December 27, 2024

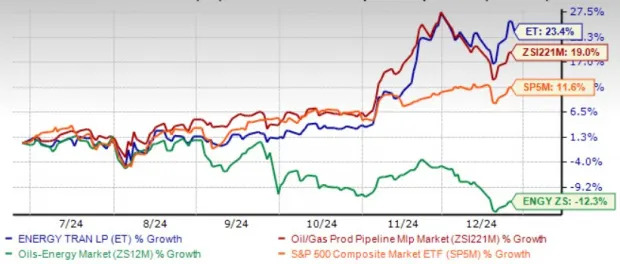

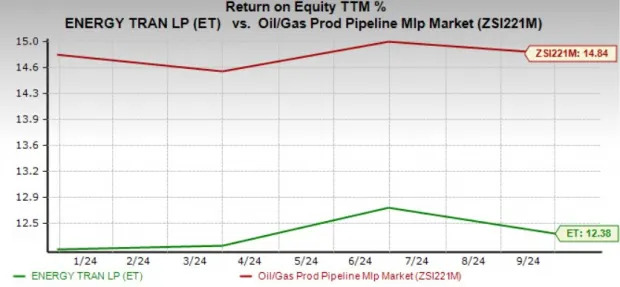

Units of Energy Transfer LP ET have rallied 23.4% year to date compared with its industry’s growth of 19%. The oil and gas midstream firm owns a wide network of pipelines across the United States and is pursuing opportunities to serve growing power loads from new demand centers across its network.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar

The firm also exports Liquefied petroleum gas and has natural gas liquids (NGL) export facilities to cater to the rising demand for NGL globally.

The ET stock has also outperformed its sector and the S&P 500 in the last six months.

Improving unit price cannot be the only reason for adding Energy Transfer to your portfolio. Let us delve deeper and find out factors that can assist investors in deciding whether it is a good entry point or one needs to wait longer for a better entry point into the ET stock.

The firm is expanding its operations through organic means and accretive acquisitions. It has been making one large accretive acquisition each year since 2021. The WTG acquisition, which closed earlier this year, expanded ET’s natural gas pipeline and processing network in the Permian Basin.

Energy Transfer owns more than 130,000 miles of pipelines and related infrastructure spread across 44 states in the United States. Energy Transfer has a well-balanced asset mix that provides strong earnings support. ET’s oil and gas pipelines, gathering and processing, and storage assets are spread in major U.S. basins and growing demand markets. The firm will invest $3-$3.2 billion in 2024 to further expand and strengthen its asset base.

Courtesy of its widespread pipelines, the firm is now able to transport nearly 1.85 million barrels of crude oil per day and more than 1.1 million barrels of natural gas liquids per day. As oil and gas production volumes are rising across the United States, ET will have enough producers to utilize its pipelines for transportation.

The majority of Energy Transfer’s revenues are generated from fee-based contracts and are anchored by strong customers. The firm generates nearly 90% of its revenues by charging fees for transportation and storage services it provides to its strong customer base, significantly lowering its commodity price fluctuation risks.

ET’s management and insiders own a sizeable chunk of its units. Management members and independent board members continue to purchase units of the firm. Energy Transfer insiders bought more than 44 million units worth $468 million since January 2021.

Insider ownership in the ET stock is nearly 10%, more than its peers in the same industry. The increasing ownership of insiders indicates bright prospects and sustainable growth amid the rising demand in the midstream space.

The Zacks Consensus Estimate for Energy Transfer’s 2024 and 2025 earnings per unit indicates year-over-year growth of 21.1% and 11.7%, respectively. The year-over-year increase in earnings estimates implies analysts’ increasing confidence in the stock.

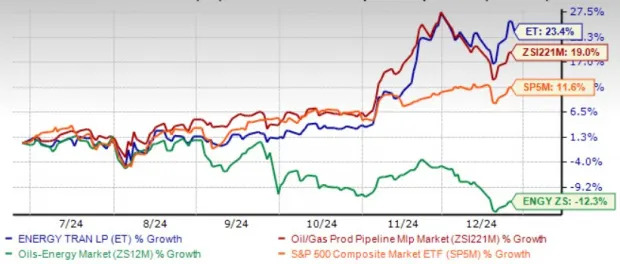

Energy Transfer units are somewhat inexpensive on a relative basis, with its current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA) being 10.53X compared with the industry average of 12.04X.

ONEOK Inc

. OKE, operating in the same industry, is currently trading at EV/EBITDA TTM of 15.57X, a premium compared to the industry average.

Energy Transfer issues debt from time to time to provide liquidity for new capital projects of its subsidiaries, fund acquisitions, or other partnership purposes. The total long-term of the firm as of Sept. 30, 2024, was nearly $59 billion, up from $51.4 billion as of Dec. 31, 2023. The debt to capital of the firm at the end of the third quarter was 56.2%, higher than its industry average of 55.04%.

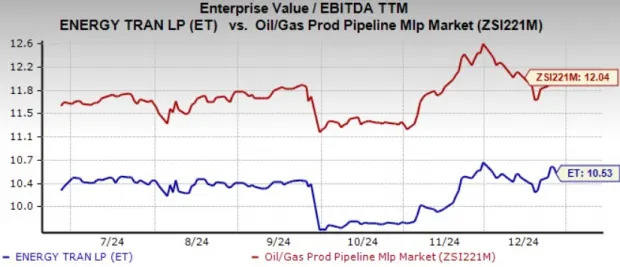

Energy Transfer’s trailing 12-month return on equity is 12.38%, lower than the industry average of 14.84%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Energy Transfer has widespread operations across the United States, and expanding operations through acquisitions and organic methods are boosting its performance.

The positive factors, like Energy Transfer’s stock trading at a discount and increasing year-over-year earnings estimate, are offset by its return on equity lower than the industry and debt level higher than the industry average.

Thus, it is better to adopt a wait-and-see approach on this Zacks Rank #3 (Hold) stock.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research