December 20, 2024

Shares of

Berkshire Hathaway Inc.

(BRK.B) have been trading above its 50-day simple moving average (SMA), signaling a short-term bullish trend as well as making it an attractive option for investors from a technical perspective.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of an uptrend or downtrend.

This insurance behemoth has a market capitalization of more than $986.6 billion. The average volume of shares traded in the last three months was 3.7 million.

Shares of BRK.B have rallied 26.4% year to date, outperforming the industry’s growth of 25.3%, the Finance sector's return of 18% and the Zacks S&P 500 composite’s rise of 25.8%.

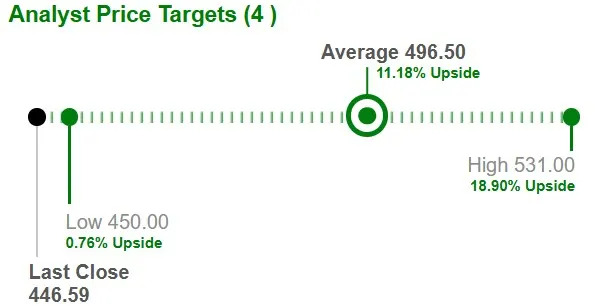

Based on short-term price targets offered by four analysts, the Zacks average price target is at $496.50 per share. The average suggests an 11.2% upside from Thursday’s closing price.

The insurance business primarily contributes to Berkshire’s top line. About 40% of the company’s operating earnings came from its insurance underwriting and insurance investment subsidiaries in 2023. Other operations — including utilities and energy, and manufacturing, service and retail — accounted for the remaining 60%.

Thus, occurrences of catastrophe activities weigh on profitability. The insurer incurred $465 million in catastrophe events in the first nine months of 2024. Berkshire estimates pre-tax incurred losses between $1.3 billion and $1.5 billion from Hurricane Milton that struck Florida in October 2024.

Insurers invest a portion of their premiums and, thus, are direct beneficiaries of an improved rate environment. However, as expected, the Fed cut the interest rate by 25 basis points to a target range of 4.25-4.50%, marking the third cut this year. As the Fed wants to take the rate between 3.75% and 4% by the end of 2025, there should be more next year. With a lower rate of return, investment income will suffer. However, a broader invested base will limit the downside.

According to the Fed's December Economic Projections, GDP in 2025 is pegged to grow 2.1%, while the unemployment rate is likely to be 4.3%, both metrics improving from its September projection. The performances of Berkshire’s utilities and energy, and manufacturing, service and retail units are dependent on the health of the economy. With inflation cooling and a decent job market, we expect these units to continue to deliver better results.

With a huge cash hoard, Berkshire Hathaway acquires entities or adds stakes of companies that have consistent earning power, sufficient moat and generate impressive returns on equity. While prudent acquisitions open up more business opportunities for the company, bolt-on acquisitions enhance the earnings of the existing business. Buffet has about 60% of his investment cumulated in Apple, American Express, Coca-Cola and Bank of America.

The company also distributes wealth to shareholders and thus bought back shares worth $2.9 billion in the first nine months of 2024.

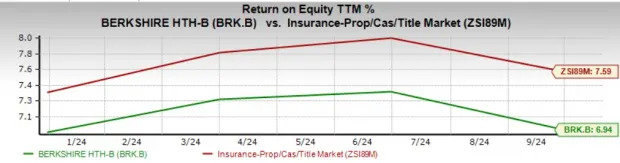

Return on equity in the trailing 12 months was 6.9%, underperforming the industry average of 7.6%. Return on equity, a profitability measure, here reflects BRK.B’s inefficiency in utilizing its shareholders' funds.

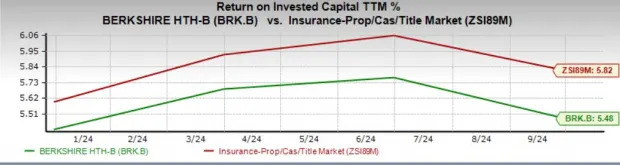

The company’s return on invested capital in the trailing 12 months was 5.5%, lower than the industry average of 5.8%. This reflects BRK.B’s inefficiency in utilizing funds to generate income.

One of the three analysts covering the stock has raised estimates for 2024 and 2025 over the past 30 days. The Zacks Consensus Estimate for 2024 implies a 14.6% year-over-year increase, whereas the same for 2025 suggests a 1.4% rise.

The consensus estimate for 2024 and 2025 has moved 5.1% and 1% north, respectively, in the past 30 days.

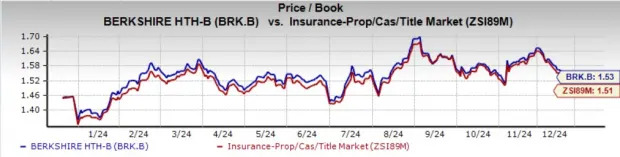

Berkshire Hathaway shares are trading premium to the industry. Its price-to-book value of 1.53X is higher than the industry average of 1.51X . It has a Value Score of C, indicating stretched valuation.

The stock remains attractively valued compared with other insurers like The Progressive Corporation PGR and The Allstate Corporation ALL.

Holding shares of Berkshire Hathaway renders dynamism to one’s portfolio. Also, it has Warren Buffett at its helm, who has been creating tremendous value for shareholders over nearly six decades with his unique skills. Favorable analyst sentiment, growth projections and an average target price suggesting a solid upside instill confidence.

Despite Berkshire shares trading at a premium for quite some time, it's time to add this Zacks Rank #2 (Buy) behemoth for better returns this year and beyond. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research