December 12, 2024

As of December 2024, the United States stock market is experiencing a remarkable surge, with the Nasdaq Composite surpassing the 20,000 mark for the first time thanks to a rally in major technology stocks. Amidst this bullish environment, identifying stocks trading below their intrinsic value can provide investors with opportunities to capitalize on potential growth. In such a climate, understanding fundamental analysis and assessing intrinsic value becomes crucial for investors aiming to make informed decisions about potentially undervalued stocks.

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Clear Secure (NYSE:YOU) |

$27.38 |

$53.40 |

48.7% |

|

UMB Financial (NasdaqGS:UMBF) |

$124.97 |

$244.29 |

48.8% |

|

West Bancorporation (NasdaqGS:WTBA) |

$23.94 |

$46.42 |

48.4% |

|

Equity Bancshares (NYSE:EQBK) |

$47.67 |

$92.84 |

48.7% |

|

U.S. Physical Therapy (NYSE:USPH) |

$95.66 |

$187.03 |

48.9% |

|

First Advantage (NasdaqGS:FA) |

$19.81 |

$39.49 |

49.8% |

|

DoubleVerify Holdings (NYSE:DV) |

$20.77 |

$41.28 |

49.7% |

|

VSE (NasdaqGS:VSEC) |

$115.51 |

$226.68 |

49% |

|

Carter Bankshares (NasdaqGS:CARE) |

$19.30 |

$38.28 |

49.6% |

|

Marcus & Millichap (NYSE:MMI) |

$41.47 |

$81.20 |

48.9% |

Underneath we present a selection of stocks filtered out by our screen.

Overview: Rocket Lab USA, Inc. is a space company offering launch services and space systems solutions for the space and defense industries, with a market cap of approximately $11.42 billion.

Operations: The company's revenue is derived from two main segments: Space Systems, generating $272.33 million, and Launch Services, contributing $91.49 million.

Estimated Discount To Fair Value: 19.2%

Rocket Lab USA is trading at US$23.35, below its estimated fair value of US$28.89, indicating it may be undervalued based on discounted cash flow analysis. Despite recent volatility and shareholder dilution, the company is poised for significant revenue growth at 30.4% annually, surpassing market averages. Recent contracts with the U.S. Department of Commerce and defense sectors highlight Rocket Lab's strategic position in space-grade technology development, potentially enhancing future cash flows as it scales operations to meet demand.

Overview: Symbotic Inc., with a market cap of $15.72 billion, is an automation technology company that develops technologies to enhance operating efficiencies in modern warehouses.

Operations: The company's revenue is primarily derived from its Industrial Automation & Controls segment, which generated $1.79 billion.

Estimated Discount To Fair Value: 43.2%

Symbotic, currently trading at US$26.68, is significantly undervalued with an estimated fair value of US$46.94 based on discounted cash flow analysis. Despite recent legal challenges and delayed SEC filings, the company reported substantial revenue growth to US$1.82 billion for the fiscal year 2024. Forecasts suggest a robust annual revenue growth rate of 20.8%, exceeding market averages, with profitability expected within three years as it expands internationally into markets like Mexico through strategic partnerships with major retailers like Walmart de Mexico y Centroamerica.

Overview: Cushman & Wakefield plc, operating under its brand, offers commercial real estate services across the United States, Australia, the United Kingdom, and internationally with a market cap of $3.47 billion.

Operations: The company's revenue segments are comprised of $1.46 billion from APAC, $950.80 million from EMEA, and $6.96 billion from the Americas.

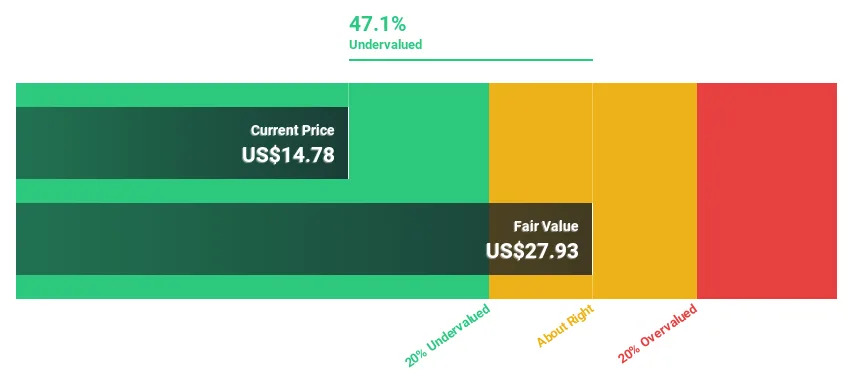

Estimated Discount To Fair Value: 17.9%

Cushman & Wakefield, trading at US$15.29, is undervalued compared to its fair value estimate of US$18.63 based on discounted cash flow analysis. The company recently became profitable, reporting a net income of US$33.7 million for Q3 2024, reversing a net loss from the previous year. While earnings are expected to grow significantly at 27% annually, revenue growth is projected to lag behind market averages at 5.8% per year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:RKLB NasdaqGM:SYM and NYSE:CWK .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]