December 20, 2024

Cruise ship company Carnival (NYSE:CCL) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 10% year on year to $5.94 billion. Its non-GAAP profit of $0.14 per share was 94% above analysts’ consensus estimates.

Is now the time to buy Carnival? Find out in our full research report .

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

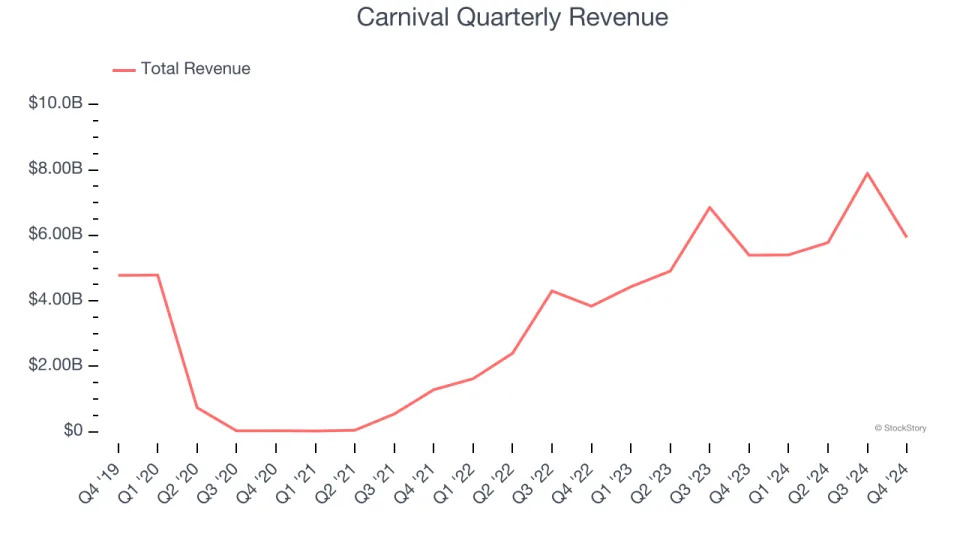

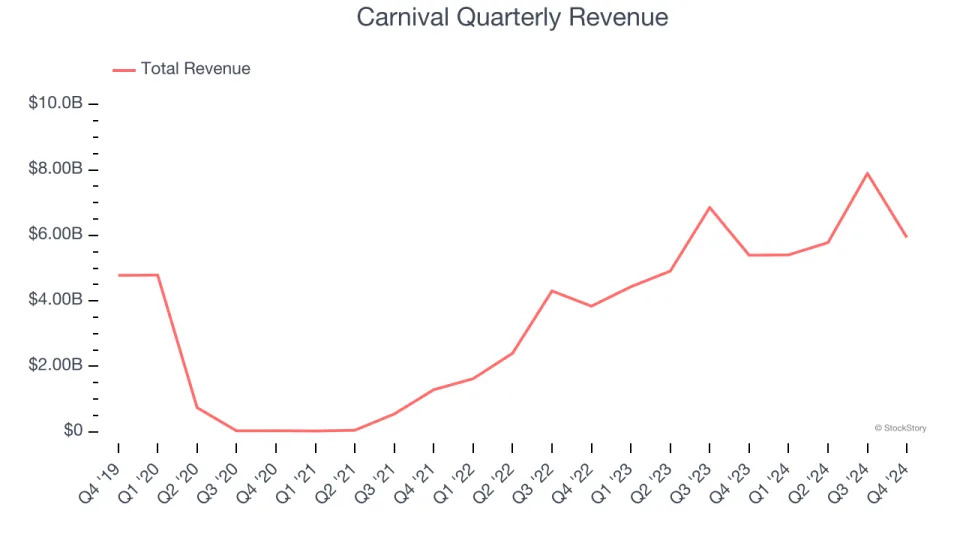

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Carnival grew its sales at a sluggish 3.7% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Carnival’s annualized revenue growth of 43.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Carnival’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its number of passenger cruise days, which reached 24.6 million in the latest quarter. Over the last two years, Carnival’s passenger cruise days averaged 48.2% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Carnival’s year-on-year revenue growth was 10%, and its $5.94 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

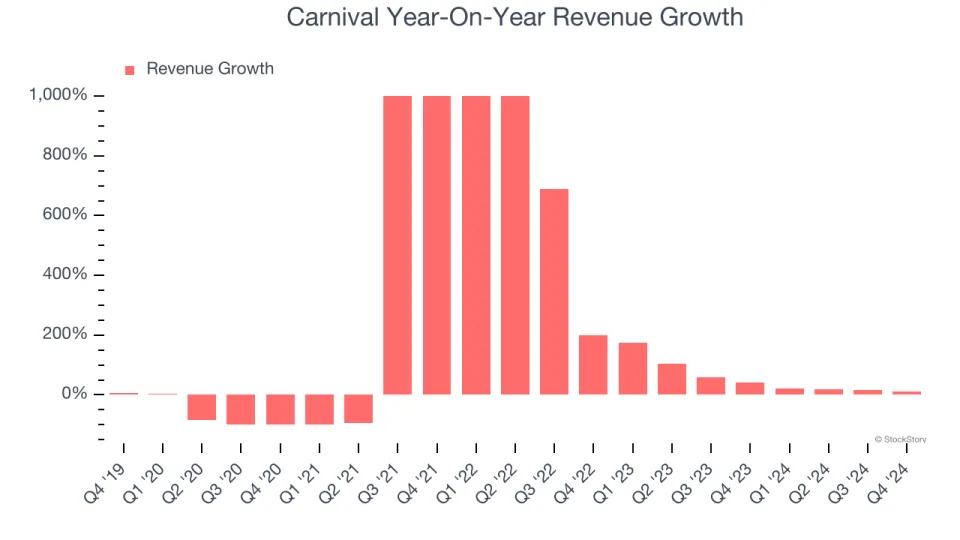

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carnival has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, lousy for a consumer discretionary business.

Carnival’s free cash flow clocked in at $319 million in Q4, equivalent to a 5.4% margin. This cash profitability was in line with the comparable period last year and its two-year average.

We liked how Carnival beat analysts’ EBITDA and EPS expectations this quarter. That full year EBITDA guidance was in line with expectations can be considered a solid outcome. The stock traded up 5% to $26.44 immediately after reporting.

Sure, Carnival had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .