December 18, 2024

Carbon Collective Climate Solutions U.S. Equity ETF, based at 234 West Florida Street, Milwaukee, US-WI 53204, has recently submitted its N-PORT filing for the third quarter of 2024. This filing provides valuable insights into the ETF's investment strategies and portfolio adjustments during this period. Known for its focus on sustainable and climate-conscious investments, the ETF aims to align financial returns with environmental impact. This update highlights key transactions, including significant increases in holdings of Nucor Corp and Li Auto Inc, as well as complete exits from certain positions.

Carbon Collective Climate Solutions U.S. Equity ETF made notable increases in its holdings, adding to a total of 190 stocks. Among these, the most significant increase was in Nucor Corp ( NYSE:NUE ), with an additional 1,573 shares, bringing the total to 8,527 shares. This adjustment represents a substantial 22.62% increase in share count, impacting the current portfolio by 0.89%, with a total value of $1,389,390. The second largest increase was in Li Auto Inc ( NASDAQ:LI ), with an additional 8,428 shares, bringing the total to 42,930. This adjustment signifies a 24.43% increase in share count, with a total value of $847,440.

During the third quarter of 2024, Carbon Collective Climate Solutions U.S. Equity ETF completely exited 11 holdings. Notably, the ETF sold all 72,510 shares of Polestar Automotive Holding UK PLC ( NASDAQ:PSNY ), resulting in a -0.39% impact on the portfolio. Additionally, it liquidated all 923 shares of Cadeler AS ( NYSE:CDLR ), causing a -0.07% impact on the portfolio.

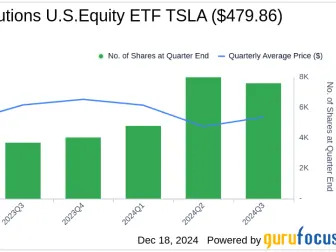

The ETF also reduced its position in 9 stocks, with significant changes including a reduction in Carrier Global Corp ( NYSE:CARR ) by 1,620 shares, resulting in a -7.05% decrease in shares and a -0.39% impact on the portfolio. The stock traded at an average price of $64.61 during the quarter and has returned -9.62% over the past 3 months and 23.40% year-to-date. Additionally, Tesla Inc ( NASDAQ:TSLA ) was reduced by 398 shares, resulting in a -4.98% reduction in shares and a -0.28% impact on the portfolio. The stock traded at an average price of $201.21 during the quarter and has returned 110.58% over the past 3 months and 93.12% year-to-date.

As of the third quarter of 2024, Carbon Collective Climate Solutions U.S. Equity ETF's portfolio comprised 205 stocks. The top holdings included 6.12% in Tesla Inc ( NASDAQ:TSLA ), 5.05% in Carrier Global Corp ( NYSE:CARR ), 4.88% in Johnson Controls International PLC ( NYSE:JCI ), 4.82% in Nucor Corp ( NYSE:NUE ), and 4.79% in Waste Connections Inc ( NYSE:WCN ). The holdings are primarily concentrated in 8 of the 11 industries: Industrials, Consumer Cyclical, Basic Materials, Technology, Utilities, Energy, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on

GuruFocus

.