January 8, 2025

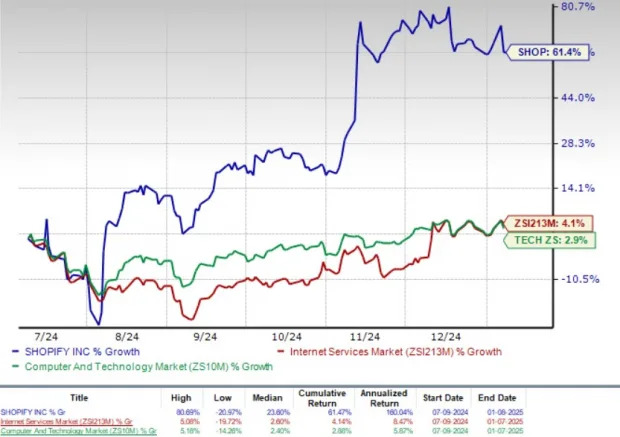

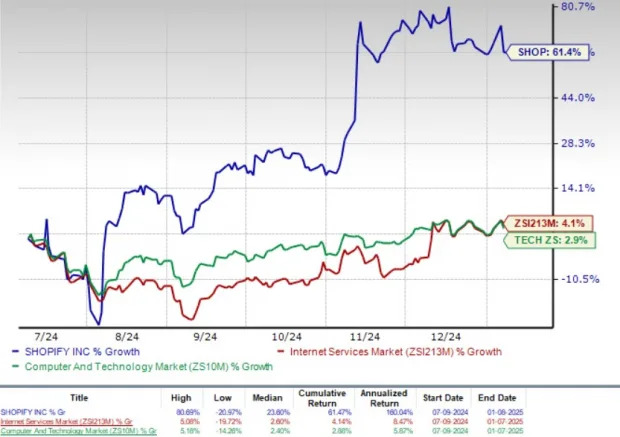

Shopify SHOP shares have surged 61.4% in the trailing six months, outperforming the Zacks Computer and Technology sector’s appreciation of 2.9% and the Zacks Internet – Services industry’s return of 4.1%.

Shopify has been benefiting from robust growth in its merchant base, driven by its merchant-friendly tools like Shop Pay, Shopify Payments, Shopify Collective, Shopify Audiences, Shopify Capital and Shop Cash. These innovative offerings are enabling Shopify to attract merchants, even amid challenging economic conditions.

SHOP’s ongoing efforts to streamline operations are successfully drawing a mix of smaller, emerging merchants and well-established large brands to its platform. By investing in cutting-edge solutions tailored for modern e-commerce, the company is strengthening its competitive edge.

Shopify’s expanding client base includes big brands like Reebok, Lions Gate Entertainment, Hanes, Vera Bradley and Victoria’s Secret.

However, SHOP’s Value Score of F suggests a premium valuation at the moment.

In terms of the 12-month price/sales, SHOP is currently trading at 12.88X compared with the broader sector’s 7.12X.

Now, the question is whether it is worthwhile for investors to buy SHOP shares. Let us dig deeper to find out.

Shopify’s latest updates have brought more than 150 new features to its platform to enhance merchants’ businesses, making operations smoother and more efficient. On Shopify Checkout, merchants can customize thank-you pages with Checkout Blocks, integrate chat apps and use Checkout UI extensions to create tailored checkouts.

With Customer Account Extensions, merchants can deliver a seamless, branded experience for customers. These extensions enable passwordless logins, personalized account pages, and B2B-specific functionalities like bulk-ordering and invoicing to simplify account management for merchants.

SHOP’s enhanced point-of-sale (POS) features now support bundle sales, split-screen functionality and customer data collection via metafields. These updates will help merchants deliver personalized in-store experiences while capturing valuable customer insights.

Shopify’s POS solutions’ client base includes major retailers like Orlebar Brown, AKIRA, Billy Reid, Fit2Run and Canadian women’s fashion retailer Laura.

SHOP now allows merchants to boost customer acquisition with Shop Campaigns, which automates marketing across Shopify, Meta Platforms and Alphabet GOOGL.

These updates are empowering merchants on the SHOP platform with innovative tools to streamline operations and grow their businesses. It is making SHOP poised for continued growth.

Companies like Dermatologica, Therabody, Life Fitness and Daily Harvest are utilizing Shopify’s new automation features with Shopify Flow templates, which allows merchants to assign a sales staff to particular B2B customers.

SHOP continues to benefit from its partnerships with prominent names like TikTok, Instagram, Target, PayPal PYPL, Alphabet, Manhattan Associates, Oracle, COACH and Adyen.

Through its expanded partnership with PayPal, SHOP is diversifying its Payments product offerings. With Alphabet’s Youtube, SHOP has provided its merchants with a powerful sales channel, leveraging YouTube creators to tap into its massive global audience.

In its commerce integration partnership with Roblox RBLX, Shopify has opened newer avenues for merchants to reach a younger and more engaged audience.

The Zacks Consensus Estimate for SHOP’s 2025 earnings is pegged at $1.50 per share, unchanged over the past 30 days, indicating year-over-year growth of 18.89%.

The consensus mark for SHOP’s 2025 revenues is pegged at $10.67 billion, indicating year-over-year growth of 21.57%.

SHOP beat the Zacks Consensus Estimate for earnings in the trailing four quarters, the average surprise being 24.50%.

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

SHOP is benefiting from strong growth in its merchant base and expanding footprint. Its focus on improving its client base is a key catalyst. Strong growth prospects justify a premium valuation.

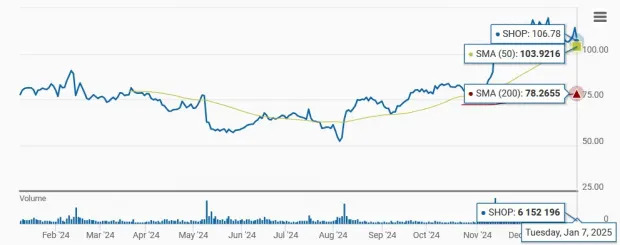

Shopify shares are currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

The company currently has a Zacks Rank #2 (Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Roblox Corporation (RBLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research