January 3, 2025

Over the last 7 days, the United States market has dropped 2.8%, yet it has risen by 24% over the past year, with earnings expected to grow by 15% annually in the coming years. In this context of fluctuating short-term performance and promising long-term growth prospects, identifying high-growth tech stocks involves looking for companies with strong innovation potential and solid financial fundamentals that can withstand market volatility.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Super Micro Computer |

24.13% |

24.28% |

★★★★★★ |

|

Ardelyx |

22.86% |

54.70% |

★★★★★★ |

|

Alkami Technology |

21.99% |

102.65% |

★★★★★★ |

|

Clene |

61.16% |

59.11% |

★★★★★★ |

|

Alnylam Pharmaceuticals |

21.24% |

56.34% |

★★★★★★ |

|

TG Therapeutics |

30.06% |

45.28% |

★★★★★★ |

|

Blueprint Medicines |

22.63% |

55.38% |

★★★★★★ |

|

Travere Therapeutics |

28.68% |

62.50% |

★★★★★★ |

|

Seagen |

22.57% |

71.80% |

★★★★★★ |

|

ImmunoGen |

26.00% |

45.85% |

★★★★★★ |

Let's uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

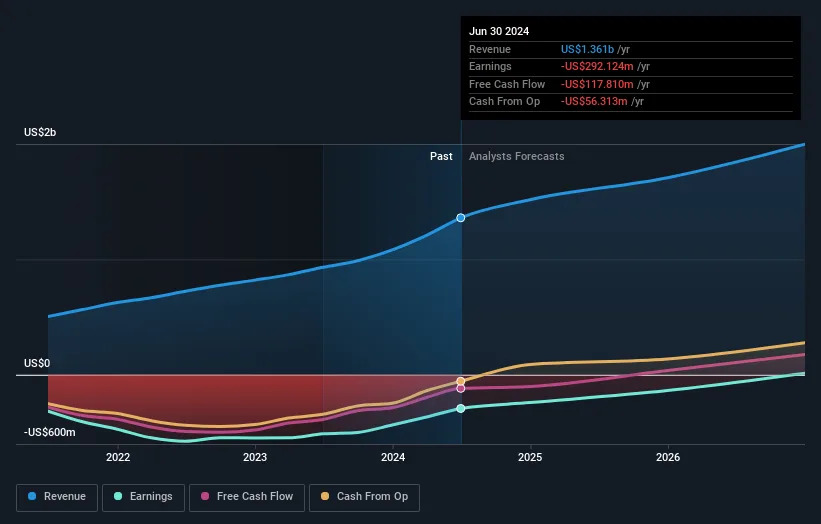

Overview: Natera, Inc. is a diagnostics company that develops and commercializes molecular testing services globally, with a market cap of $20.90 billion.

Operations: The company focuses on the development and commercialization of molecular testing services, generating approximately $1.53 billion in revenue.

Natera, with its focus on genetic testing and liquid biopsies, exemplifies innovation in the high-growth tech sector. Despite being unprofitable, the company is forecasted to reverse this trend within three years, with earnings expected to surge by 58.5% annually. This growth trajectory is bolstered by a robust R&D commitment, evident from recent initiatives like the SAGITTARIUS clinical trial aimed at enhancing colon cancer treatment through personalized strategies. Moreover, strategic alliances such as the integration of MyOme's polygenic risk score into Natera's offerings underscore a forward-thinking approach to healthcare solutions that could redefine patient management in oncology and beyond.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $19.60 billion.

Operations: The company generates revenue primarily from advertising services within its visual search and discovery platform, amounting to $3.47 billion. The business model focuses on leveraging user engagement to attract advertisers seeking targeted marketing opportunities.

Pinterest's recent performance underscores its potential within the tech sector, with a notable increase in sales to $898.37 million in Q3 2024 from $763.2 million the previous year and a swing to a net income of $30.56 million from a loss of $6.73 million. This turnaround is mirrored by an aggressive share repurchase strategy, highlighting confidence in its financial health as it bought back shares worth $500.05 million since September 2023. The company's R&D focus remains robust, supporting innovations that drive user engagement and advertising efficacy, crucial for sustaining its revenue growth forecast at 12.1% annually—outpacing the US market average of 9%.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Snap Inc. is a technology company that operates in North America, Europe, and internationally with a market capitalization of approximately $18.06 billion.

Operations: Snap generates revenue primarily through its software and programming segment, totaling approximately $5.17 billion. The company operates across various regions, including North America and Europe.

Snap's trajectory in the tech sector, particularly within interactive media and services, is marked by a strategic pivot towards profitability, expected within three years. Despite current unprofitability, its revenue growth at 11.3% annually surpasses the US market average of 9%, showcasing resilience and potential for scale. The firm's commitment to innovation is evident from its substantial R&D investments, aligning with an anticipated earnings surge of 58.21% per year. Recent actions underscore this confidence; Snap initiated a $500 million share repurchase program, reinforcing its financial stability amidst improving quarterly sales figures which rose to $1.37 billion from $1.19 billion year-over-year in Q3 2024. This strategic blend of operational enhancements and robust financial maneuvers positions Snap as a noteworthy contender in high-growth tech landscapes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:NTRA NYSE:PINS and NYSE:SNAP .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]