December 23, 2024

The Zacks Transportation sector, being widely diversified in nature, includes airlines, railroads, package delivery companies and truckers, to name a few. Most sector participants have mostly performed well this year owing to multiple tailwinds like solid air-travel demand, online e-commerce growth and shareholder-friendly measures. Driven by these tailwinds, we believe that transportation stocks like ZIM Integrated Shipping Services Ltd. ZIM, The Greenbrier Companies, Inc. ( GBX ), Wabtec Corporation (WAB ) and C.H. Robinson Worldwide, Inc. ( CHRW ), have not only performed well this year but are also expected to continue doing the same in 2025.

The airline stocks in the sector benefited from an improvement in air-travel demand following the end of the pandemic and normalization of economic activities. Record-breaking traffic during the Thanksgiving period and higher passenger volumes during the summer season outweigh concerns like escalating labor costs and weather-related issues.

Online shopping continues to gain despite economic activities returning to normalcy. This continued strength in e-commerce demand bodes well for packaging companies in the sector. The financial health of transportation companies has improved this year.

As a result, we have seen many companies in the space hiking dividends. Dividend stocks are safe bets for creating wealth, as the payouts generally act as a hedge against economic uncertainty. Investors are always looking for dividend stocks as these provide a steady source of income and a cushion against market uncertainty, as is the current scenario.

A decline in oil prices is also positive for the bottom line of transportation companies, as fuel expenses represent a key input cost. To combat the weak demand scenario due to woes like high inflation and supply-chain disruptions, companies are cutting costs, which are aiding their bottom line.

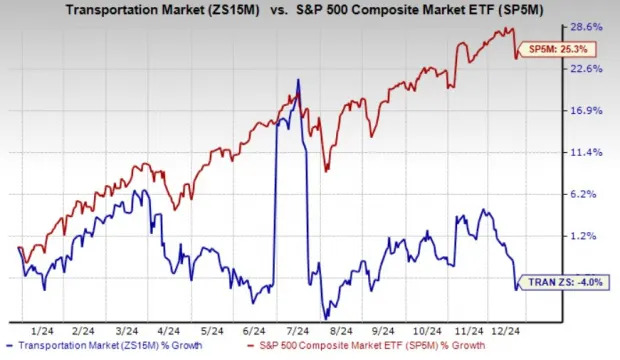

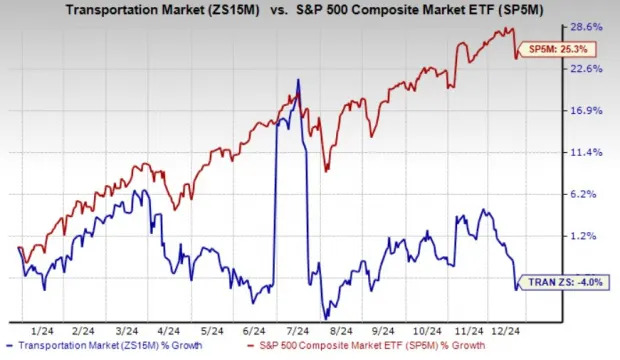

The sector has plunged 4% against the S&P 500’s rally of 25.3% in the year-to-date period.

We believe that the above-mentioned positives are likely to aid the sector in 2025 as well. Consequently, investing in the above-mentioned transportation stocks is a prudent move. These stocks have a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a Growth score of either A or B. They have also witnessed upward estimate revisions in the past 90 days and have a solid expected earnings growth rate for 2025.

Each stock has a market capitalization of more than $1 billion.

ZIM Integrated Shipping Services : This Haifa, Israel-based company provides container shipping and related services in Israel and internationally. The Red Sea crisis-induced high freight rates, focus on niche markets and a shareholder-friendly approach bode well for ZIM.

ZIM currently sports a Zacks Rank #1 and has a growth score of B. ZIM has a market capitalization of $2.20 billion. The Zacks Consensus Estimate for ZIM’s 2025 earnings has improved more than 100% over the past 90 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Greenbrier: Headquartered in Lake Oswego, OR, GBX designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

GBX presently sports a Zacks Rank #1 and has a growth score of A. GBX has a market capitalization of $1.96 billion. The Zacks Consensus Estimate for GBX’s 2025 earnings has improved 11% over the past 90 days. GBX has an expected earnings growth rate of 6.7% for 2025.

Wabtec : This Pittsburgh, PA-based company offers technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide. Strong segmental performance, driven by an improving economy and restructuring actions, has led to a healthy balance sheet that supports WAB’s shareholder-friendly stance.

WAB presently carries a Zacks Rank #2 and has a growth score of B. WAB has a market capitalization of $33.18 billion.

WAB has an expected earnings growth rate of 12.7% for 2025. The Zacks Consensus Estimate for WAB’s 2025 earnings has improved 4.1% over the past 90 days.

C.H. Robinson: Headquartered in Eden Prairie, MN, CHRW provides freight transportation services, as well as related logistics and supply chain services in the United States and internationally.

CHRW presently carries a Zacks Rank #2 and has a growth score of B. CHRW has a market capitalization of $12.87 billion.

CHRW has an expected earnings growth rate of 11.1% for 2025. The Zacks Consensus Estimate for CHRW’s 2025 earnings has improved 5.6% over the past 90 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX) : Free Stock Analysis Report

Wabtec (WAB) : Free Stock Analysis Report

ZIM Integrated Shipping Services Ltd. (ZIM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research