December 26, 2024

The Federal Reserve’s reset of interest rate expectations for 2025, with the latest forecast of only two quarter-point rate reductions next year, lower than prior projections, has sent the market in jitters. Particularly, the more rate-sensitive stocks like REITs that depend on debts and pay a higher-yielding dividend have faced downward pressure.

Realty Income

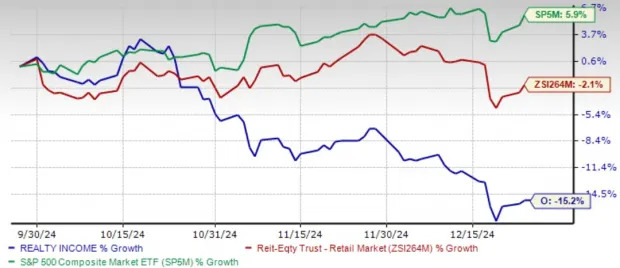

O stock has not been an exception, and the stock has tanked 15.2% over the past three months, closing at $53.24 on Tuesday on the NYSE. In the past three months, the stock has also underperformed the Zacks REIT and Equity Trust - Retail industry and the S&P 500 composite.

The initial rate cuts had positioned this leader in the net lease sector as a top choice among investors, propelling the stock to a 52-week high of $64.88 on Oct. 21. However, the rally lost momentum amid rising concerns that President-elect Donald Trump's proposed tariffs could negatively impact some of Realty Income's retail tenants. Market uncertainty stemming from potential policy changes, economic volatility and expectations of higher inflation and interest rates left investors wary of maintaining their positions in Realty Income stock.

However, the recent sell-off has led Realty Income to offer higher dividend yields, presenting an opportunity for investors. Its dividend now yields 5.94% after the recent sell-off. Nevertheless, before hastily deciding to remove this stock from your portfolio or rushing to buy after the dip, it’s important to evaluate whether this REIT has strong growth potential to sustain its dividend payments and assess whether the current concerns could significantly impact the company’s performance.

Three-Month Price Performance

With robust cash flows generated from 15,457 properties spanning all 50 U.S. states, the U.K. and six other European countries as of Sept. 30, 2024, along with a strong balance sheet and A3 /A- credit ratings by Moody’s & S&P, “The Monthly Dividend Company” has delivered 24 dividend increases over the past five years. This track record underscores its resilience and solidifies its appeal as a reliable, income-focused investment for shareholders. This S&P 500 Dividend Aristocrats index member has delivered 30 consecutive years of rising dividends and 109 consecutive quarterly increases. It has witnessed compound average annual dividend growth of 4.2% since 1994.

Realty Income exited the third quarter of 2024 with $5.2 billion of liquidity. The company ended the quarter with modest leverage and strong coverage metrics, with net debt to annualized pro forma adjusted EBITDAre of 5.4X and a fixed charge coverage of 4.6X. Realty Income has a well-laddered debt-maturity schedule with a weighted average maturity of 6.9 years.

Realty Income has achieved remarkable growth and diversification, transforming from a traditional net lease operator into a prominent REIT with a diversified portfolio spanning multiple industries and regions. Over the last decade, the company has strategically moved beyond its retail origins, venturing into industrial properties to capitalize on the growth of e-commerce and omnichannel retail. This strategic evolution has strengthened its market position while mitigating risks associated with conventional retail.

Realty Income’s growth initiatives are promising, with its international expansion, especially in Europe, opening new opportunities for sustained long-term growth. Bolstered by a favorable investment climate, the company raised its 2024 investment volume guidance to approximately $3.5 billion during its third-quarter earnings announcement.

Realty Income’s move into non-traditional asset classes, including gaming and data centers, highlights its strategic focus on future growth. Notable acquisitions like Encore Boston Harbor and Bellagio Las Vegas, coupled with a partnership with

Digital Realty

DLR for data center investments, demonstrate its dedication to tapping into high-growth industries. The January 2024 merger with Spirit Realty Capital has enhanced its scale and tenant mix, reinforcing its position as a leader in the REIT sector.

However, Realty Income faces near-term challenges amid growing concerns over Trump’s proposed tariffs. These tariffs could negatively impact its tenant base, particularly those reliant on low-cost imports. Retail tenants, already grappling with financial strains and store closures, are especially at risk, heightening fears of increased vacancy rates and reduced rental income for Realty Income.

Economists anticipate that tariffs and other Trump-era policies could drive inflation higher. In response, the Federal Reserve may need to keep interest rates elevated for an extended period. This environment poses challenges for rate-sensitive REITs, including Realty Income, which depend heavily on debt, fueling investor caution during periods of high interest rates.

Investor worries about inflation play a significant role in driving Treasury yields higher. Since bonds and REITs like Realty Income attract income-focused investors with their high yields, rising bond yields can make bonds more appealing, potentially drawing dividend-focused investors away from REITs.

The recent estimate revision trends mark a somewhat bullish view of analysts, with the consensus estimate for adjusted funds from operations (AFFO) per share being revised marginally upward over the past month for 2024. However, the same for 2025 has remained unrevised.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar

.

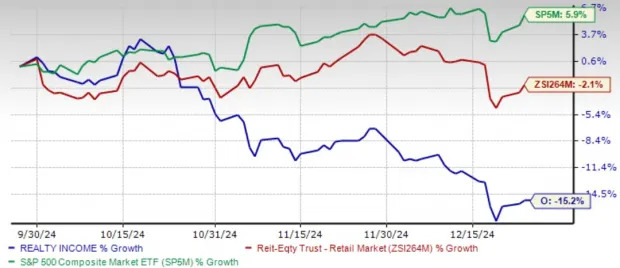

Realty Income stock is trading at a forward 12-month price-to-FFO of 12.26X, below the retail REIT industry average of 16.35X and lower than its one-year median of 13.02X. Although Realty Income stock is currently trading at a discount compared to its industry peers like

Agree Realty Corporation

ADC, this valuation disparity might not be as favorable as it seems.

Forward 12 Month Price-to-FFO (P/FFO) Ratio

Realty Income stands out as a leading dividend stock, offering a compelling mix of income and growth. Its diversified tenant base, focus on long-term net leases and emphasis on recession-resistant sectors position it well for consistent growth.

However, Trump’s proposed tariffs could create cost challenges for Realty Income’s tenants, drive up development expenses and potentially dampen consumer spending. Expectations of rising inflation and interest rates may continue to weigh on investor sentiment toward REITs, including Realty Income.

While the stock currently trades at a discount relative to its peers, it would be prudent to wait for greater clarity on policy changes, inflation trends and their potential impact on Realty Income before determining whether the current valuation signals a buying opportunity or underlying risks. Existing shareholders may choose to remain invested, given the company’s strong history of paying monthly, growing dividends and focus on appealing property sectors.

At present, Realty Income carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Note:

Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Realty Income Corporation (O) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Agree Realty Corporation (ADC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research