December 26, 2024

Occidental Petroleum Corporation

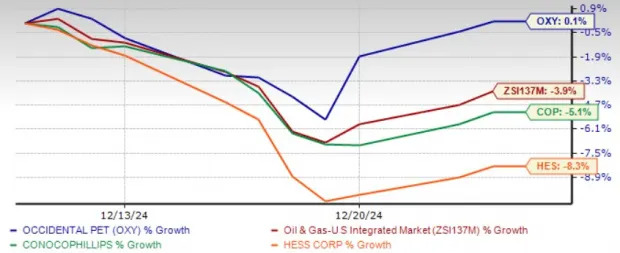

’s OXY shares have gained 0.1% in the last fortnight against the Zacks Oil and Gas-Integrated-United States industry’s decline of 3.9%.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

The company operates in a very competitive industry, but Occidental’s strong presence in the prolific Permian Basin acts to its advantage.

Occidental has outperformed some other operators in this space. In the same period, other operators in the same industry, like

ConocoPhillips

COP and

Hess

HES, have lost 5.1% and 8.3%, respectively.

Occidental's persistent focus on Permian resources has been beneficial for the company. Its core development area in the Permian region has been recording solid results.

Occidental expects total production in the band of 1,430-1,470 Mboe/d in the fourth quarter of 2024. Permian assets remain a consistent contributor to the firm’s overall production. Production from the Permian region is expected to be in the range of 751-769 thousand barrels of oil equivalent per day (Mboe/d) for the fourth quarter of 2024.

Occidental strengthened its portfolio by adding CrownRock's assets in the Midland Basin. Courtesy of CrownRock's contribution, the company has revised its production volume upward. Occidental has raised its fourth-quarter production Permian volume by 12,000 barrels per day, 9,000 of which are coming from its CrownRock assets.

As a result of strong operational performance across all business segments, the company generated $1.5 billion of free cash flow before working capital in the third quarter.

Courtesy of strong free cash flow, it has repaid nearly $4 billion in debt during the third quarter of 2024, which is nearly 90% of its near-term debt reduction target of $4.5 billion. Ongoing debt reduction will reduce its capital servicing expenses.

Occidental's operational excellence, paired with a high-quality asset portfolio, allows it to deliver strong performance. The company continued its stable performance in the last four quarters, resulting in an average surprise of 18.7%.

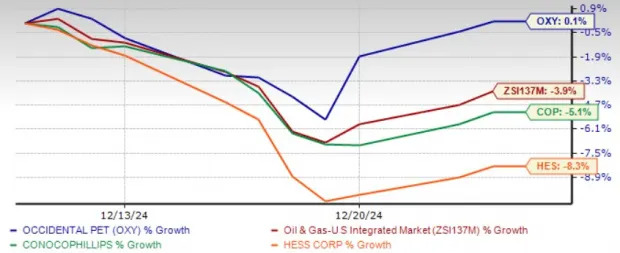

The Zacks Consensus Estimate for Occidental’s 2024 earnings per share has moved up by 1.51% in the past 60 days. In the same period, the 2025 earnings estimate has decreased by 14.78%.

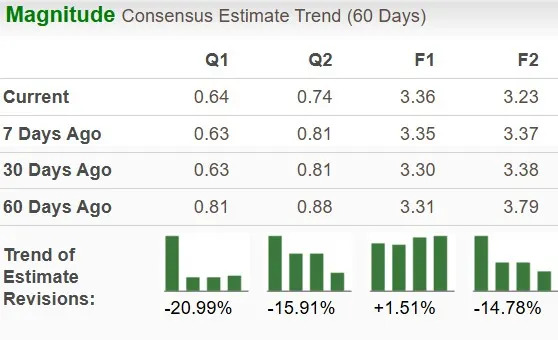

Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income. The trailing 12-month ROE of OXY is currently lower than its industry.

Fluctuations in demand and volatile global and local commodity prices affect Occidental’s results of operations. The company remains exposed to fluctuating market prices of commodities, and as of Dec. 31, 2023, there were no active commodity hedges in place. If the commodity prices drop substantially from their current level, it will impact Occidental’s performance.

OXY operates in a highly competitive environment, which could affect its profitability and growth. The company faces competition from peers to procure new reserves and replenish production volumes.

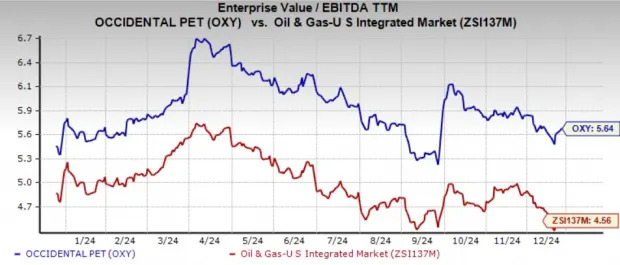

Occidental shares are currently trading at a premium compared to its industry. OXY’s current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA) is 5.64X compared with the industry average of 4.56X. It indicates that the company is presently marginally overvalued compared to its industry.

Occidental’s focus on the Permian region, free cash flow generation and ongoing initiatives to lower debts, and benefits from acquisition will boost performance.

However, exposure to commodity price fluctuation and a very competitive oil and gas industry pose challenges for the company. Occidental’s premium valuation and lower return compared with the industry also do not make a strong case for the company.

Despite the headwinds, it is advisable to keep this Zacks Rank #3 (Hold) stock in your portfolio, given its strong domestic operations and exposure to the prolific Perman Basin.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research