December 19, 2024

Used automotive vehicle retailer Carmax (NYSE:KMX) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 1.2% year on year to $6.22 billion. Its GAAP profit of $0.81 per share was 33.3% above analysts’ consensus estimates.

Is now the time to buy CarMax? Find out in our full research report .

“I am pleased with the positive momentum that we are driving across our diversified business model. Our solid execution and a more stable environment for vehicle valuations enabled us to deliver robust EPS growth driven by increases in unit sales and buys, solid margins, growth in CAF income, and ongoing management of SG&A,” said Bill Nash, president and chief executive officer.

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

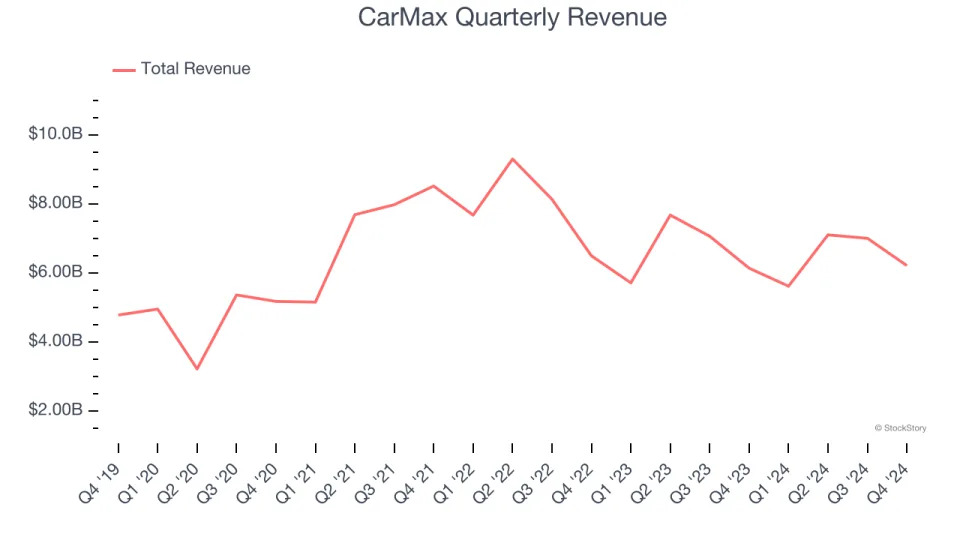

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

CarMax is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when you've penetrated most of the market.

As you can see below, CarMax grew its sales at a tepid 5.7% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, CarMax reported modest year-on-year revenue growth of 1.2% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and suggests its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

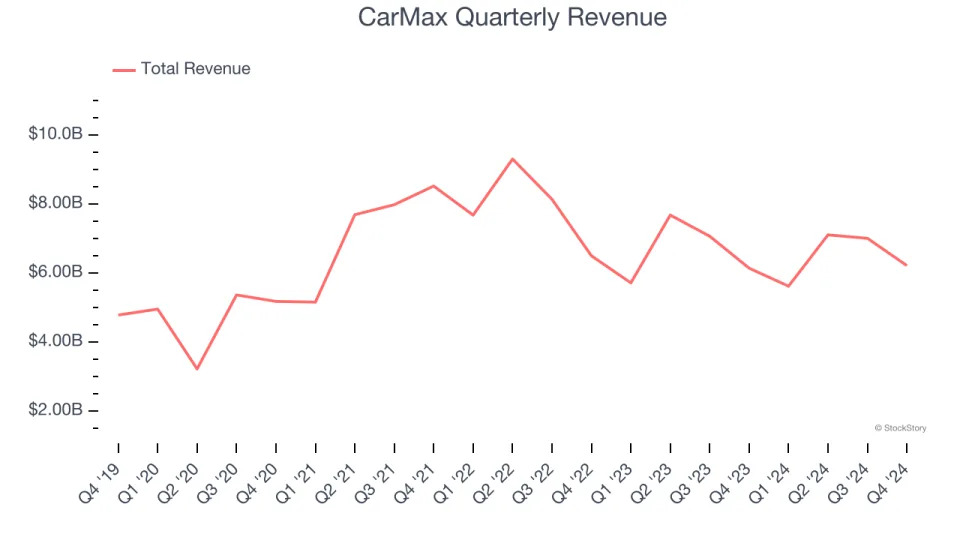

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

CarMax sported 245 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 3.2% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

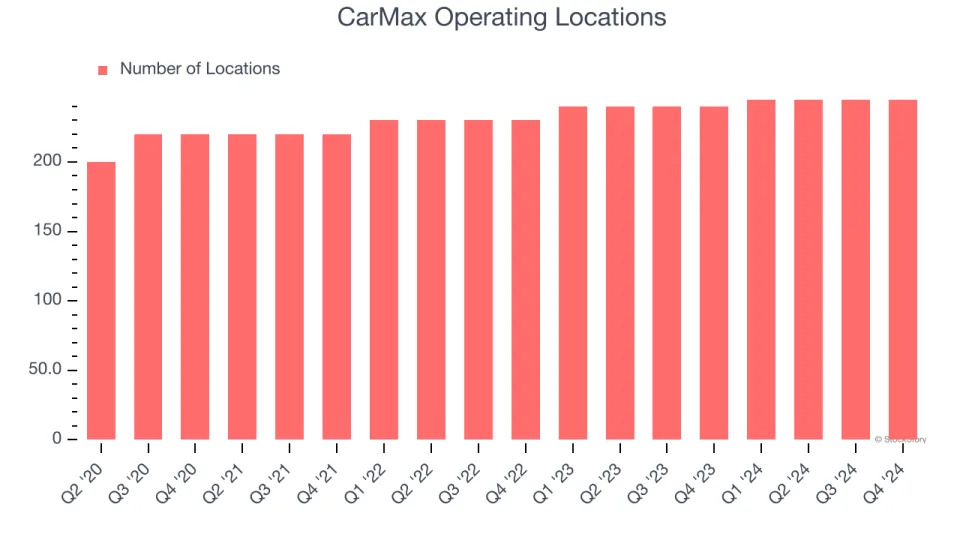

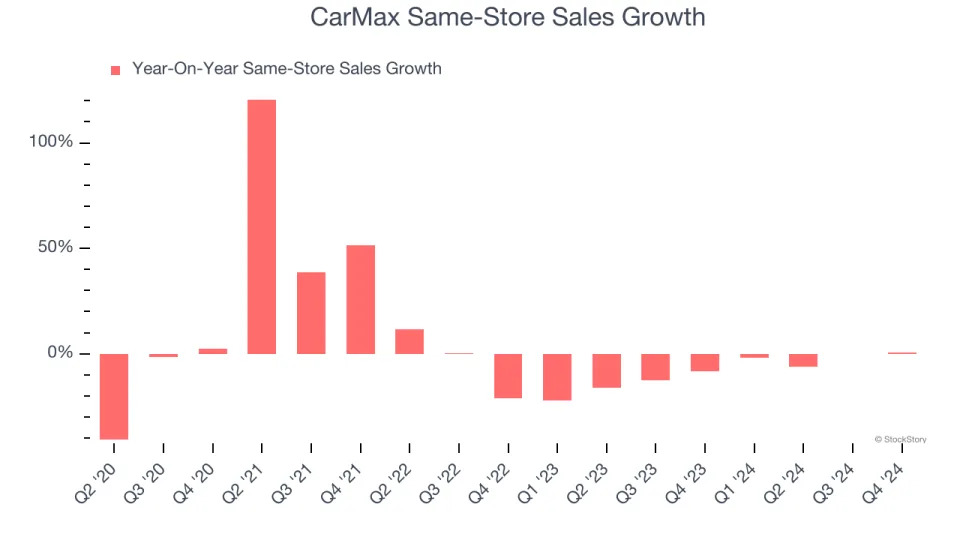

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

CarMax’s demand has been shrinking over the last two years as its same-store sales have averaged 8.4% annual declines. This performance is concerning - it shows CarMax artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, CarMax’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

We were impressed by how significantly CarMax blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. The CEO called out a "more stable environment for vehicle valuations", which is important for the business. Overall, this quarter had some key positives. The stock traded up 5.8% to $86.11 immediately after reporting.

CarMax may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .