December 19, 2024

Rigetti Computing

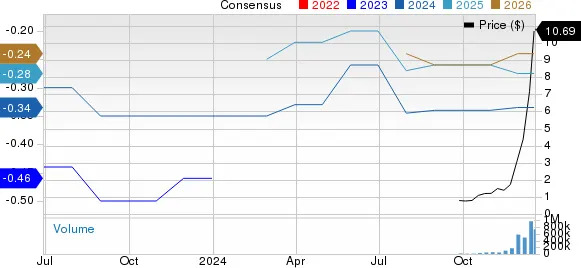

RGTI shares have skyrocketed 691.9% in the past month compared with the Zacks Internet - Software industry’s return of 2% and the broader Zacks Computer & Technology sector’s growth of 2%.

RGTI shares have outperformed its peers

International Business Machines

IBM and

Microsoft

MSFT, which offer quantum computing hardware and software solutions.

Shares of IBM and Microsoft have gained 34.6% and 16.5%, respectively, in the same time frame.

The outperformance can be attributed to RGTI’s expanding clientele and its growing influence in the quantum computing space.

RGTI’s partnership with Riverlane,

NVIDIA

NVDA and Quantum Machines has been a major growth driver for its success, positioning the company as a key player in the rapidly evolving quantum computing space.

Rigetti recently announced the successful application of AI, in collaboration with Quantum Machines, to automate the calibration of its 9-qubit Novera QPU. This was achieved by leveraging NVIDIA DGX Quantum, enabling high gate fidelities and marking a significant advancement in quantum computing operations.

Rigetti’s partnership with Riverlane to develop quantum error correction technology has been noteworthy. This collaboration is essential for improving the reliability of quantum computing, a key hurdle in scaling up quantum systems.

In October, Rigetti, in collaboration with Riverlane, successfully demonstrated real-time and low-latency quantum error correction on Rigetti’s 84-qubit Ankaa-2 system, achieving faster decoding times to avoid backlog issues and ensure fault tolerance in quantum computing.

Rigetti’s advancement in quantum computing technology has been a key catalyst in driving the company’s success.

In the third quarter of 2024, RGTImade advancements in quantum computing, including the development of its multi-chip architecture for scaling up qubit systems. This positions Rigetti at the forefront of the industry, enhancing its capabilities in quantum computing.

Building on this momentum, Rigetti successfully demonstrated 9-qubit chips with 99.4% median 2-qubit gate fidelity and announced plans to release a 36-qubit system by mid-2025. These advancements in quantum hardware are vital for RGTI’s future growth.

Further enhancing its role as a leader in the quantum computing space in the third quarter of 2024, Rigetti’s 24-qubit Ankaa system was made operational at the U.K. National Quantum Computing Centre, which officially opened its facility. The system is now available for testing and exploration, marking another step forward in the company’s expansion and influence within the quantum computing field.

As the quantum computing market continues to evolve, RGTI is poised to benefit from its growth. Per a Grand View Research report, the quantum computing market is expected to witness a CAGR of 20.1% from 2024 to 2030.

Rigetti’s advancements in the quantum computing space are continuously benefiting the company’s top-line growth.

However, challenging macroeconomic uncertainties and intense competition in the rapidly evolving and highly competitive quantum computing market have negatively impacted the company’s top-line growth.

In the third quarter of 2024, revenues decreased to $2.4 million, down from $3.1 million in the same period of the prior year. This drop was attributed to the variable nature of contract deliverables, especially with major government agencies, which led to fluctuating revenue streams.

Gross margin fell significantly to 51% in the third quarter of 2024 from 73% in the third quarter of 2023. This decrease was partly due to a contract for a 24-qubit quantum system, which had a lower gross margin profile compared to most other revenue sources.

The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $2.40 million, indicating a decline of 28.99% year over year.

The consensus mark is currently pegged at a loss of 8 cents per share, unchanged over the past 30 days.

Rigetti Computing, Inc. price-consensus-chart | Rigetti Computing, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

RGTI stock is not so cheap, as suggested by the Value Score of F.

In terms of the forward 12-month Price/Sales, RGTI is trading at 135.46X, higher than the sector’s 6.35X.

Currently, Rigetti carries a Zacks Rank #3 (Hold), implying that investors should wait for a better entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research