- US Dollar meanders ahead of vital US inflation print

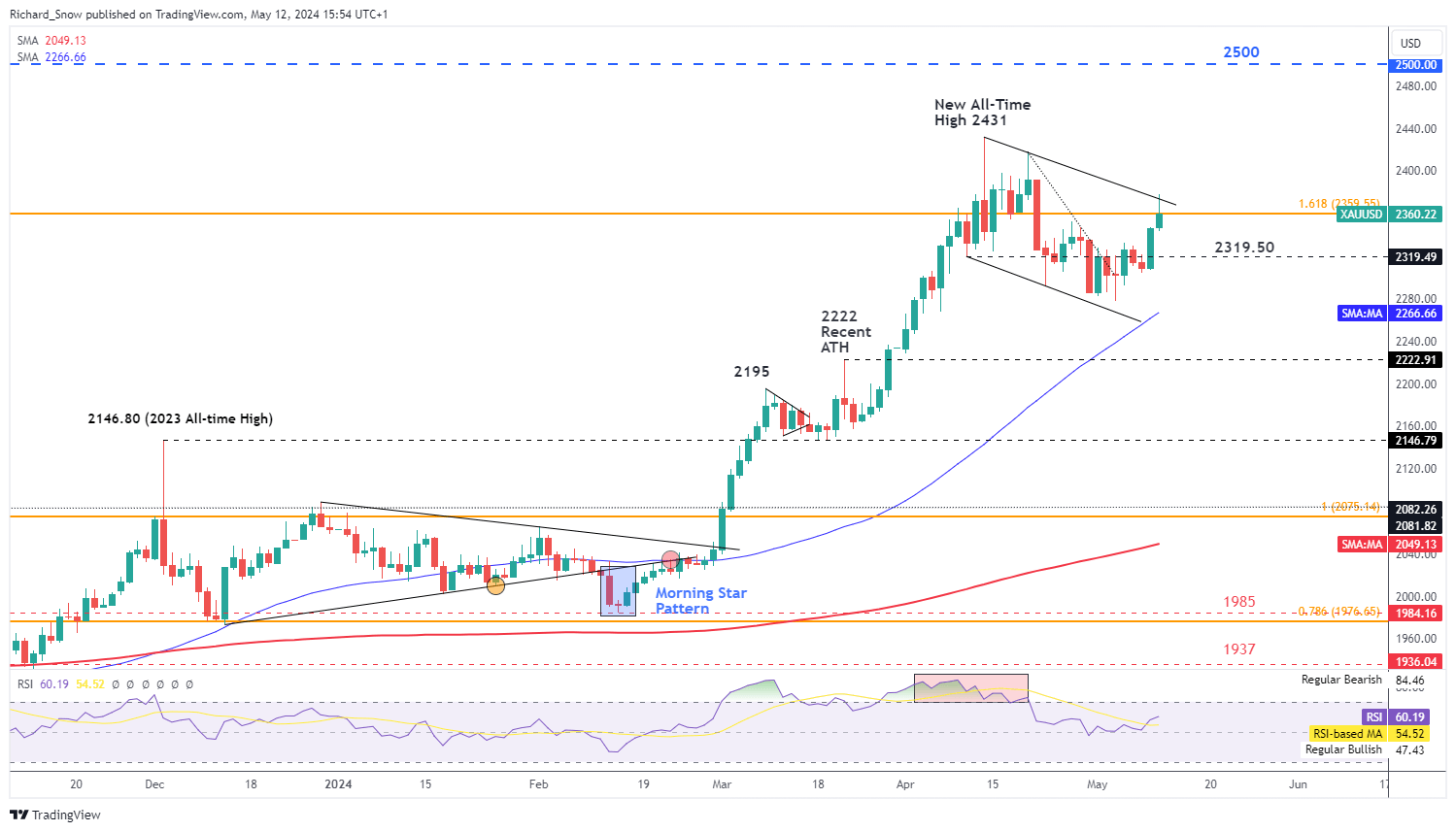

- Gold (XAU/ USD ) attempts bullish continuation as the IDF pushes into Rafah

- Sterling to be driven by labour market data and Fed speak, with the Euro eying sentiment data as well as US-linked data and speeches

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

US Inflation Data and Fed Comments Ought to Provide Direction for USD

The US dollar traded in an indecisive manner last week, reacting to incoming data – most notably initial jobless claims on Thursday. US CPI data on Wednesday is likely to provide a directional catalyst unless figures print in line with the general consensus.

The chart below highlights the influence inflation data can have on interest rate expectations and ultimately the dollar, after the March CPI data worryingly exceeded expectations. The month on month core CPI data has been stubbornly hot at 0.4% for the last three readings and markets will be eager to see if this focus point can head to a preferable measure of 0.2% or lower.

The US has also experienced a softening in the labour market, first with a lower-than-expected NFP data and secondly, through higher-than-anticipated initial jobless claims. The weaker data places a temporary ceiling on USD upside, something that a hot CPI print is more than capable of rising above. However, if the market gives in to ‘recency bias’, lower CPI data may compound on the recent weaker jobs data, sending the dollar lower.

US Dollar Basket (DXY) Daily Chart