December 17, 2024

SoFi Technologies, Inc. SOFI shares hit a 52-week high of $17.04 on Monday, before closing a tad lower at $16.88.

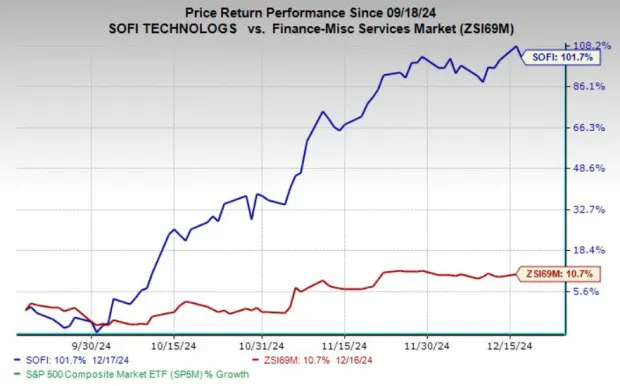

The stock has more than doubled over three months, rallying 102% compared with the industry's meager 11% rise.

Several factors contribute to SOFI's impressive price surge and serve as catalysts for future growth.

The Federal Reserve's recent rate cuts have significantly boosted SOFI by alleviating pressure on its lending business. Lower interest rates reduce borrowing costs, encouraging more customers to take loans and refinance existing ones. This improves SoFi’s loan origination volumes and enhances its overall profitability.

Additionally, the reduced cost of capital supports SoFi's ability to expand its lending capabilities while maintaining competitive interest rates. These rate cuts are particularly beneficial in a challenging macroeconomic environment, where borrowers seek affordability, giving SoFi an edge in growing its customer base and improving its financial performance. This rate cut extended a trend of reductions throughout 2024, which is expected to continue into 2025.

SOFI's student loan-refinance business stands due to less generous loan-forgiveness policies under the Trump administration. Stricter forgiveness criteria may prompt borrowers to seek refinancing options to lower repayment costs, creating opportunities for SoFi to expand its customer base. By offering competitive rates and flexible terms, SoFi is well-positioned to attract borrowers seeking relief from higher repayment burdens. This shift in policy could revive demand for private refinancing, which had slowed under broader forgiveness programs. As a result, SoFi’s refinance segment could experience increased growth, contributing to its overall revenue and strengthening its position in the market.

Overall, continuous digitalization across all industries, particularly in the financial sector, presents a significant opportunity for SOFI. As a company focusing on online banking and offering a comprehensive suite of products and services, SOFI is well-positioned to benefit from this trend.

The demand for online financial platforms is expected to rise, and SOFI's technology platform, Galileo, is integral to its banking business and is being adopted by other financial firms. This expansion positions SOFI to capture more market share from traditional banks. Conventional banking giants like JPMorgan JPM, Bank of America BAC and Wells Fargo WFC are more mature and are experiencing slower growth.

SoFi stock remains a Zacks Rank #2 (Buy), backed by its robust fundamentals and impressive growth trajectory. In the third quarter of 2024, the company achieved a remarkable 30% year-over-year increase in net sales. The highlight was a significant shift in profitability, with SoFi turning a $267 million net loss from the previous year into a $61 million net income. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

This profitability improvement reflects SoFi's strong operating leverage, as its larger scale supports a more efficient cost structure. Scalability remains critical to its success, with management focused on aggressive growth in key metrics. The addition of 756,000 new members during the quarter, the highest in absolute terms, strengthens SoFi's ability to drive cross-selling opportunities and lower customer acquisition costs, enhancing long-term profitability.

All three business segments contributed to the revenue growth in the third quarter. Lending and Technology Platform revenues grew 14% year over year, while the Financial Services segment soared with an impressive 102% increase. Additionally, SoFi’s $2 billion partnership with Fortress Investment Group aims to diversify its revenue streams toward fee-based, less capital-intensive models.

New collaborations, like the Nova Credit integration, enhance SoFi’s risk assessment capabilities and expand its market reach, while innovative product launches, such as two new credit cards, further bolster growth potential and customer engagement.

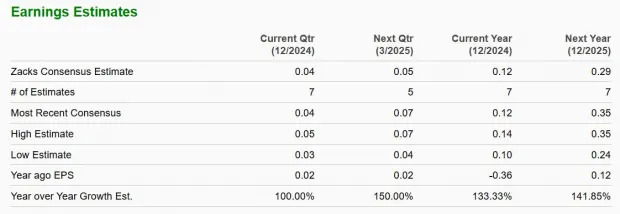

The Zacks Consensus Estimate for SOFI’s 2024 earnings is pegged at 12 cents, indicating substantial growth of 133.3% from the previous year. Earnings for 2025 are expected to increase 142% year over year. The company’s sales are projected to grow 21.4% and 16.8% year over year in 2024 and 2025, respectively.

In the past 60 days, there were six upward revisions in earnings estimates for 2024 with no downward revision, indicating strong confidence among analysts regarding the company’s future performance. The Zacks Consensus Estimate for 2024 earnings has increased 20% in the past 60 days.

Six estimates for 2025 earnings were revised upward with no downward revision in the past 60 days. The Zacks Consensus Estimate for 2024 earnings has increased 11.5% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research