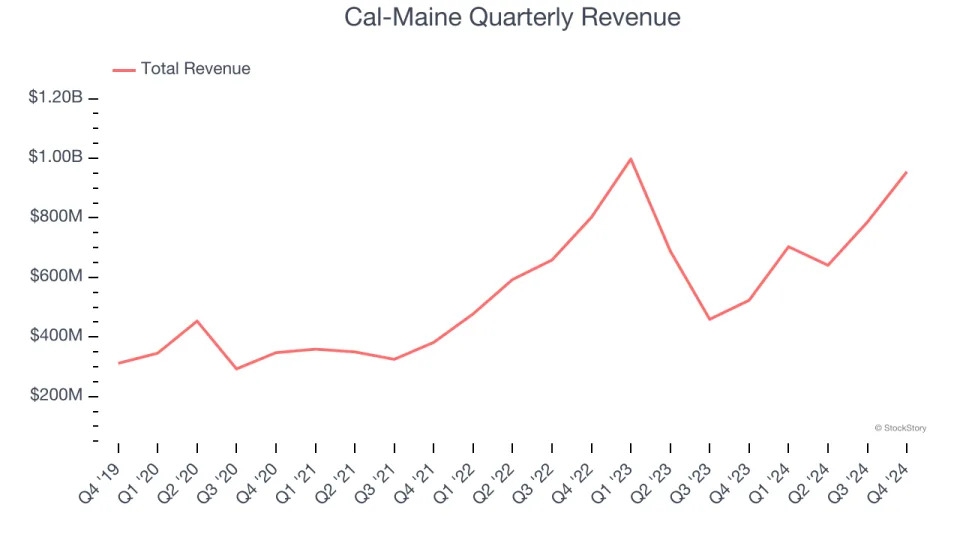

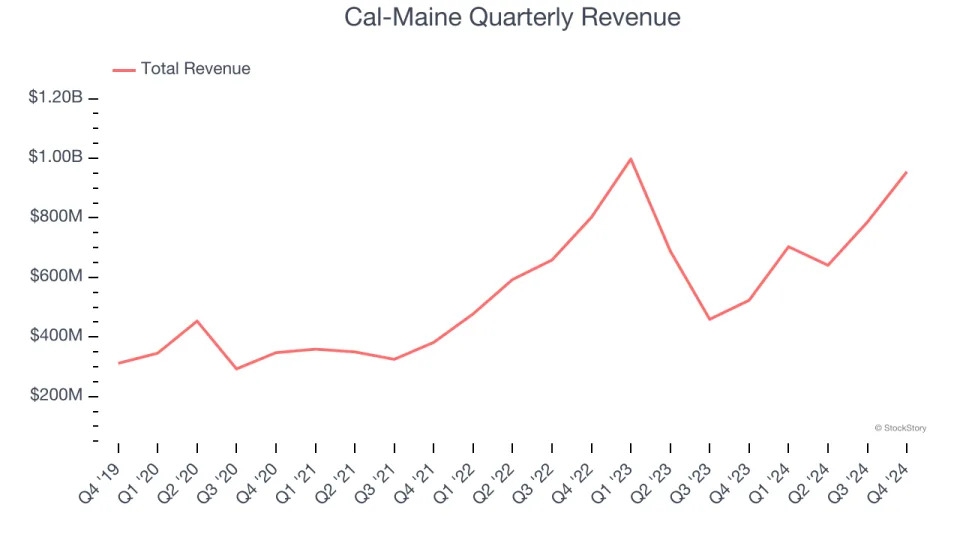

As you can see below, Cal-Maine’s sales grew at an exceptional 29.6% compounded annual growth rate over the last three years. This shows it had good demand, a useful starting point for our analysis.

This quarter, Cal-Maine reported magnificent year-on-year revenue growth of 82.5%, and its $954.7 million of revenue beat Wall Street’s estimates by 27%.

Looking ahead, sell-side analysts expect revenue to decline by 25% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

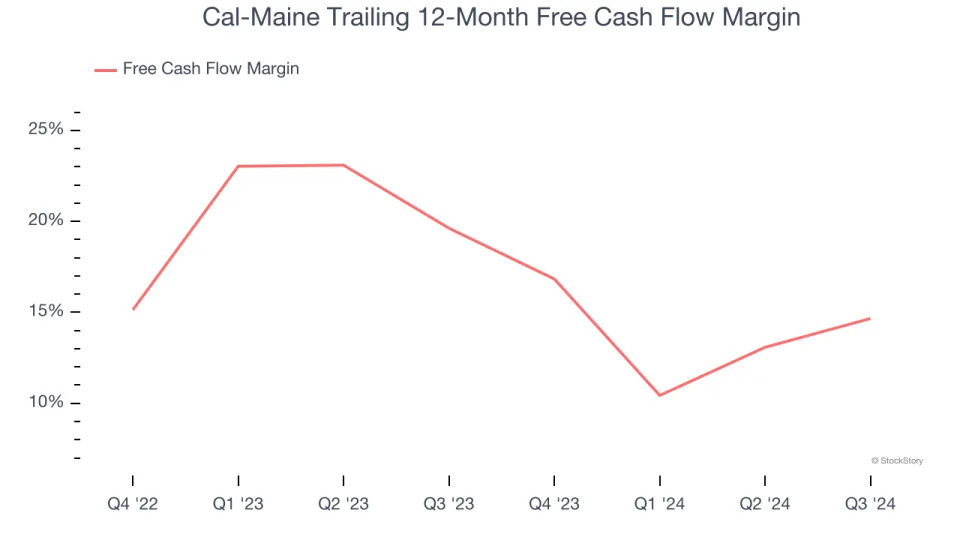

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Cal-Maine has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 17.2% over the last two years.

We were impressed by how significantly Cal-Maine blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 3.6% to $107.42 immediately after reporting.

Indeed, Cal-Maine had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .