December 19, 2024

The Food and Drug Administration has finalized its decision to call an end to the drug shortage of Eli Lilly's ( LLY ) blockbuster GLP-1 products, often referred to by their formula name, tirzepatide.

The new decision comes after a lawsuit filed by compounders forced the FDA to announce it was reviewing its original decision from October. Compounders, which invest millions in bulk buying of the key ingredient to make vials of the drugs, have now been put on notice.

"FDA’s decision today, reiterating that the tirzepatide shortage is resolved, reflects the tireless work of our manufacturing and quality colleagues to safely expand our manufacturing capacity to bring these medicines to people who need them," Lilly said in a statement to Yahoo Finance.

"Anyone marketing or selling unapproved tirzepatide knockoffs must stop," the company added.

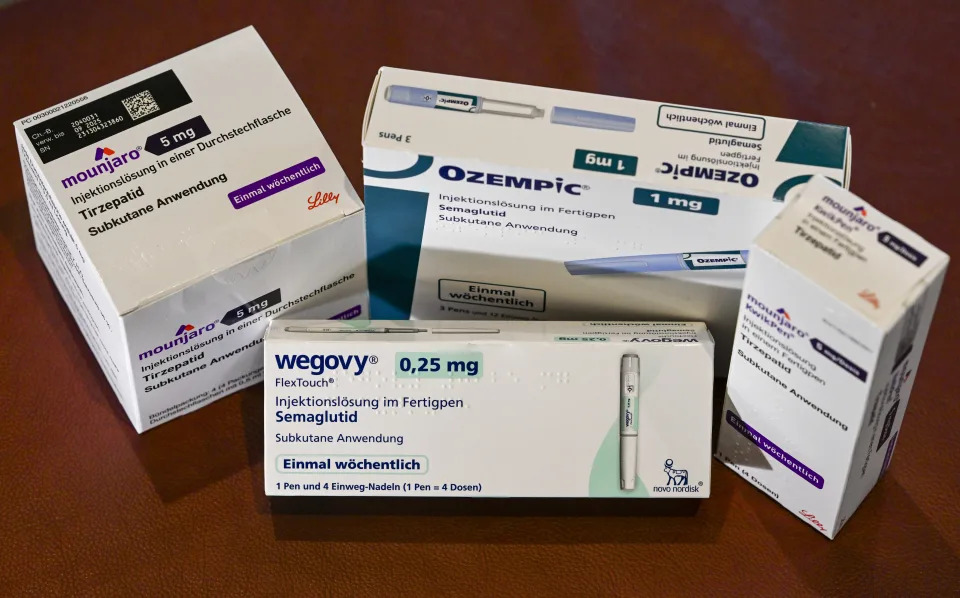

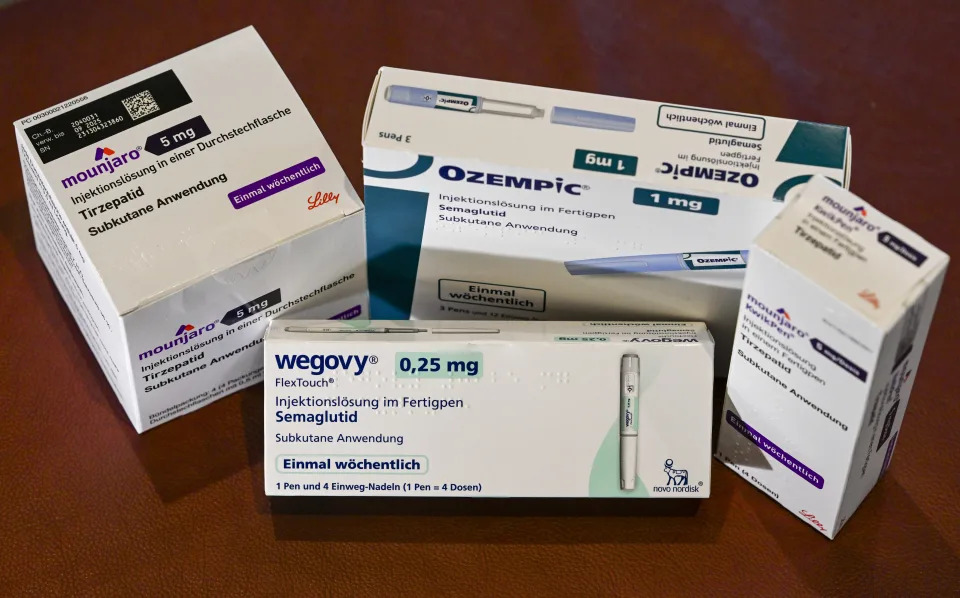

Tirzepatide is the key ingredient in Lilly's blockbuster weight-loss drug Zepbound and diabetes drug Mounjaro. The FDA's decision starts a countdown clock of about 60 days, or until February, for copycat manufacturers to halt production.

While Lilly and competitor Novo Nordisk struggled to meet unprecedented demand in the last few years, compounding pharmacies stepped up to fill the shortage gap, as allowed by the FDA. But once the shortage is over, patent enforcements go back into full swing.

Novo Nordisk's ( NVO ) GLP-1 drugs, Ozempic for diabetes and Wegovy for weight loss, are also poised to be taken off the FDA's shortage list after the company notified the FDA of the drugs' availability in November.

Weight-loss platforms such as Allurion ( ALUR ) will have to halt their planned rollout of tirzepatide copycats. The company's stock slid more than 13% on the news, trading at less than $0.30 per share.

Copycats of Novo's semaglutide drugs are the more popular drugs available on telehealth platforms like Hims & Hers ( HIMS ), Ro, and Sesame — and could soon face a similar fate.

The news still crushed Hims stock Thursday afternoon. Shares traded down nearly 10% at $25.81 per share.

Piper Sandler analysts said in a note that Hims should be fine "for the time being." They noted, however, that the FDA's move does signal that it's "not giving much leeway for the compounders."

It means these players will have to work more closely with pharma companies to gain access.

"We've proactively developed partnerships, including our recent collaboration with Eli Lilly, to ensure patients can access branded medications like Zepbound at more affordable price points," said Sesame president Michael Botta in a statement Thursday.

The trade group representing the copycat manufacturers said they disagree with the FDA's decision .

"The fact of the matter is that patients across the nation continue to experience difficulty filling prescriptions for branded tirzepatide products and that pharmacy distributors continue to list branded tirzepatide products as out-of-stock or available in only limited quantities," the Outsourcing Facilities Association said in a LinkedIn post.

Hims has also tried to appeal to the FDA that the shortages are not over, submitting a survey of members who reported experiencing shortages this year from September through November.

Allurion said it will continue to offer compounded semaglutide, as well as the branded products from both Lilly and Novo. Hims declined to comment.

Anjalee Khemlani is the senior health reporter at Yahoo Finance, covering all things pharma, insurance, care services, digital health, PBMs, and health policy and politics. That includes GLP-1s, of course. Follow Anjalee on social media platforms X (Twitter), LinkedIn Bluesky @AnjKhem .

.