January 6, 2025

Vanda Pharmaceuticals Inc. VNDA generates revenues from the sale of its three commercial products, Fanapt, Hetlioz and Ponvory.

Fanapt is approved in the United States for two indications, schizophrenia and acute treatment of manic or mixed episodes associated with bipolar I disorder. Hetlioz is approved to treat non-24-hour sleep-wake disorder and nighttime sleep disturbances in Smith-Magenis syndrome.

Ponvory is an oral treatment approved to treat relapsing forms of multiple sclerosis. VNDA acquired the United States and Canada rights to Ponvory from Actelion Pharmaceuticals Limited, a subsidiary of Johnson & Johnson JNJ, in December 2023.

JNJ gained approval for Ponvory as an oral treatment for adults with relapsing forms of multiple sclerosis in 2021.

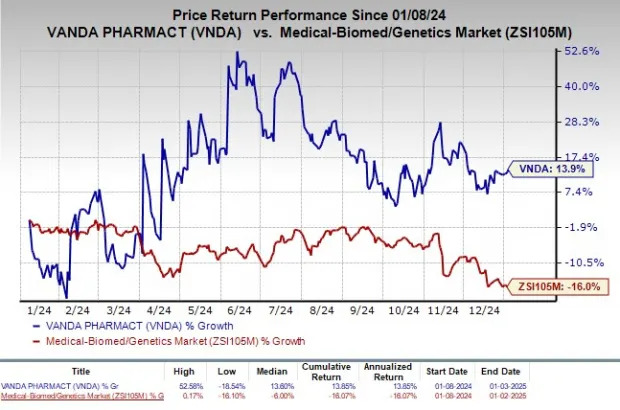

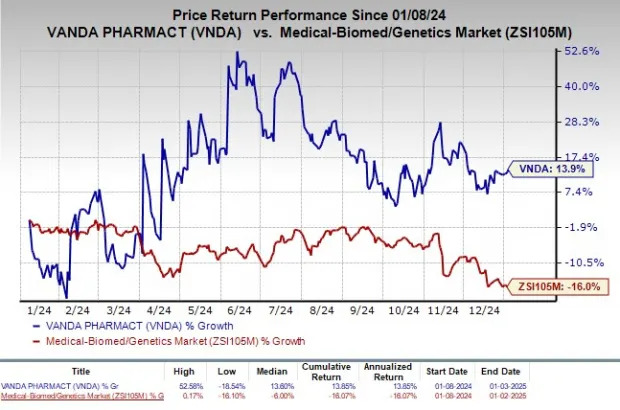

In the past year, shares of Vanda have gained 13.9% against the industry’s decline of 16%.

Beside the three marketed products, Vanda has a promising pipeline targeting various indications in neuroscience, immunology and oncology.

Management plans to submit regulatory filings with the FDA for two pipeline candidates, tradipitant (for preventing vomiting induced by motion sickness) and milsaperidone (for schizophrenia and acute bipolar I disorder indications) shortly.

Successful development and potential approval of these candidates should help VNDA diversify its commercial portfolio and drive long-term growth.

Last month, the FDA granted an Orphan Drug designation to another pipeline candidate, VGT-1849A for treating polycythemia vera (PV), a rare hematologic malignancy.

VNDA is developing VGT-1849A, a novel antisense oligonucleotide (ASO)-based JAK2 inhibitor for treating PV and other JAK2-driven hematologic malignancies.

Vanda currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

In the past 60 days, estimates for Vanda’s 2025 loss per share have narrowed from 53 cents to 35 cents.

With a sound cash position and some clinical milestones expected later this year, investor focus remains on the VNDA stock.

Some other top-ranked stocks from the biotech sector are Puma Biotechnology, Inc. PBYI and Castle Biosciences, Inc. CSTL, each sporting a Zacks Rank #1 at present.

In the past 60 days, estimates for Puma Biotechnology’s 2025 earnings per share have increased from 42 cents to 54 cents. In the past year, shares of PBYI have declined 38.8%.

PBYI’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 32.78%.

In the past 60 days, Castle Biosciences’ loss per share estimates for 2025 have narrowed from $1.88 to $1.84. In the past year, shares of CSTL have surged 30.9%.

CSTL’s earnings beat estimates in each of the trailing four quarters, the average surprise being 172.72%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research